Bitcoin price had been lingering under the ,900 mark for the past 48 hours, despite another injection of billion entering the global crypto market at that period.In the last hour, however, a sudden surge in buying pressure finally arrived, which assisted in driving prices over the psychological ,000 resistance for the first time in over a week. The bulls drove the price higher than ,125, which was the 2020 high since the beginning of August.This key level has so far succeeded in defeating bullish BTC traders on two separate occasions in the first ten days of August. Will it be third time lucky for the primary cryptocurrency, including a daily close above ,100?Price Levels to Watch in the Short-termRight now, BTC is attempting to close above the median line (dashed line) of

Topics:

Ollie Leech considers the following as important: AA News, Bitcoin (BTC) Price, BTC Analysis, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Bitcoin price had been lingering under the $11,900 mark for the past 48 hours, despite another injection of $6 billion entering the global crypto market at that period.

In the last hour, however, a sudden surge in buying pressure finally arrived, which assisted in driving prices over the psychological $12,000 resistance for the first time in over a week. The bulls drove the price higher than $12,125, which was the 2020 high since the beginning of August.

This key level has so far succeeded in defeating bullish BTC traders on two separate occasions in the first ten days of August. Will it be third time lucky for the primary cryptocurrency, including a daily close above $12,100?

Price Levels to Watch in the Short-term

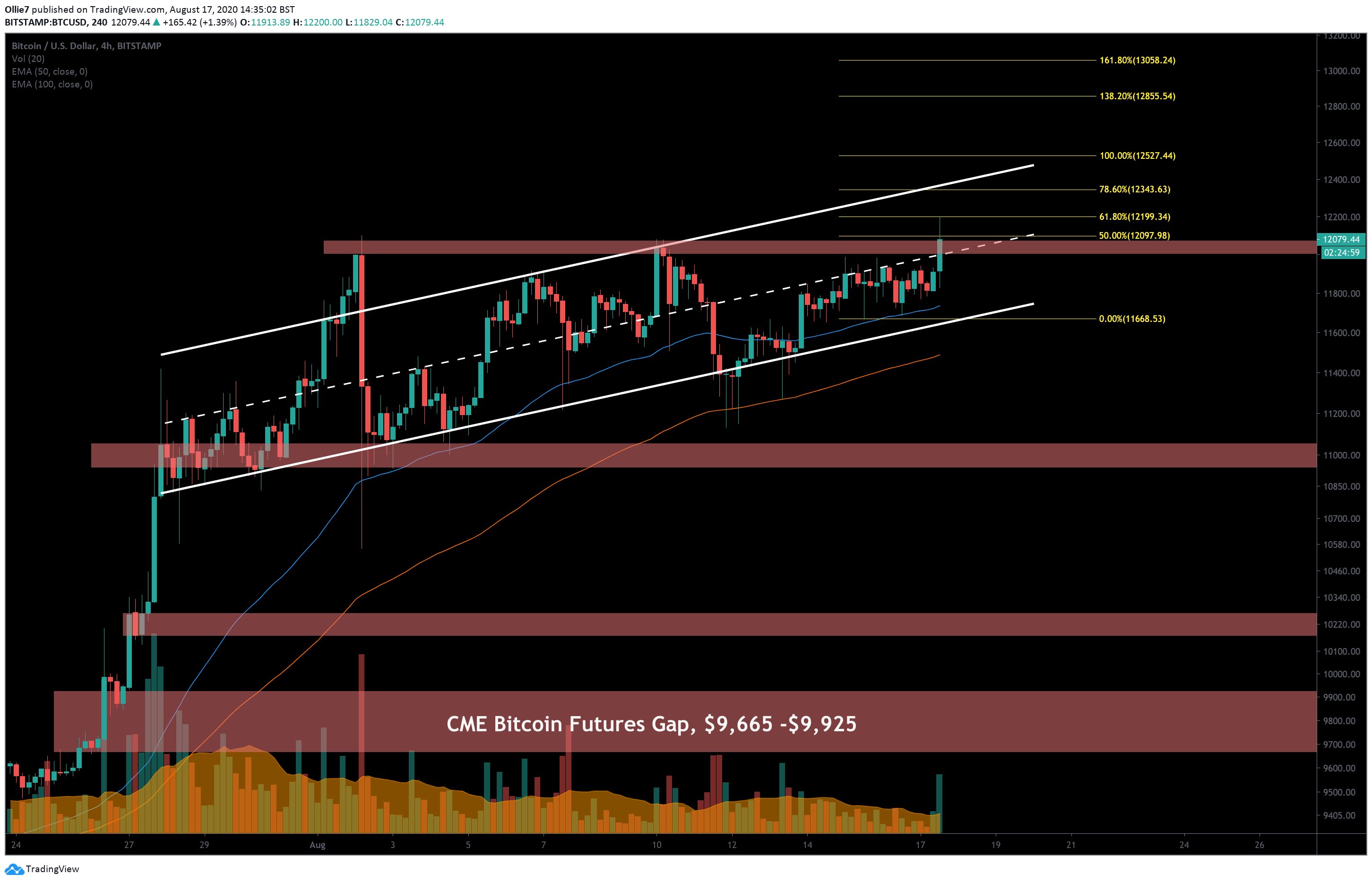

Right now, BTC is attempting to close above the median line (dashed line) of the long-standing rising channel. This particular level also overlaps with the first major resistance area (green area) between $12,000 and $12,070.

Breaking over this will secure a new reliable support for Bitcoin as bulls attempt to daily-close a new YTD high above $12,100.

Looking at the Fibonacci extension levels on the 4-Hour chart (yellow lines), we can see that the initial breakout ricocheted cleanly off the 0.618 level ($12,199). If this area is overcome during the current uptrend, the first significant test for bulls will be at the 0.786 fib extension level ($12,343), which also overlaps with the upper channel resistance.

There will undoubtedly be a lot of selling pressure at this key level, but breaking over it will almost certainly signal that the Bitcoin bull market is about to add its next leg.

Looking back at previous daily closes, the only area which has shown any real resistance in the past year is the $12,400 level – between June 29 and July 08, 2019.

Going back to 2018 candles, we can also see the $12,800 was a key S/R level during the month of January.

Short-term supports to watch out for if the current trend reverses will be the median line, the 50 EMA (blue line), then the channel support, followed by the 100 EMA (red line).

Total market capital: $389 billion

Bitcoin market capital: $222 billion

Bitcoin market dominance: 57.0%

* Data provided by Coingecko.

BTC/USD Bitstamp 4-Hour Chart