The current crisis, largely induced by the unexpected spread of the novel coronavirus (COVID-19), took its toll on oil prices. For the first time in history, crude oil trades below zero, meaning that producers are paying the buyers for disposing of their supplies. While this is undoubtedly an event to be remembered, it’s unlikely that this will have a severe impact on Bitcoin’s price. Crude Oil Prices Tank Below %excerpt% Benchmark US crude oil prices sank to below %excerpt% on Monday for the first time in history. Essentially, this means that oil producers or traders have to pay other market participants to take the oil off their hands. The West Texas Intermediate crude (WTI) futures expiring in May plunged to negative .63 yesterday. The reasons for that are undoubtedly found in the consequences of

Topics:

George Georgiev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, Coronavirus (COVID-19), United States

This could be interesting, too:

Wayne Jones writes Beyond Hacks: Vitalik Buterin Calls for Wallet Solutions to Address Crypto Loss

Chayanika Deka writes Internal Conflict at Thorchain as North Korean Hackers Leverage Network for Crypto Laundering

Chayanika Deka writes Consensys and SEC Reach Agreement to Dismiss MetaMask Securities Case

Chayanika Deka writes Meme Coins Do Not Qualify as Securities: SEC Confirms

The current crisis, largely induced by the unexpected spread of the novel coronavirus (COVID-19), took its toll on oil prices. For the first time in history, crude oil trades below zero, meaning that producers are paying the buyers for disposing of their supplies. While this is undoubtedly an event to be remembered, it’s unlikely that this will have a severe impact on Bitcoin’s price.

Crude Oil Prices Tank Below $0

Benchmark US crude oil prices sank to below $0 on Monday for the first time in history. Essentially, this means that oil producers or traders have to pay other market participants to take the oil off their hands.

The West Texas Intermediate crude (WTI) futures expiring in May plunged to negative $37.63 yesterday.

The reasons for that are undoubtedly found in the consequences of the COVID-19 pandemic. Almost all countries halted their international flights. A lot of countries also restricted internal land travel between different cities. This was done in an attempt to slow down the spread of the novel coronavirus that continues to take thousands of victims every day. Land-based and air travel industries are among the greatest consumers of petrol-based products, hence the significantly reduced demand.

As such, the oil industry is currently in a state of oversupply, and this causes storage tanks to become so full that it’s challenging and costly to find physical space to store it.

Why Is This Unlikely To Affect Bitcoin’s Price?

Arguably the biggest expense for Bitcoin miners is the electricity cost. With plunging oil prices, a lot of people wonder if this could impact the cost of mining, and hence the price of bitcoin.

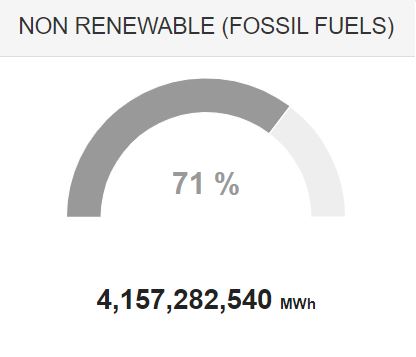

China has historically been one of the countries where Bitcoin mining is concentrated. As Cryptopotato reported last year, 66% of the hash rate comes from there. The electricity sources in the country are variable, and there’s a tendency for it to move to renewable energy sources. However, at the time of this writing, almost 71% of the electricity in China is sourced from various fossil fuels.

These, nevertheless, aren’t limited to oil, but they also include coal, natural gas, and others. Hence, even if the price of oil continues to plummet (which is also unlikely because the COVID-19 crisis will eventually pass), it’s questionable if it will have a serious impact on electricity costs.

In the US, the primary fossil fuel used for energy production is natural gas. According to a recent report, the prices for natural gas and oil have been rather uncorrelated since 2007. In other words – this is also unlikely to cause serious downswing to electricity costs.

But even if the prices of electricity drop so much that they make a difference regarding bitcoin mining’s breakeven cost, this is also unlikely to impact the price. The cheaper it is to mine Bitcoin, the more miners are likely to enter the space. This, in turn, should increase the network’s hash rate, making it even more secure. Even though this would, in theory, suggest that those miners would sell their product (bitcoin) at cheaper rates, this hasn’t been the case with Bitcoin.

There are other factors involved when it comes to Bitcoin’s price formation, speculation being the leading one.

If anything, cheaper prices should make the network more secure as the barrier to entry would be essentially lower.

There’s More To It, However

The extraction of oil has historically been one of the most prominent and profitable industries in the world. As the current financial crisis continues to unwind, it’s possible that the problems that it’s currently going through would resonate with other sectors, causing even more pressure to legacy markets.

Bitcoin’s price has been largely correlated with that of the stocks, and it’s not out of the question that pressure on Wall Street will also spell trouble for Bitcoin.