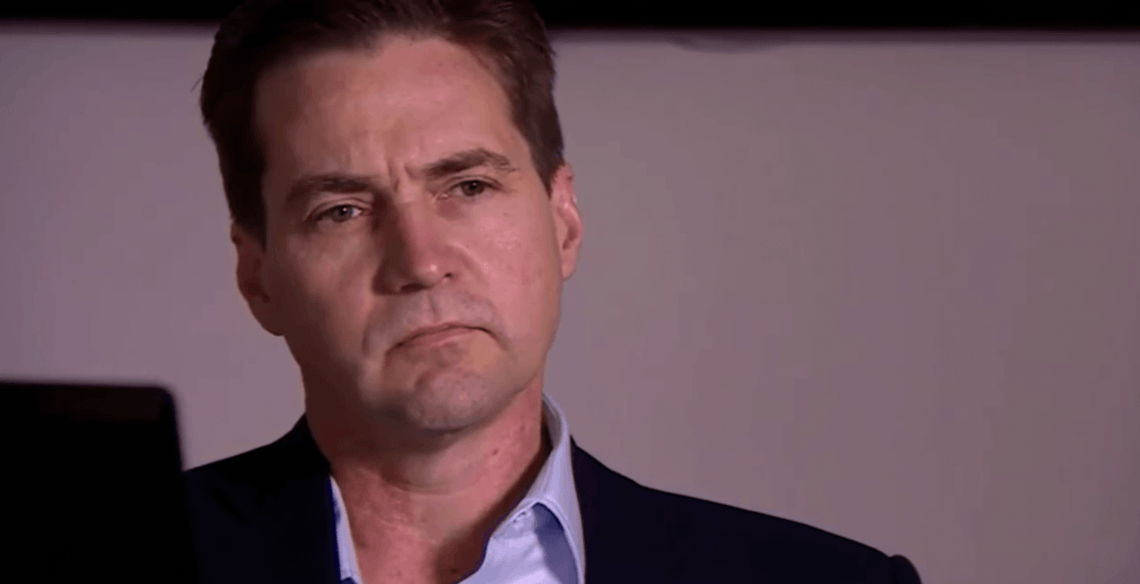

Last month, a judge ordered Craig Wright to turn over 50% of the bitcoin he mined with his former business associate, deceased computer genius Dave Kleiman. | Image: YouTube/BBC Craig Wright and Ira Kleiman have entered settlement discussions, with both parties requesting a 30-day extension of all case deadlines to facilitate negotiations. According to a joint motion filed on Sept. 17, the parties have reached a “non-binding agreement in principle” to settle the case, with both parties agree that reaching a binding settlement is in their "best interests." Both parties are seeking an extension of all deadlines pertaining to the case in order to exclusively devote

Topics:

Samuel Haig considers the following as important: craig wright, Cryptocurrency News, Ira Kleiman, Satoshi Nakamoto

This could be interesting, too:

Bitcoin Schweiz News writes Die Geschichte von Bitcoin geht mehr als 40 Jahre zurück

Bitcoin Schweiz News writes P2P Foundation: Das Forum, das Bitcoin einer breiten Öffentlichkeit präsentierte

Bitcoin Schweiz News writes Bitcoin: Von der Grassroot-Bewegung zum globalen Finanzinstrument?

Bitcoin Schweiz News writes Das ist die Evolution des Bitcoin-Logos: Vom Open-Source-Experiment zum globalen Symbol

Craig Wright and Ira Kleiman have entered settlement discussions, with both parties requesting a 30-day extension of all case deadlines to facilitate negotiations.

According to a joint motion filed on Sept. 17, the parties have reached a “non-binding agreement in principle” to settle the case, with both parties agree that reaching a binding settlement is in their "best interests."

Both parties are seeking an extension of all deadlines pertaining to the case in order to exclusively devote their efforts to settlement discussions. Currently, Kleiman’s motion for attorneys’ fees is due on Sept. 20, Wright’s opposition to sanctions ordered by Judge Reinhart is due on Sept. 23, and expert disclosures are due on Nov. 5.

Many analysts have attributed the 40% federal estate tax incurred by Ira Kleiman through the court’s ruling as the motivation for the plaintiff’s desire to settle.

The case has been ongoing since 2018, when Ira Kleiman sued Craig Wright for $10 billion, alleging that Wright had sought to fraudulently gain custody over his late-brother David Kleiman’s bitcoin holdings.

Court Rules Against Craig Wright

On August 27, the magistrate overseeing the case, Judge Bruce Reinhart, ruled in favor of Kleiman.

By Reinhart’s assessment, both parties had a "50/50 partnership," and that the plaintiffs retain an ownership interest in roughly 1.1 million bitcoin.

As such, the judge ruled that Wright must forfeit 50% percent of any bitcoin-related intellectual property developed by Wright prior to Kleiman’s death in 2014, in addition to 50% of any bitcoin that was mined by Wright prior to Kleiman’s death.

The court also ruled that Wright must pay for any attorney’s fees and reasonable expenses related to the filing and litigation of the case incurred by Kleiman.

Wright’s Testimony Found to be “Intentionally Misleading”

The judge concluded that Wright had made “inconsistent statements” relating to material matters concerning his purported inability to demonstrate the value of his bitcoin holdings as of Dec. 31, 2013. Judge Reinhart asserted:

“I completely reject Dr. Wright’s testimony about the alleged Tulip Trust, the alleged encrypted file, and his alleged inability to identify his bitcoin holdings.”

According to the magistrate, Wright’s testimony “was not supported by other evidence in the record” and “defies common sense and real-life experience.” The judge also noted that “When it was favorable to him,” Wright “appeared to have an excellent memory and a scrupulous attention to detail.” Otherwise, however, Wright was found to be “belligerent and evasive.”

The court found that Wright had numerous reasons not to tell the truth, citing “evidence indicating that relevant documents were altered in or about 2014, when the Australian Tax Office was investigating one of Dr. Wright’s companies” to suggest that Wright’s testimony may have been motivated by “legal and factual positions he took in the Australian Tax Office investigation and from which he cannot now recede.”

Last modified (UTC): September 19, 2019 6:24 PM