The correlation between the price of gold, silver, and Bitcoin continues. The three assets are moving in a very similar matter, regardless of the direction. Most recently, all three experienced a decline.According to some analysts, gold’s price could be used as an indicator of Bitcoin’s behavior so long as the correlation remains high.On another note, the similarity in their performance also hints that the cryptocurrency is increasingly seen as a store of value purchase for investors.Bitcoin, Gold, and Silver Highly CorrelatedOver the year, Bitcoin has been highly correlated with a lot of different asset classes. When the prices tumbled during the mid-March crisis, largely induced by the spread of the coronavirus, the cryptocurrency was moving in line with the stock market.Now, however,

Topics:

George Georgiev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, nasdaq

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

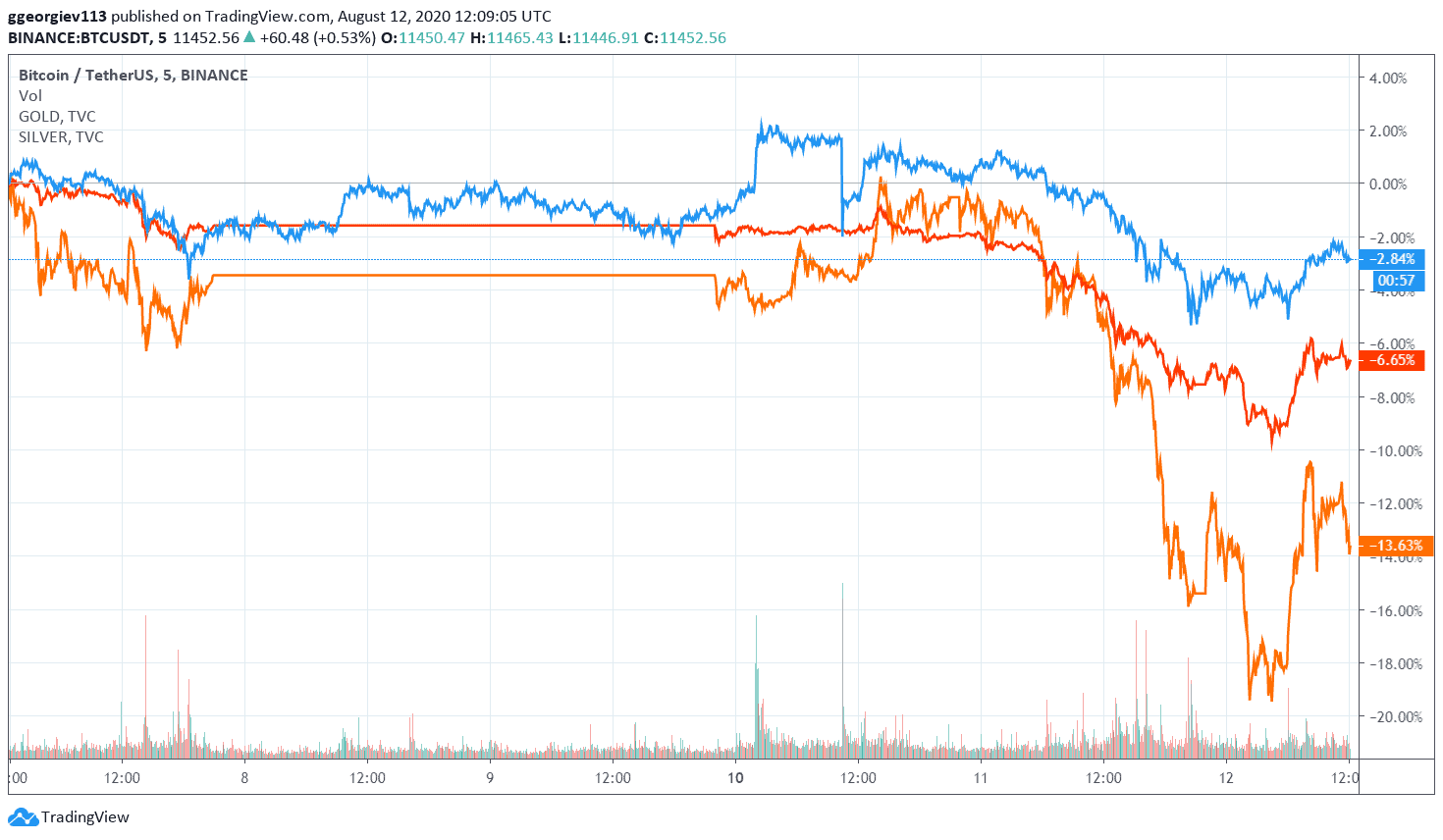

The correlation between the price of gold, silver, and Bitcoin continues. The three assets are moving in a very similar matter, regardless of the direction. Most recently, all three experienced a decline.

According to some analysts, gold’s price could be used as an indicator of Bitcoin’s behavior so long as the correlation remains high.

On another note, the similarity in their performance also hints that the cryptocurrency is increasingly seen as a store of value purchase for investors.

Bitcoin, Gold, and Silver Highly Correlated

Over the year, Bitcoin has been highly correlated with a lot of different asset classes. When the prices tumbled during the mid-March crisis, largely induced by the spread of the coronavirus, the cryptocurrency was moving in line with the stock market.

Now, however, there’s a notable correlation between the price of the two most popular precious metals – gold and silver, and Bitcoin.

This is particularly apparent in the last five days of trading when the prices for all of these assets were tumbling. Since August 7th, gold lost about 6.5% of its value, Bitcoin is down around 5%, while silver saw a steeper decline of about 11%. In other words, – the assets are performing in a very similar way.

The similarities have been going on for about a month now, and they were also very apparent when Bitcoin started increasing from the $9,000 level. At the time, gold went on a massive run and broke $2,000 for the first time.

What Are The Implications for Bitcoin?

A few important conclusions can be drawn from this. First and foremost, gold is historically seen as an inflation hedge because of its scarce supply. Unlike fiat currency, its value isn’t inflated by governments.

This narrative has been strengthening up for Bitcoin as well in the last month. As CryptoPotato reported yesterday, a NASDAQ-listed company bought $250 million of BTC as an inflation hedge, hence giving more merit to the store of value characteristic of the digital asset.

This is supported by information provided by the popular data firm Santiment.

“Gold continues to look like a legitimate leading BTC indicator during these uncertain times. There appears to be a continued simultaneous interest in these two non-fiat stores of value.” – The company concluded.

It also raises another important point – gold’s performance being indicative of future Bitcoin moves. So far, that’s turning out to be the case, but it’s important to stay vigilant because the market conditions are constantly changing.