Another week has passed, and it’s safe to say it was an intense one. First things first, the major headline is that the US Commodity and Futures Trading Commission (CFTC) charged the owner-operators of 100x Group, the parent company of BitMEX, with illegally running a derivatives exchange.Needless to say, BitMEX is one of the leading Bitcoin derivatives trading platforms, and one would think that something of the kind would cause a big blow. Arthur Hayes and the rest of the executive team stepped down, while Samuel Reed was arrested and later let go under an appearance bond.The following day, the UK’s Financial Conduct Authority (FCA) announced that it would ban cryptocurrency derivatives starting January 2021.To top it all up, John McAfee was detained in Spain and is to be extradited to

Topics:

George Georgiev considers the following as important: AA News, Bitmex, BTCEUR, BTCGBP, btcusd, btcusdt, John McAfee, Market Updates, sec, United States

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Another week has passed, and it’s safe to say it was an intense one. First things first, the major headline is that the US Commodity and Futures Trading Commission (CFTC) charged the owner-operators of 100x Group, the parent company of BitMEX, with illegally running a derivatives exchange.

Needless to say, BitMEX is one of the leading Bitcoin derivatives trading platforms, and one would think that something of the kind would cause a big blow. Arthur Hayes and the rest of the executive team stepped down, while Samuel Reed was arrested and later let go under an appearance bond.

The following day, the UK’s Financial Conduct Authority (FCA) announced that it would ban cryptocurrency derivatives starting January 2021.

To top it all up, John McAfee was detained in Spain and is to be extradited to the US on tax evasion charges. The SEC is also suing him for failing to disclose $23 million in profits and fraudulently promoting initial coin offerings.

The most interesting thing about this week, however, is Bitcoin’s price performance. Clearly, it was a horrible week for the industry and, yet, BTC’s price stayed stable. Not only that but yesterday, it broke out to the upside and finally conquered $11,000 – something we didn’t see since September 20th – 18 days ago.

This happened just as Jack Dorsey’s Square announced that it had bought $50 million worth of BTC. As such, it became the second publicly-traded company that owns Bitcoin as part of its balance sheet after MicroStrategy.

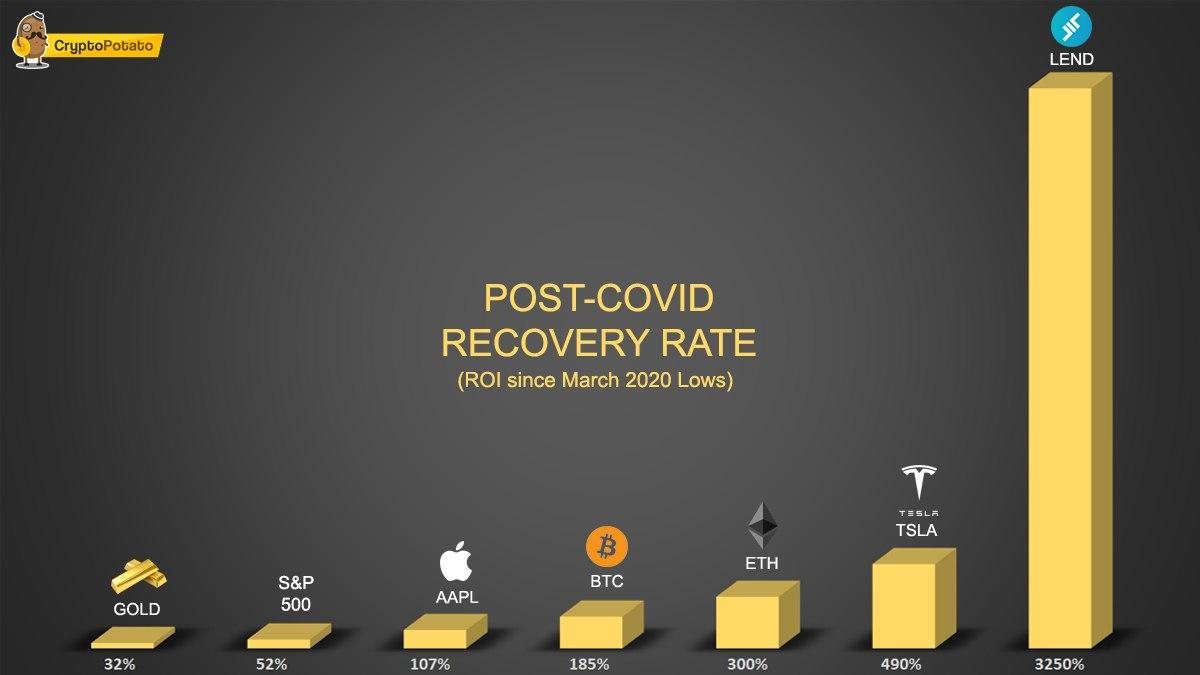

Speaking of companies, it appears that Tesla’s stock is performing better than both BTC and ETH since the mid-March COVID crash. Of course, the entire market fades compared to the massive boom of DeFi, exemplified perfectly with Aave’s LEND growth.

As CryptoPotato recently reported, Bitcoin was trading within a very narrow range, and its historic volatility levels were at a low point. This usually coincides with a major move, and this time it appears to be toward the upside. Of course, only time will tell if BTC will continue its 2020 bull run or if bears will intercept.

Market Data

Market Cap: $352B | 24H Vol: 123B | BTC Dominance: 58.2%

BTC: $11,073 (+5.17%) | ETH: $364.39 (+5.7%) | XRP: $0.251(+8.1%)

Bitcoin Tumbles $400 As CFTC Charges BitMEX Owners with Illegally Operating a Crypto Exchange. The US Commodities and Futures Trading Commission (CFTC) has charged the owner-operators of BitMEX with illegally running a derivatives platform. Since then, Arthur Hayes has stepped down as the CEO of the exchange’s parent company.

UK FCA Bans Cryptocurrency Derivatives Starting in January 2021. The UK’s Financial Conduct Authority has announced that it will ban cryptocurrency derivatives for retail users starting January 2021. The regulator will also shut down the trading of exchange notes (ETNs).

Jack Dorsey’s Square Buys $50 Million Worth of Bitcoin (BTC). The financial services company Square, run by the CEO of Twitter, Jack Dorsey, has purchased $50 million worth of Bitcoin. As such, it becomes the second publicly-traded company to own BTC on its spreadsheet.

Cryptocurrency Enforcement Framework Announced by the US Department of Justice. The US Department of Justice published its Cryptocurrency Enforcement Framework and explained its views and actions to tackle criminal activities within the cryptocurrency community. It talks of the dangers associated with the adoption of virtual currencies.

Bitcoin Fundamentals are in ‘Moon Mode’ Now: Will Market Respond Only In 2021? Despite Bitcoin’s calm price performance over the past month, its on-chain fundamentals are in ‘moon mode,’ according to an esteemed analyst. This could, supposedly, lead to a massive bull run coming in 2021.

Binance DeFi Index Tumbles Over 50% on Its First Month and There Is Even Worse News. In a somewhat horrific turn of events for DeFi coins, most of them are trading in the red for quite some time. The Binance DeFi index is down over 50% in its first month, and it doesn’t even include some of the worst performers among the popular coins.

Charts

This week we have a chart analysis of Bitcoin, Ethereum, Ripple, Monero, and Bitcoin Cash – click here for the full price analysis.