The Bitcoin (BTC) price dip seen on Thursday has triggered a cascade of forced liquidation on derivatives exchanges like BitMEX and Bitfninex. U.S. stocks have also taken a beating, with the markets experiencing its worst performance since June.Bitcoin Long Bloodbath as BTC Price Falls to ,700According to data from the crypto derivatives analytics platform Datamish, about 1 million in Bitcoin Longs on the BitMEX exchange got liquidated, following Bitcoin’s plunge to below ,500.As earlier reported by CryptoPotato, Bitcoin price shed 00 in 48 hours, with the price of Ethereum and other altcoins also nosediving. Such was the extent of Thursday’s price crash that the total cryptocurrency market capitalization is down by over billion.Apart from BitMEX long traders suffering as a

Topics:

Anthonia Isichei considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Shorts and Longs, Bitmex, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Wayne Jones writes Beyond Hacks: Vitalik Buterin Calls for Wallet Solutions to Address Crypto Loss

Chayanika Deka writes Internal Conflict at Thorchain as North Korean Hackers Leverage Network for Crypto Laundering

Chayanika Deka writes Consensys and SEC Reach Agreement to Dismiss MetaMask Securities Case

Chayanika Deka writes Meme Coins Do Not Qualify as Securities: SEC Confirms

The Bitcoin (BTC) price dip seen on Thursday has triggered a cascade of forced liquidation on derivatives exchanges like BitMEX and Bitfninex. U.S. stocks have also taken a beating, with the markets experiencing its worst performance since June.

Bitcoin Long Bloodbath as BTC Price Falls to $10,700

According to data from the crypto derivatives analytics platform Datamish, about $131 million in Bitcoin Longs on the BitMEX exchange got liquidated, following Bitcoin’s plunge to below $10,500.

As earlier reported by CryptoPotato, Bitcoin price shed $1500 in 48 hours, with the price of Ethereum and other altcoins also nosediving. Such was the extent of Thursday’s price crash that the total cryptocurrency market capitalization is down by over $40 billion.

Apart from BitMEX long traders suffering as a result of BTC’s price decline, traders with long positions on Bitfinex also suffered significant liquidations. About $1.47M of Bitcoin longs were also liquidated on the veteran crypto exchange.

Forced liquidation of crypto longs and shorts is a common feature of the market, with traders often entering into overleveraged bets. Thus, days of significant price movements can catch such traders unawares, leading to a cascade of forced liquidations with these positions underwater.

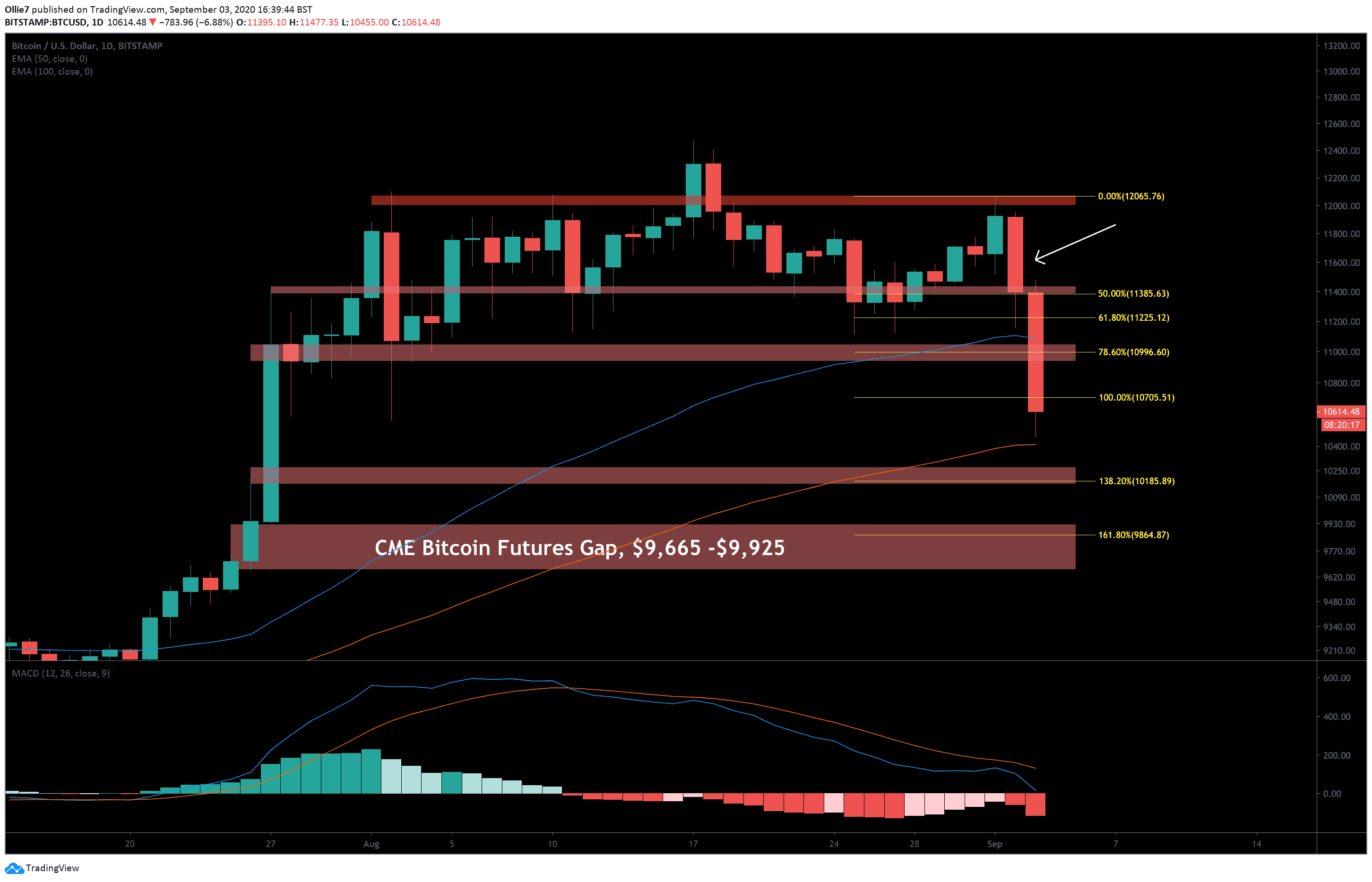

Before Thursday’s price drop, Bitcoin was attempting to stay above the $12,000 price level. Indeed several advances above this price band were met with swift reversals.

Amid rising U.S. job fears, the stock market has seen massive selloffs with the S&P and the Dow down by 3.5% and 800 points, respectively. This panic in the equity market appears to be mirrored in the crypto space leading to Thursday’s price drop.

However, Bitcoin may see a swift recovery based on the performance of gold. With BTC closely coupled with gold over the last few months, the top-ranked crypto by market cap could see a sudden bounce to the upside.

Indeed, it appears Bitcoin futures traders might share the same sentiment judging from the still overwhelming proportion of long positions despite Thursday’s events. As of the time of writing, the number of Bitcoin long bets is still three times more than the figures for short positions.