The monthly Bitcoin Futures Contracts of CME Group are set to expire today, as it’s the last trading Friday of the month. With the recent volatility, the volume of BTC futures contracts has also been on the rise at CME, as it hits the highest number in the last month. Meanwhile, Bitcoin has been on the rise in the past 24 hours just before the contracts are about to expire.CME Group Bitcoin Futures To Expire TodayAccording to the contract specifications, the cash-settled Bitcoin Futures on CME are about to expire today, November 29th because it’s the last trading day of the month.Each contract contains 5 BTC and they are settled monthly. Interestingly enough, the volume of CME Bitcoin Futures contract has also been increasing throughout the past few days and it reached its monthly high on

Topics:

George Georgiev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The monthly Bitcoin Futures Contracts of CME Group are set to expire today, as it’s the last trading Friday of the month. With the recent volatility, the volume of BTC futures contracts has also been on the rise at CME, as it hits the highest number in the last month. Meanwhile, Bitcoin has been on the rise in the past 24 hours just before the contracts are about to expire.

CME Group Bitcoin Futures To Expire Today

According to the contract specifications, the cash-settled Bitcoin Futures on CME are about to expire today, November 29th because it’s the last trading day of the month.

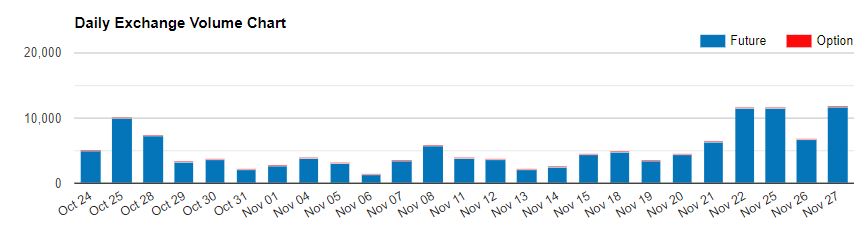

Each contract contains 5 BTC and they are settled monthly. Interestingly enough, the volume of CME Bitcoin Futures contract has also been increasing throughout the past few days and it reached its monthly high on November 27th.

Looking at Bitcoin’s price performance throughout this, indeed, volatile month of November, we can see that in a lot of the cases, the sudden spikes in the price also lead to an increase in the volume of the Bitcoin Futures Contracts traded on CME.

Bitcoin’s Price Surges In Anticipation

In the past couple of days alone, Bitcoin has managed to gain almost $1,000 to its dollar value. On Wednesday, the cryptocurrency dropped to about $6,850 but is now trading at $7,750, having peaked at about $7,800.

Interestingly enough, it’s not just Bitcoin that’s having a good couple of days. All the other major cryptocurrencies are also trading in the green, as BTC Dominance stands flat at around 66.7% for the past few days.

It’s interesting to see whether or not the expiry and settlement of the Bitcoin monthly futures contracts on CME would have any impact on the price. As Cryptopotato reported, the inverse head and shoulders pattern has granted Bitcoin a further target of $8,300. While it’s unsure if it will reach it or not, the settings look healthy so far.