Bitcoin and most altcoins have marked a few consecutive days of negative price action. In a recent poll regarding Bitcoins’s potential bottom, over 70% of voters said that it would be below ,000. Additionally, the Fear and Greed Index is dropping daily, further confirming the negative sentiment among the community.Where Will Bitcoin Bottom?One of the most prominent cryptocurrency analysts conducted a Twitter poll regarding Bitcoin’s bottom. The community had four options to choose from, ranging from ,000 to ,500, and the results are rather interesting.Pick a $btc bottom.— fil₿fil₿ (@filbfilb) December 17, 2019Most people seem to think that the largest crypto’s decrease is not finished yet, and it will go below ,000.36% answered that it would find the lowest point somewhere between

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin and most altcoins have marked a few consecutive days of negative price action. In a recent poll regarding Bitcoins’s potential bottom, over 70% of voters said that it would be below $6,000. Additionally, the Fear and Greed Index is dropping daily, further confirming the negative sentiment among the community.

Where Will Bitcoin Bottom?

One of the most prominent cryptocurrency analysts conducted a Twitter poll regarding Bitcoin’s bottom. The community had four options to choose from, ranging from $3,000 to $6,500, and the results are rather interesting.

Pick a $btc bottom.

— fil₿fil₿ (@filbfilb) December 17, 2019

Most people seem to think that the largest crypto’s decrease is not finished yet, and it will go below $6,000.

36% answered that it would find the lowest point somewhere between $5,000 and $6,000, while the option “$6,000-$6,500” received 31%. The two most pessimistic choices were from $3,000 to $4,000 and $4,000 to $5,000. The former got 19%, while the latter collected the least amount of votes – 14%.

Interestingly enough, this is not the first time the community answered in a similar bearish way. Back in the middle of October, negativity was spreading as well, with Bitcoin trading at around $8,000, and people were predicting a fall to $6,000. However, In the next few weeks, the cryptocurrency didn’t go below $7,300 and just days later exploded to $10,350.

Fear & Greed Index

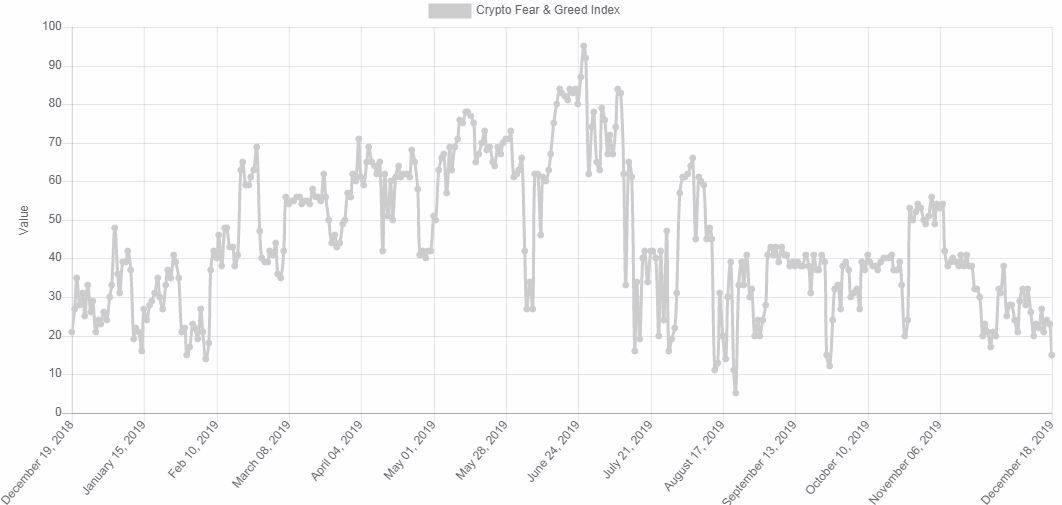

The Fear and Greed index provides the current sentiment in the market, by measuring and aggregating different data, including volume, surveys, social media, volatility, and BTC dominance. The results start from 0, representing “extreme fear,” to 100, which indicates “extreme greed.”

In the last several weeks, the index has been generally within the extreme fear phase. Yesterday, it was at 23, and the number has fallen to 15 now. Moreover, the last time it was above 40 was precisely a month ago, and since then, fear appears to be the main sentiment among the community.

However, it’s worth mentioning that the index is not necessarily a price indicator. For instance, when Bitcoin was trading at around $3,400 on February 6th, the fear index showed “14”. In the next several days, BTC’s price surged to $4,200, and over $5,000 later on.

Another example comes from June 26th this year, when greed was at its highest yearly point – 95. Coincidently (or not), this was also the day when Bitcoin reached its year-to-date high of almost $14,000. What followed was another move in the opposite direction, dropping the price to $9,000 in just a few weeks.