An analyst says bitcoin could crash to ,000 to ,000 range as miners sell-off. In December 2018, bitcoin dropped from ,000 to around ,000 within weeks. If miners capitulate, they are likely to return after the halving. While many investors expect the dip to ,600 of bitcoin last week to have been a bottom, one analyst believes the bitcoin price could fall to as low as ,020 in 2020. This looks bad… The perception of value for #bitcoin exceeded the 2017 mania this year but price did not. A change in perception like 2018 will likely drag the price down much further than the majority expect. 20 in 2020 doesn't seem crazy to me. pic.twitter.com/8G8vQWxaQA — EX (@icoexplorer) November 29, 2019 Speaking to CCN, the analyst said that as the slump in the cryptocurrency market

Topics:

Joseph Young considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

- An analyst says bitcoin could crash to $2,000 to $3,000 range as miners sell-off.

- In December 2018, bitcoin dropped from $6,000 to around $3,000 within weeks.

- If miners capitulate, they are likely to return after the halving.

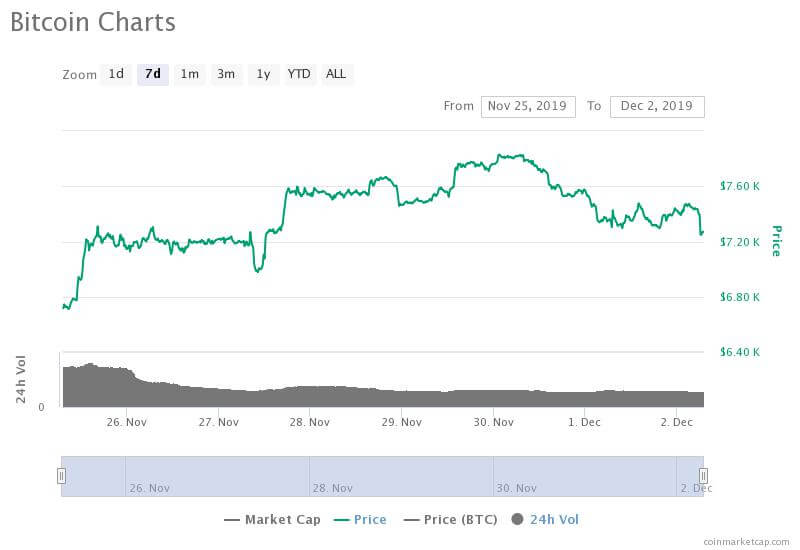

While many investors expect the dip to $6,600 of bitcoin last week to have been a bottom, one analyst believes the bitcoin price could fall to as low as $2,020 in 2020.

This looks bad…

The perception of value for #bitcoin exceeded the 2017 mania this year but price did not.

A change in perception like 2018 will likely drag the price down much further than the majority expect.

$2020 in 2020 doesn't seem crazy to me. pic.twitter.com/8G8vQWxaQA

— EX (@icoexplorer) November 29, 2019

Speaking to CCN, the analyst said that as the slump in the cryptocurrency market continues, miners will likely look to take profits. Potential sell-offs of bitcoin by miners as seen in December 2018 could trigger a deeper pullback.

Where is bitcoin most likely to bottom?

In the past 48 hours, the bitcoin price has started to show signs of rejection at higher resistance levels following a recovery from mid-$6,000.

When the bitcoin price initially started to rebound from lower support levels, traders eyed a breakout to at least low-$8,000s. But, BTC struggled to maintain momentum above $7,500, moving towards retesting $7,000 again.

The analyst explained that the chart of bitcoin is showing a decline in the perception of value. A further move down from current levels could cause another downtrend in the near term.

Elaborating, he stated:

The chart is showing the perception of value is in decline. If it continues and revisits the levels it had previously in 2018 I expect another downtrend, bitcoin is known for behaving unpredictably and many see the upcoming halving as a given excuse for a price increase to find the balance after production is cut in half. I think it makes more sense that the equilibrium is found with a reduction in speculative infrastructure.

Low price targets in the $2,000 to $3,000 range come from bitcoin’s abrupt 50% drop in December 2018 from $6,000 to $3,000. The move is described as “miner capitulation,” when bitcoin miners begin to sell their holdings as price moves below the breakeven point.

May 2020 is a critical period

Whether the block reward halving in May 2020—a mechanism that decreases the rate of bitcoin production by half—would have an immediate impact on the price of bitcoin remains unclear.

In the previous two halvings, it took well over a year for BTC to enter a bull market, which indicates that the halving may be priced in.

However, the analyst said that if miners take profit before the year’s end and hold off in the first quarter of 2019, they are most likely to return after the halving.

The analyst added:

Miners will likely be preparing for worse case scenarios by taking profit and possibly re entering once the market finds balance after the halving. The price prediction isn’t something I am holding strongly, but onchain data and some of the older fiat exchanges show an average price of around 2-3k with an irrational crowd of speculators and over leveraged miners things can go down as fast as they go up.

Halving itself may not have a significant short term impact on the price of bitcoin upon its activation. But, if it serves as a critical period for the re-entrance of miners, BTC could see large movements in mid-2020.

This article was edited by Samburaj Das.