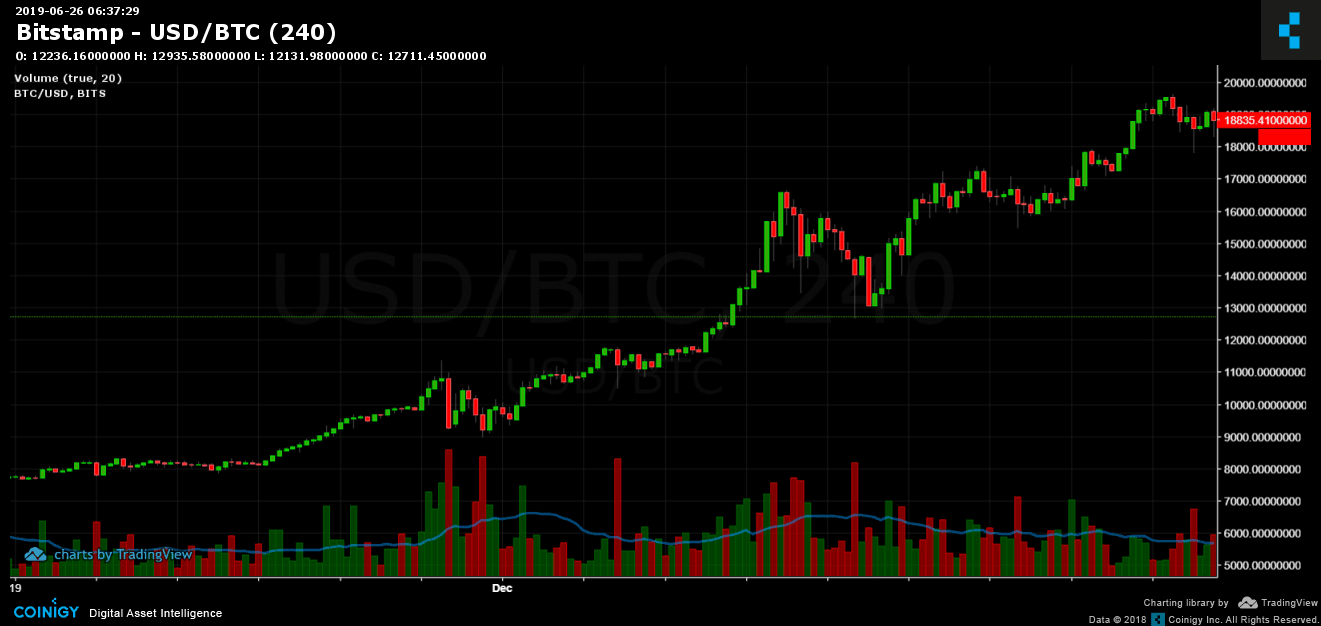

The cryptocurrency market went through a parabolic price surge in late 2017 causing a stir around the financial world. Bitcoin, the largest crypto by market cap, reached its all-time high at ,000 but according to two U.S.-based academics, this price movement was manipulated by a single whale.Cryptocurrency Price Manipulation?The topic of price manipulation in the cryptocurrency market has been around for a few years. Finance professor John M. Griffin from the University of Texas and assistant professor of finance at the Ohio State University – Amin Shams, came up with a paper in 2018 that the price actions may have been manipulated.Bitcoin: Nov – Dec 2017 Bull-run. Chart by TradingViewThe initial research was published last year and it said that the surge in 2017 was caused “probably by

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The cryptocurrency market went through a parabolic price surge in late 2017 causing a stir around the financial world. Bitcoin, the largest crypto by market cap, reached its all-time high at $20,000 but according to two U.S.-based academics, this price movement was manipulated by a single whale.

Cryptocurrency Price Manipulation?

The topic of price manipulation in the cryptocurrency market has been around for a few years. Finance professor John M. Griffin from the University of Texas and assistant professor of finance at the Ohio State University – Amin Shams, came up with a paper in 2018 that the price actions may have been manipulated.

The initial research was published last year and it said that the surge in 2017 was caused “probably by market manipulation”. Reportedly, one of the most used stablecoins, Tether (USDT), was used to artificially inflate Bitcoin’s price. By analyzing cryptocurrency investments, Griffin and Shams found out that major Tether purchases were timed with the declines in the market in order to stabilize its bottom.

The same paper was updated recently, including their new research showing that the price manipulation was caused by one large entity and it was apparently carried out on the cryptocurrency exchange BitFinex.

“Our results suggest instead of thousands of investors moving the price of Bitcoin, it’s just one large one. Years from now, people will be surprised to learn investors handed over billions to people they didn’t know and who faced little oversight[…] This one large player or entity either exhibited clairvoyant market timing or exerted an extremely large price impact on Bitcoin that is not observed in aggregate flows from other smaller traders.”

The research also refers to the possibility that not all tether is backed by traditional currencies.

Tether and Bitfinex Controversy

A single parent company called iFinex owns both BitFinex and Tether and it’s safe to say that there’s no shortage of controversy. A lawsuit was filed in April this year from the U.S. Justice Department and the attorney general from New York. The accusation was for covering an $850 million loss by accessing at least $700 million worth of USDT tokens from Tether’s reserves.

The case noted several delays with more information needed and it’s still to see a conclusive resolution. Most recently, BitFinex won a motion in front of the New York Supreme court, meaning that the company won’t have to provide any documents regarding the use of Tether until further notice.