This week the market was shuffling down and traded in the red. It could be because of the Chinese trying to soothe the hype created around blockchain. They are currently trying to focus on the distinction between Bitcoin and cryptocurrency market and the blockchain technology. Bitcoin’s downturn to the ,000 area is driving the market’s reaction as the trade volume declines and the fear index rises. Despite the bearish momentum, some altcoins were in the green. Fusion, for example, surged by 300% this week and others have also emerged which shows a mixed trend and further indicates the state of confusion in the cryptocurrency market over the past week. This week, the Bank of America shut down the account of PayPal’s ex-CFO despite him being a client for over 20 years. He shared this

Topics:

Jonathan Berger considers the following as important: AA News, Market Updates

This could be interesting, too:

Wayne Jones writes Charles Schwab to Launch Spot Crypto ETFs if Regulations Change

Wayne Jones writes Here’s When FTX Expects to Start Repaying Customers .5B

Dimitar Dzhondzhorov writes Is Cryptoqueen Ruja Ignatova Alive and Hiding in South Africa? (Report)

Wayne Jones writes Casa CEO Exposes Shocking Phishing Scam Targeting Wealthy Crypto Users

This week the market was shuffling down and traded in the red. It could be because of the Chinese trying to soothe the hype created around blockchain. They are currently trying to focus on the distinction between Bitcoin and cryptocurrency market and the blockchain technology.

Bitcoin’s downturn to the $8,000 area is driving the market’s reaction as the trade volume declines and the fear index rises. Despite the bearish momentum, some altcoins were in the green. Fusion, for example, surged by 300% this week and others have also emerged which shows a mixed trend and further indicates the state of confusion in the cryptocurrency market over the past week.

This week, the Bank of America shut down the account of PayPal’s ex-CFO despite him being a client for over 20 years. He shared this information and the cryptocurrency community reacted immediately, outlining that this couldn’t possibly happen with Bitcoin because of its censorship-resistant nature. However, there’s still a long way to regulate the field and it will take time for the masses to learn about the importance of Bitcoin’s decentralization and the benefits it brings over fiat currencies.

In conclusion, this was another week in the cryptocurrency market and perhaps a step before there is a new turning point that will change the sentiment and momentum.

Market Data

BTC Longs (BFX): 25.7K BTC

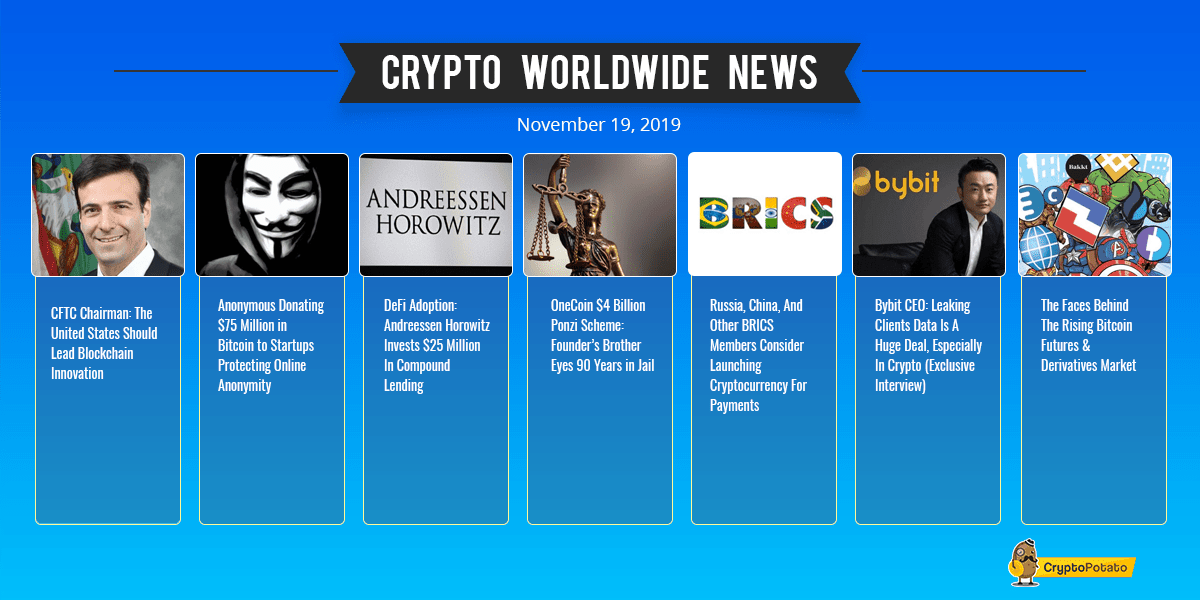

CFTC Chairman: The United States Should Lead Blockchain Innovation. Heath Tarbert, the Chairman of the US CFTC, has said that the country should put effort into leading the way when it comes to digital currencies and blockchain. Apart from this, he also reiterated that there’s a need of more regulatory clarity and governance in the field.

Anonymous Donating $75 Million in Bitcoin to Startups Protecting Online Anonymity. The popular and yet shrouded in mystery organization Anonymous is launching the so-called Unknown Fund. The initiative will donate a total of $75 million in Bitcoin to startups which support the idea of anonymity.

DeFi Adoption: Andreessen Horowitz Invests $25 Million In Compound Lending. Andreessen Horowitz, a well-known venture capital firm, has recently invested $25 million in one of the most popular DeFi projects, Compound. The latter is a San Francisco-based company and it uses smart contracts and blockchain to allow users to borrow and lend cryptocurrencies.

OneCoin $4 Billion Ponzi Scheme: Founder’s Brother Eyes 90 Years in Jail. OneCoin is among the biggest cryptocurrency scams in history. The project raised around $4 billion but it seems to be nothing but a Ponzi scheme. Now the brother of the founder is taken to court, eyeing a sentence of 90 years jail time.

Russia, China, And Other BRICS Members Consider Launching Cryptocurrency For Payments. Members of a prominent international group of emerging nations called BRICS, are reportedly considering the launch of a single-point payment settlement system and a cryptocurrency designed for it. The countries in the organization include Brazil, Russia, India, China, and South Africa.

Bybit CEO: Leaking Clients Data Is A Huge Deal, Especially In Crypto (Exclusive Interview). In an exclusive interview for Cryptopotato, Ben Zhou, the CEO at one of the rapidly evolving cryptocurrency exchanges, Bybit, said that leaking personal information of clients is a big deal, especially in this field. He also talked about regulations in China and their potential effect on the market.

The Faces Behind The Rising Bitcoin Futures & Derivatives Market. The market for Bitcoin futures exploded in the past few years. With this in mind, it’s important to be aware of the faces behind some of the most predominant organizations in the field. From BitMEX’s Arthur Hayes to Bakkt’s Kelly Loeffler, the list goes on and it’s definitely an interesting one to go through.

Charts

This week, we’ve analyzed the Bitcoin, Ethereum, XRP, Fusion, and Dogecoin markets – click here for the full price analysis.