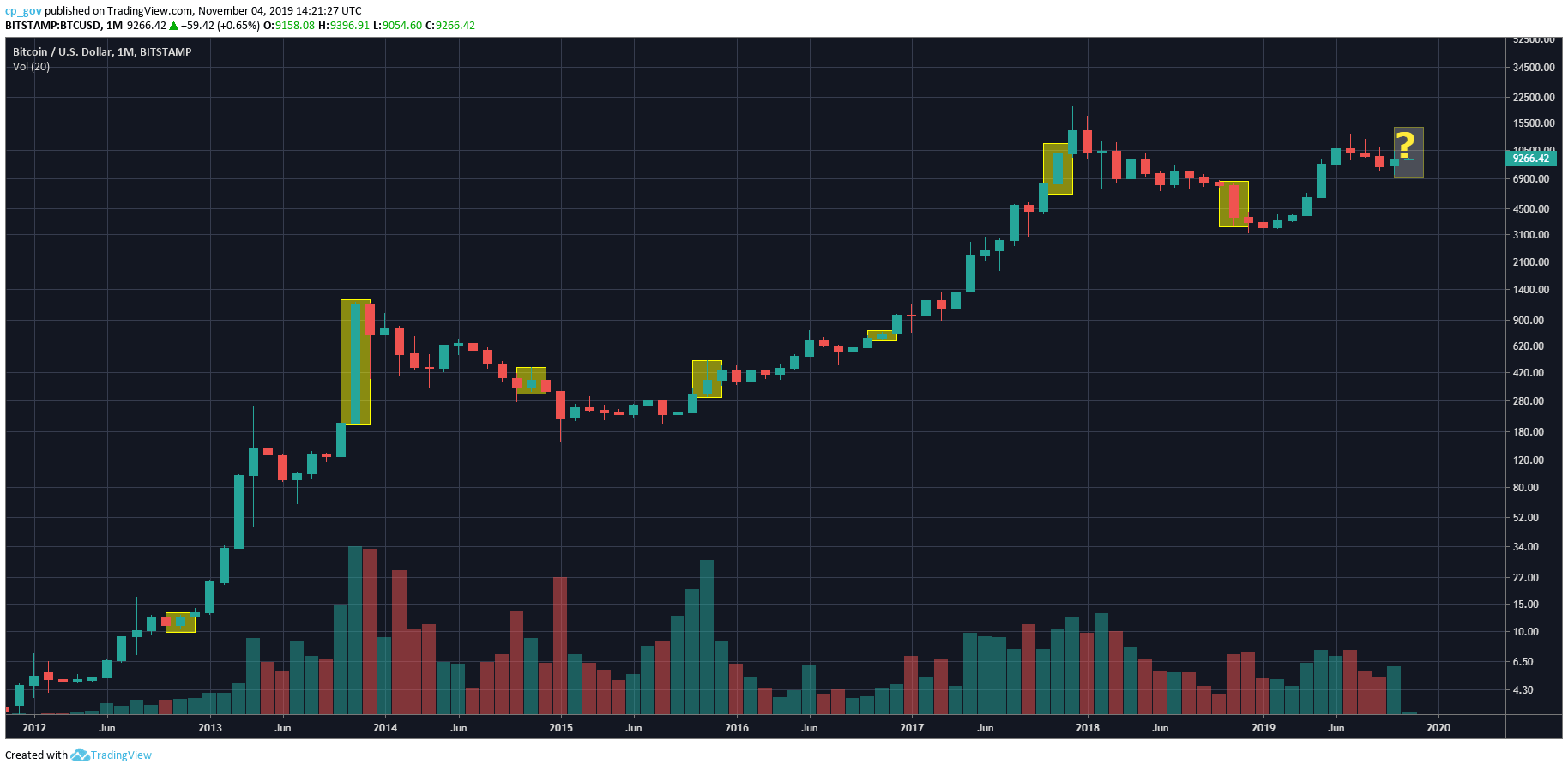

Let’s rewind the clock for two years: The phrase “November 2017” is perhaps causing some eager smiles on anyone familiar with the cryptocurrency space. It was the peak of the most famous Bitcoin bubble.Now, let’s get back in time a year later to November 2018, a year ago. Or, if you want to be even more specific – November 14th, Bitcoin’s horror day. On that day, the Bitcoin price dropped below the significant 2018-support of 00 and set the course for a 50% plunge in one month.When looking at the charts for other Novembers, we can see that this specific month tends to be very volatile for Bitcoin. Apart from the one in 2018, November has traditionally been a very positive month for the cryptocurrency.Bitcoin monthly chart (Bitstamp), November is marked. Source: TradingView“The crypto

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Let’s rewind the clock for two years: The phrase “November 2017” is perhaps causing some eager smiles on anyone familiar with the cryptocurrency space. It was the peak of the most famous Bitcoin bubble.

