The price of Bitcoin (BTC) on major exchanges has dropped by approximately 2.9 percent to ,558.60 over the past 24 hours, as of press time —sparking widespread declines throughout the wider cryptocurrency market.Tokens relating to decentralized finance have seen particularly harsh declines of late, and BTC’s drop in valuation since a failure to push higher over the weekend hasn’t done DeFi tokens any favors.The cryptocurrency market is rapidly losing valuation today. Source: Coin360Where The S&P 500 Goes, BTC FollowsThe cryptocurrency market’s decline in valuation isn’t taking place in a vacuum, of course. The S&P 500 Index has steadily dropped in September from levels approaching 3,600 to nearly 3,300.The S&P 500 Index has been in decline throughout September. Source: TradingViewWith

Topics:

George Georgiev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, kraken, United States

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The price of Bitcoin (BTC) on major exchanges has dropped by approximately 2.9 percent to $10,558.60 over the past 24 hours, as of press time —sparking widespread declines throughout the wider cryptocurrency market.

Tokens relating to decentralized finance have seen particularly harsh declines of late, and BTC’s drop in valuation since a failure to push higher over the weekend hasn’t done DeFi tokens any favors.

Where The S&P 500 Goes, BTC Follows

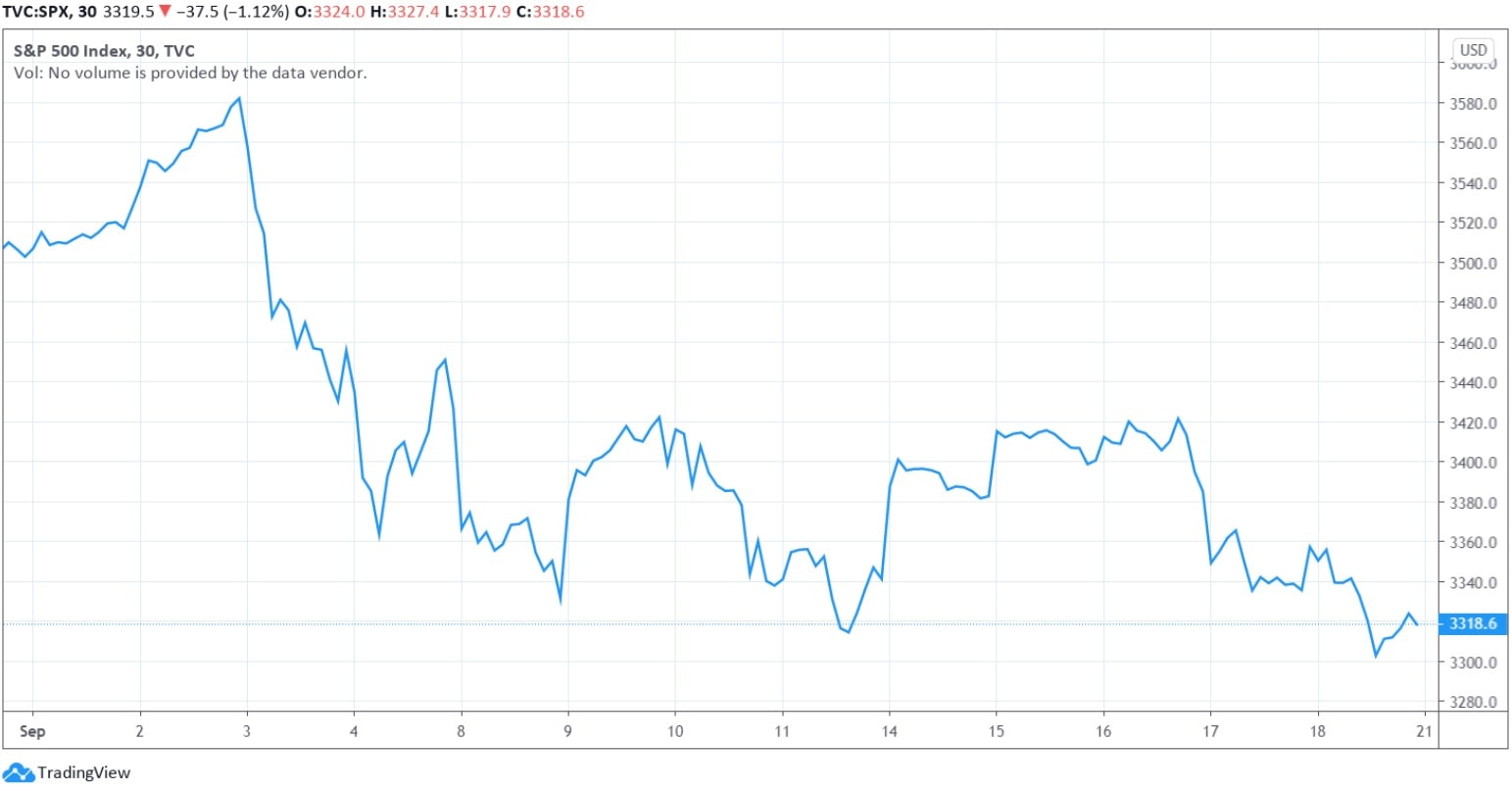

The cryptocurrency market’s decline in valuation isn’t taking place in a vacuum, of course. The S&P 500 Index has steadily dropped in September from levels approaching 3,600 to nearly 3,300.

With the S&P 500 Index struggling, it comes as no surprise that the price of the leading cryptocurrency is also finding it hard to gain a foothold in September. As noted by Kraken’s Bitcoin Volatility Report for August, the correlation between BTC and the S&P 500 reached as high as 0.84 last month.

With widespread economic uncertainty plaguing the traditional markets amid a volatile year and COVID-19 cases increasing in Europe, it stands to reason that risk-on assets — such as cryptocurrencies — may struggle to find gains while the stock market declines.

Bitcoin Drops in September (Remember?)

Furthermore, September has never been a friendly month for BTC. In fact, it is the market leader’s worst month, historically — with an average return of -7 percent.

With this historical context in mind, it comes as even less of a surprise that BTC is currently down approximately 9 percent this month.

Looking at the markets for the past three years, things appear rather grim for September. In 2017, the price dropped by roughly around 11.8%, in 2018 – with 6.3%, and in 2019 – with 17.7%. On average, Bitcoin’s lost about 12% during September for the past three years.

Not to be deterred

With all of this in mind, many Bitcoin investors are finding plenty of reasons to remain bullish amid a predictable September decline.

Research suggests that major institutional players have been accumulating BTC throughout critical junctions in 2020, which is backed up my news that investors like Paul Tudor Jones and MicroStrategy are investing in BTC as a hedge against inflation.