Just as Bitcoin was a spark for the cryptocurrency movement, it seems that Ethereum is likely to take a similar role in the history of DeFi.Decentralized finance is undoubtedly the biggest hit of 2020, with billion in total value locked looking like a realistic target for 2020. Over recent months, several dApps have topped the charts on DeFi Pulse. Compound, Aave, and Uniswap have recently taken the number one spot, pushing the previously-dominant Maker down the rankings.However, as the funds have poured into DeFi, the sheer weight of transactions is starting to cause the underlying Ethereum infrastructure to creak. Miners are laughing all the way to the bank as gas prices have soared over recent months.Photo: Dune AnalyticsThe situation is only compounded by more and more applications

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Just as Bitcoin was a spark for the cryptocurrency movement, it seems that Ethereum is likely to take a similar role in the history of DeFi.

Decentralized finance is undoubtedly the biggest hit of 2020, with $12 billion in total value locked looking like a realistic target for 2020. Over recent months, several dApps have topped the charts on DeFi Pulse. Compound, Aave, and Uniswap have recently taken the number one spot, pushing the previously-dominant Maker down the rankings.

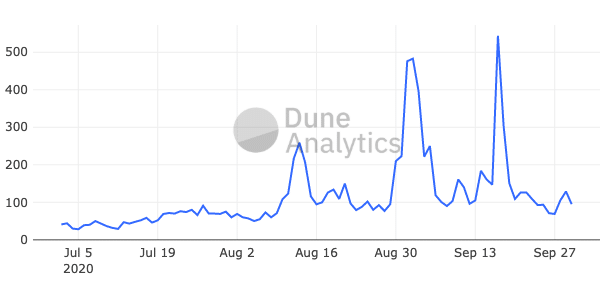

However, as the funds have poured into DeFi, the sheer weight of transactions is starting to cause the underlying Ethereum infrastructure to creak. Miners are laughing all the way to the bank as gas prices have soared over recent months.

Photo: Dune Analytics

The situation is only compounded by more and more applications piling on the DeFi bandwagon. Whereas DeFi Pulse used to list around 20 projects, the number has more than doubled over the summer. The vast majority are based on Ethereum.

Therefore, it seems almost inevitable that at some point, DeFi dApp developers will start looking for a new home. At this moment in time, there are several potential contenders.

Lining Up to Compete with Ethereum

One example is the Binance Smart Chain, which launched at the end of August and is already attracting several DeFi applications that mirror their counterparts on Ethereum. For instance, there are multiple implementations of similar code used in the now-infamous SushiSwap. These include BurgerSwap and PancakeSwap – essentially, decentralized exchange protocols that offer the opportunity to mine a native governance token. Binance CEO Changpeng Zhao has proven to be very supportive of DeFi, pointing out how listing DeFi tokens on his centralized exchange services a decentralized economy.

Another example is Radix. The project is developing a first-layer platform that’s specifically tailored for DeFi applications. Radix differentiates itself through their unique consensus model, Cerberus. To understand why this is important, the project points out how many other potential development platforms aren’t future-proofed for DeFi applications because their sharding protocols lack the necessary composability.

What is Composability?

For anyone unfamiliar with the concept of composability, then it’s necessary to understand how sharding works. The way many sharded blockchains operate is via a central chain and multiple side chains, or shards. In the typical sharding model used by platforms such as Polkadot, Cosmos, or Ethereum 2.0, applications are assigned to their own shard.

However, this segregation of applications by shard makes the idea of atomic transactions impossible. In Ethereum’s current iteration, a user can implement multiple features from different dApps simultaneously – for example, borrowing from one while simultaneously lending in another. However, if the applications are hosted on different shards, it would take multiple transactions to implement the same result.

Radix has spent seven years researching and developing its own sharding and consensus model that’s designed to overcome these issues while also enabling superior throughput. The model, called Cerberus, uses 2^256 shards. Across this huge shard space assets and dApps are deterministically mapped to shard addresses. Cerberus can then stitch together applications across these shards, allowing cross-shard synchronisation for atomisity where needed.

Therefore, composability between dApps is preserved, enabling atomic transactions with limitless scalability. Cerberus is also the subject of an academic paper written by consensus experts from the University of California.

Radix also offers royalties to developers as a share of transaction fees for usage of their smart contracts, as a means of attracting devs to the platform from the point of launch.

The project is about to launch its token sale using an ERC-20 token, with a newly-launched tokenomic model. The model involves price-based unlocking, meaning the tokens will only enter circulation incrementally once the price hits certain threshold values. The token sale is due to start on October 20, with pre-registration opening on October 6.

Stiff Competition

Radix’s plan to overhaul DeFi is ambitious, and the project is also facing stiff competition. Despite its claims about Polkadot’s lack of composability, the platform offers interoperability with Ethereum, making it an attractive proposition for developers. Although Polkadot hasn’t yet completed all stages of its mainnet launch, the token price increases this year indicate the kind of hype surrounding the project, which is developed by Ethereum co-founder Gavin Wood.

Another new platform garnering significant attention this year is NEAR Protocol. Like Radix, the project also offers developers a share of transaction fees where their smart contracts are used. NEAR puts a heavy focus on usability for developers, end-users, and validators alike – an approach which netted it $21.6 million in a funding round earlier this year, including backing from Andreessen Horowitz’s A16Z blockchain fund.

Just as Bitcoin was a spark for the cryptocurrency movement, it seems that Ethereum is likely to take a similar role in the history of DeFi. As the enthusiasm for liquidity mining and yield farming shows no signs of abating, DeFi seems likely to see a breakout on Ethereum’s rival platforms. However, with benefits including composability, interoperability, lower transaction fees, and greater throughput, such a shift would be to the benefit of all industry participants.

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.