Now, let’s get back in time a year later to November 2018, a year ago. Or, if you want to be even more specific – November 14th, Bitcoin’s horror day. On that day, the Bitcoin price dropped below the significant 2018-support of $6000 and set the course for a 50% plunge in one month.

When looking at the charts for other Novembers, we can see that this specific month tends to be very volatile for Bitcoin. Apart from the one in 2018, November has traditionally been a very positive month for the cryptocurrency.

“The crypto industry is now more established than ever before and is progressing rapidly. The endorsement of Blockchain by Xi Jinping has brought a lot of excitement to the market as have the new Bitcoin futures options from some of Wall Street’s biggest players.”, Mati Greenspan, eToro’s senior analyst, was seeing some reasons why this current November could also be promising.

“November has historically been a very volatile month for Bitcoin, and this November could be as critical as ever.”, According to the famous Bitcoin analyst Tone Vays.

Raging Months of November

Let’s have a metaphorical journey back in time and see how Bitcoin price performed in the months of November so far, starting in 2012, as the first Bitcoin exchanges popped up and enabled BTC trading. Data refers to the veteran Bitstamp exchange.

In 2012 November the price was fairly low, but that also has to do with the fact that Bitcoin, back then, wasn’t really popular. The month opened at $11 and closed at slightly above $12, representing an increase of 13%. However, the price candle saw a broader range of $10.25 – $12.74.

Back in 2013, or the first major Bitcoin bubble, followed by the cryptocurrency’s 460% monthly surge. Bitcoin started the month trading at around $204 and ended at $1150. It took Bitcoin 14 months of a bear market to return to the $200 price area.

November 2014 was one that kicked off great for Bitcoin’s price, surging from $310 to more than $450 in a few days. However, things went slightly downhill from there, and the month ended up with Bitcoin closing $380, which was still a decent increase of roughly 25%.

November 2015 was reasonably similar to the previous year. In fact, the month started trading at roughly $300 again and shot up to $470 in the first few days after displaying a similar pattern and pulling back to $370.

The following year, 2016, Bitcoin’s price went on an actual rollercoaster. November saw numerous swings of around 10%, all of which were sudden and in a matter of days. However, after all that, Bitcoin started at about $710 and ended at $730, marking an insignificant increase.

And there comes November 2017: It was the landmark year for Bitcoin because it reached its current all-time high in late December of that year. This movement, however, was predicated on an exciting November, where Bitcoin went from $6,400 to end the month of $9,300.

And finally, for now, we arrive at last year’s horrific turn of events. The year of 2018 was bad enough on its own, November of last year was the first negative ROI November in seven years. After seeing $6544 as a monthly high, Bitcoin plunged to $3474, losing 47% of its value. November closed with some optimism roughly above $3900.

To sum it up, 6:1 to the Bulls in the consecutive Novembers since 2012, but the taste is still the one of last year’s, the only Bearish November.

Bitcoin is Getting Ready For November 2019: What To Expect

This year we step into November after a memorable October with notable price actions. After weeks of consolidation, Bitcoin headed south by plunging to $7,300 in just hours, but a few days later, it gained 42%, reaching $10,350. The market retraced to $9,200-$9,400 and remains quite calm since then.

“I am still skeptical of this 2019 rise, but if we can go above $10,000 this month, we can easily set off a FOMO into halving. However, a drop back below $8,500 this month opens the door for a catastrophic drop closer to the 2019 lows in early 2020 then the all-time highs.” Tone Vays added to CryptoPotato.

Of course, it’s worth noting that previous price action shouldn’t be accepted as an indicator of what’s to come. This is something that Carl Eric Martin, better known as the popular YouTuber The Moon, reiterated.

“I believe that a big November move is coming. However, I don’t rely on previous price action to come to that conclusion. The reason why a big move is coming is because of the previous massive 40% spike Bitcoin got, that penetrated the 200-day moving average line. I was one of the very few people still being bullish before the big spike, and I’ve been calling for a move to at least $11,500 since before the spike.”, as been said by The Moon.

He also said that he expects a large continuation move in November that would follow the big 40% spike back in October. He emphasized that the fact that Bitcoin is back above the 200-day moving average line has been the signal he’s been looking out for and that he’s currently long on Bitcoin.

But Not everyone believes in the Magical November theory: Greenspan sees it just like any other day. He also said that he hadn’t seen any conclusive evidence that a specific day of the week or month of the year is any more significant than the one that proceeded it, concluding that “if November is anything like October, we’ll be in for an amazing ride.”