Summary:

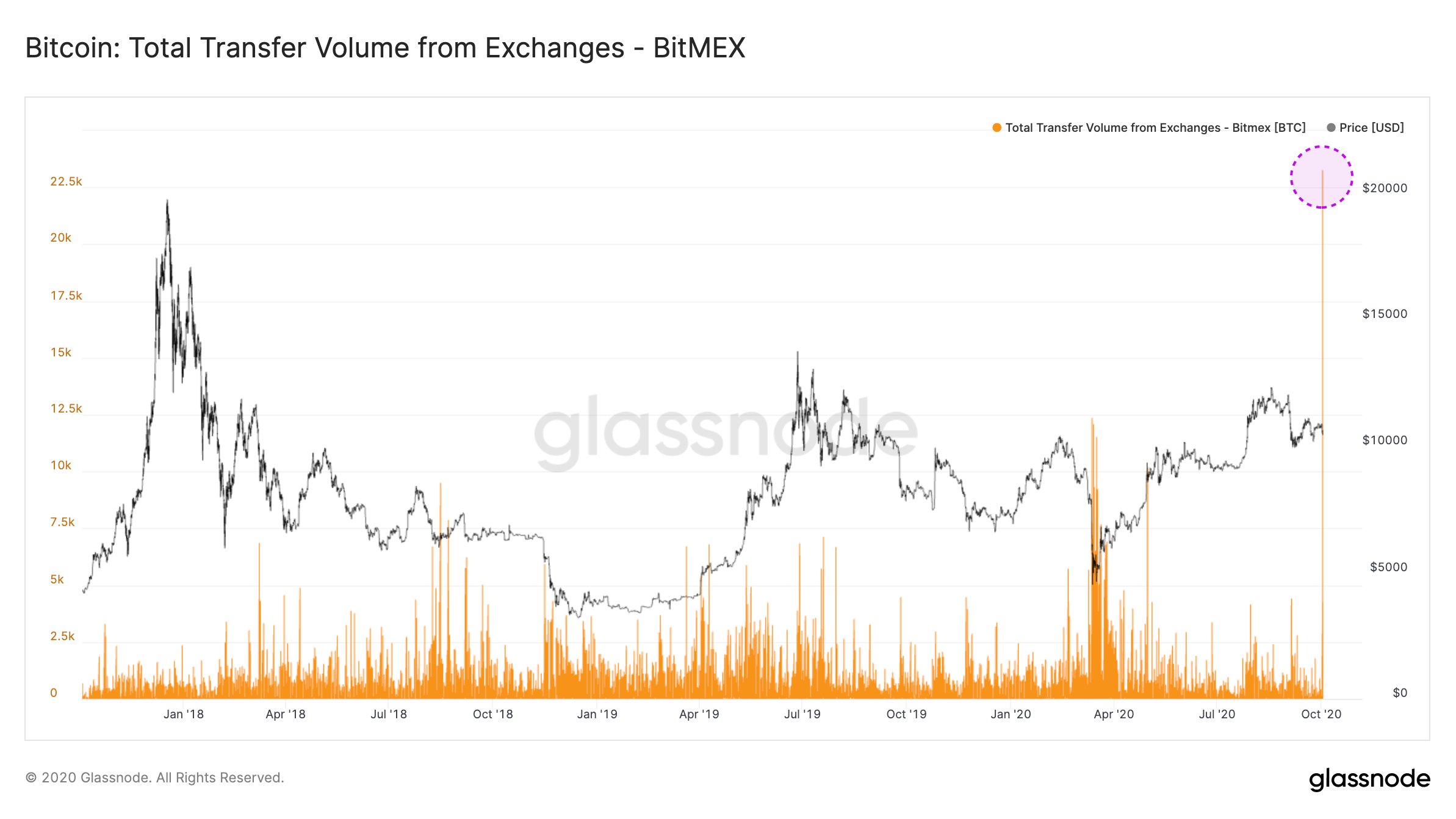

Recent data revealed that cryptocurrency traders had withdrawn the first batch of 23,200 BTC (worth over 0 million) from BitMEX in the initial hours following yesterday’s developments.This substantial amount represented about 13% of all bitcoins held on the popular Bitcoin derivatives exchange.The Glassnode data indicated that this is the “largest hourly BTC outflow from BitMEX” since the company keeps track. Bitcoin Withdrawals on BitMEX. Source: GlassnodeThe withdrawals accelerated in the following hours. The total amount grew to 32,200 BTC (or 19% of all bitcoins stored on the exchange) in three batches. Glassnode updated that the latest withdrawals of 6,000 bitcoins ( million) occurred minutes ago.The significant withdrawals come as a direct consequence of the major news that

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitmex, BTCEUR, BTCGBP, btcusd, btcusdt, CFTC

This could be interesting, too:

Recent data revealed that cryptocurrency traders had withdrawn the first batch of 23,200 BTC (worth over 0 million) from BitMEX in the initial hours following yesterday’s developments.This substantial amount represented about 13% of all bitcoins held on the popular Bitcoin derivatives exchange.The Glassnode data indicated that this is the “largest hourly BTC outflow from BitMEX” since the company keeps track. Bitcoin Withdrawals on BitMEX. Source: GlassnodeThe withdrawals accelerated in the following hours. The total amount grew to 32,200 BTC (or 19% of all bitcoins stored on the exchange) in three batches. Glassnode updated that the latest withdrawals of 6,000 bitcoins ( million) occurred minutes ago.The significant withdrawals come as a direct consequence of the major news that

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitmex, BTCEUR, BTCGBP, btcusd, btcusdt, CFTC

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

- Recent data revealed that cryptocurrency traders had withdrawn the first batch of 23,200 BTC (worth over $240 million) from BitMEX in the initial hours following yesterday’s developments.

- This substantial amount represented about 13% of all bitcoins held on the popular Bitcoin derivatives exchange.

- The Glassnode data indicated that this is the “largest hourly BTC outflow from BitMEX” since the company keeps track.

- The withdrawals accelerated in the following hours. The total amount grew to 32,200 BTC (or 19% of all bitcoins stored on the exchange) in three batches. Glassnode updated that the latest withdrawals of 6,000 bitcoins ($63 million) occurred minutes ago.

- The significant withdrawals come as a direct consequence of the major news that broke out yesterday. The US Commodity and Futures Trading Commission charged the owners of BitMEX, namely Arthur Hayes, Benjamin Delo, Samuel Reed, and Gregory Dwyer, with illegally operating the cryptocurrency derivatives platform and anti-money laundering violations.

- The Acting US Attorney for the District of New York, Audrey Strauss, also indicted Hayes, Delo, Reed, and Dwyer for violating the Bank Secrecy Act and conspiring to violate the same Act.

- BitMEX issued an official response, in which the exchange “strongly disagreed with the US government’s heavy-handed decision to bring these charges.” The company also intends to “defend the allegations vigorously.”

- Despite the BitMEX response, the cryptocurrency field felt the adverse effects almost immediately, and prices tumbled.

- The cryptocurrency community also had a controversial reaction to the entire case. Some claimed that it’s bad for the industry, while others believe it could have a positive impact in the long run.