Millennials believe in Bitcoin for the long term, as per a recent report from Charles Schwab. According to the report, the Grayscale Bitcoin Trust (GBTC) is the 5th most used investment instrument, even surpassing giants such as Berkshire Hathaway and Microsoft.Millennials, also known as Generation Y, were born between the early years of the 1980s to mid-years of the 1990s.Millennials Choose GBTCThe large brokerage firm, Charles Schwab, recently published a report regarding the investment strategies of different generations. It’s based on data from over 140,000 retirement plans of Schwab’s customers, and it reveals some interesting stats on what are the most favorable choices for the young generation’s investments.Grayscale’s GBTC is popular among Gen Y. Source: SchwabAccording to the

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin Adoption, Grayscale

This could be interesting, too:

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Christian Mäder writes Das Bitcoin-Rennen der US-Bundesstaaten: South Carolina plant millionenschweren Krypto-Reservefonds!

Millennials believe in Bitcoin for the long term, as per a recent report from Charles Schwab. According to the report, the Grayscale Bitcoin Trust (GBTC) is the 5th most used investment instrument, even surpassing giants such as Berkshire Hathaway and Microsoft.

Millennials, also known as Generation Y, were born between the early years of the 1980s to mid-years of the 1990s.

Millennials Choose GBTC

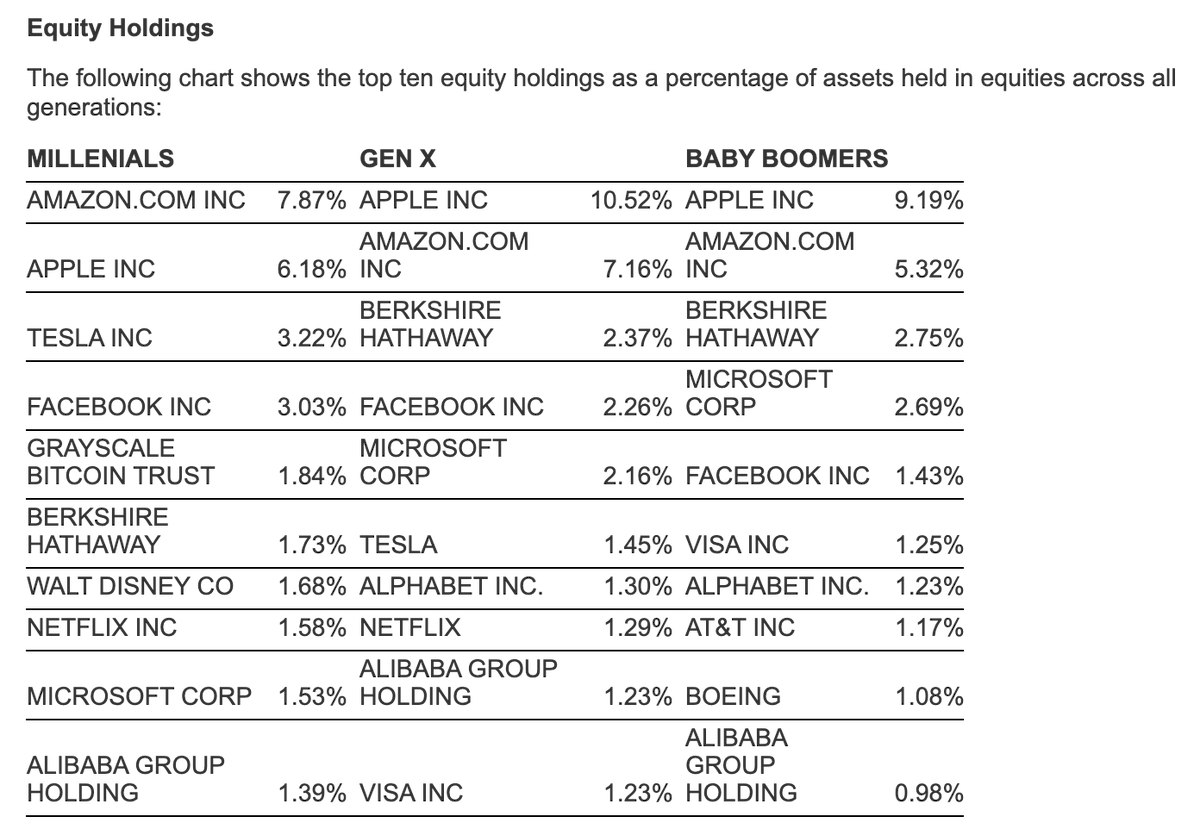

The large brokerage firm, Charles Schwab, recently published a report regarding the investment strategies of different generations. It’s based on data from over 140,000 retirement plans of Schwab’s customers, and it reveals some interesting stats on what are the most favorable choices for the young generation’s investments.

According to the report, Millennials might be on their way to leading in Bitcoin adoption. The Grayscale Bitcoin Trust (GBTC) is ranked 5th on the holding list, with almost 2% allocation of assets. Interestingly enough, GBTC purportedly has a higher percentage than Warren Buffett’s Berkshire Hathaway, Netflix Inc., and Microsoft Corp. Generally, it seems that Millennials prefer technology-based companies, as seen by the top four spots – Amazon (7.87%), Apple (6.18%), Tesla (3.22%), and Facebook (3%).

The interest from the younger generations towards Bitcoin and other cryptocurrencies is supported by another survey, as well. Compiled by KPMG, it suggests that 71% of all U.S.-based millennials are interested in the future of digital assets. The percentage went to 83% when the study focused on Americans between the ages of 18 and 24.

Additionally, people aged between 18 and 34, see Bitcoin as a better investment opportunity than real estate, as per another report.

GBTC – Youth Only

The Bitcoin Investment Trust (GBTC), run by Grayscale, is investors’ only choice to trade and to invest in the largest cryptocurrency on the traditional stock market.

Clients turn to GBTC, in case they want to trade Bitcoin but not on the standard cryptocurrency exchanges. This carries some advantages for the average Joe, whereas the client doesn’t have to worry about storing his Bitcoins and has no issues with paying a fee for someone else to do so for him.

Schwab’s report also indicates that Generation X (Gen X) and Baby Boomers are not quite as fond of GBTC as younger generations. However, their investment portfolio allocations seem somewhat identical: Apple leads the way, gathering 9.19% by Baby Boomers and 10.52% by Gen X. Amazon follows with 5.32 and 7.16%, respectively, and Berkshire Hathaway is at 2.75% and 2.37%.

The only thing left to do is to see what the next generation, which was born in the new Millenium, would prefer.