The crypto space is experiencing another red day today as a further billion disappears from the market. This exodus of investment has caused Bitcoin to unravel 0 in the last 4 hours or about ,200 in the last week.While there are no apparent catalysts for the current decline, Federal Reserve Chairman, Jerome Powell, is scheduled to give an update on Thursday regarding new steps the United State’s central bank plans to take to keep the struggling economy afloat.With rising pessimism over an economic rebound, it’s likely that a lot of institutional investors are exiting out of financial markets until there is more certainty.Not only is the crypto market left reeling today, but the Dow Jones, S&P 500, and FTSE 100 are also all down in the last 24 hours.Price Levels to Watch in the

Topics:

Ollie Leech considers the following as important: Bitcoin (BTC) Price, BTC Analysis, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Chayanika Deka writes Bitcoin Whales Offload 6,813 BTC as Selling Pressure Mounts

Wayne Jones writes Bitcoin Sentiment Hits 2022 Lows as Fear & Greed Index Falls to 10

Jordan Lyanchev writes Bitcoin Falls Below K for the First Time in 3 Months, How Much Lower Can It Go?

The crypto space is experiencing another red day today as a further $13 billion disappears from the market. This exodus of investment has caused Bitcoin to unravel $300 in the last 4 hours or about $1,200 in the last week.

While there are no apparent catalysts for the current decline, Federal Reserve Chairman, Jerome Powell, is scheduled to give an update on Thursday regarding new steps the United State’s central bank plans to take to keep the struggling economy afloat.

With rising pessimism over an economic rebound, it’s likely that a lot of institutional investors are exiting out of financial markets until there is more certainty.

Not only is the crypto market left reeling today, but the Dow Jones, S&P 500, and FTSE 100 are also all down in the last 24 hours.

Price Levels to Watch in the Short-term

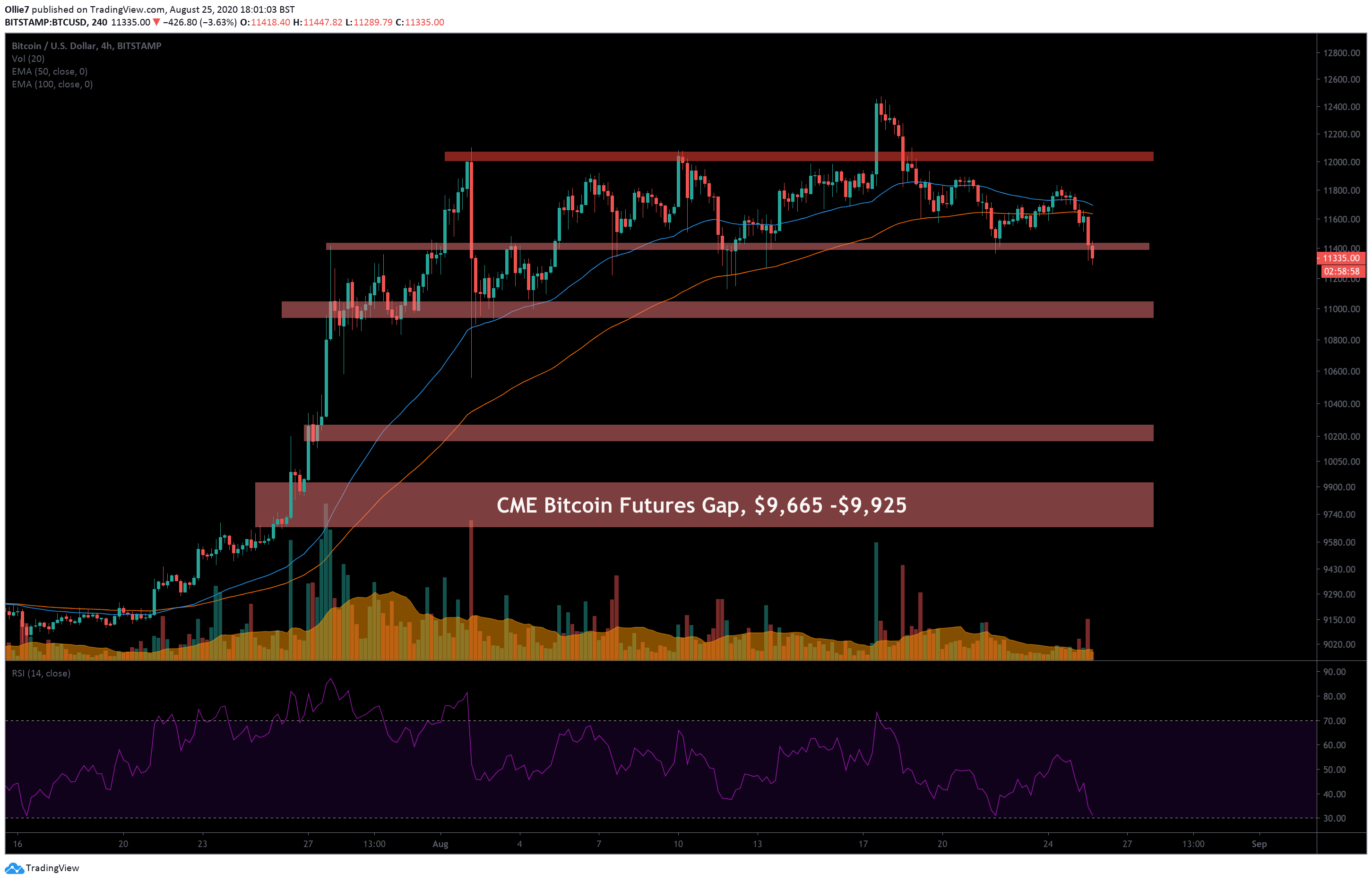

Looking at the 4-Hour BTC/USD chart, we can see that the leading crypto has returned to the main support area that was mentioned in a previous analysis.

This $11,400 zone has been a critical short-term support for Bitcoin on two separate occasions in the past two weeks and is now helping to slow down the current downtrend once again. It’s possible we could see this support push the price action sideways in a tight range between the $11,400 mark and the 100 EMA (red line) above if bulls can fight back to this level before the close.

If this crucial level fails, however, then we could see some temporary safety at the $11,120 line, which caught the bottom of the August 11 crash before Bitcoin made a strong recovery to its YTD high of $12,470.

Below that, we have the second main support zone around the $11,000 mark, which has not been revisited since July 31. Breaking down to this level would set a new 25-day low for BTC prices.

Underneath $11,000, we have $10,500, which was the previous 2020 high that got broken last month and should provide support.

The Technicals

Looking at the 50 EMA and 100 EMA (blue and red lines, respectively) on the 4-hour chart, we can see that we are very close to having a bearish convergence. This would be a bad sign for BTC traders and could cause further panic selling in the market.

On the RSI, the indicator line is really close to breaking back into the oversold region. This may be the only hope Bitcoin bulls have in the short-term to help stimulate another temporary recovery, like it did on August 22.

Total market capital: $369 billion

Bitcoin market capital: $210 billion

Bitcoin dominance: 57.0%

Bitstamp BTC/USD 4-Hour Chart