Upon printing billions of fresh USDT in the past few months, the most widely adopted stablecoin has become the third-largest cryptocurrency by market cap. Tether has now surpassed Ripple (XRP) with its nearly billion market capitalization.In the meantime, Ripple, which was among the top three cryptocurrencies for the past years, had seen its market cap continuously dropping. Earlier this month, Ripple recorded its lowest 2-year price against Bitcoin.Tether Surpassing Ripple By Market Cap. Source: CoinMarketCapTether Is Third By Market CapTether, which is pegged to the US Dollar, has been on a massive printing spree lately to cope with the growing demand from cryptocurrency traders and investors. The company had minted over 1.5 billion USDT in April alone, as CryptoPotato reported.Then,

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt, ETHBTC, ethusd, Stablecoins, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

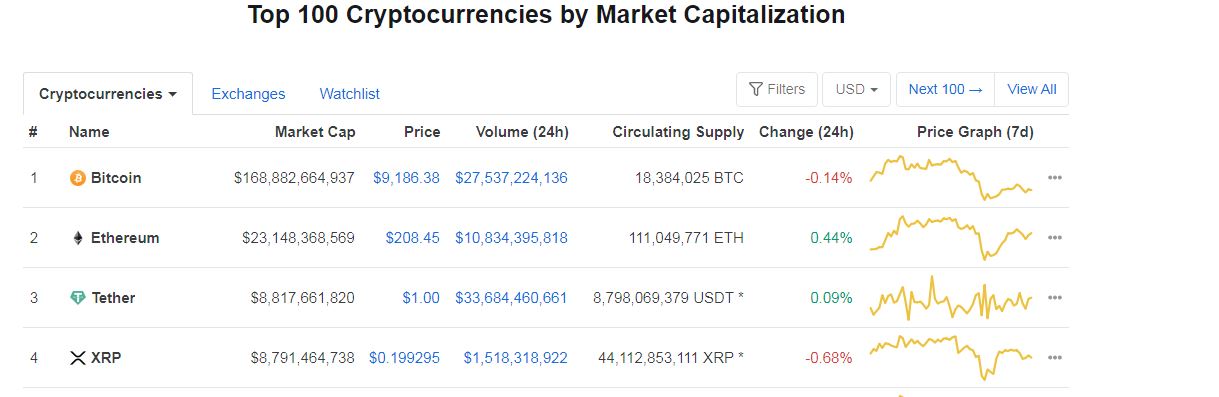

Upon printing billions of fresh USDT in the past few months, the most widely adopted stablecoin has become the third-largest cryptocurrency by market cap. Tether has now surpassed Ripple (XRP) with its nearly $9 billion market capitalization.

In the meantime, Ripple, which was among the top three cryptocurrencies for the past years, had seen its market cap continuously dropping. Earlier this month, Ripple recorded its lowest 2-year price against Bitcoin.

Tether Is Third By Market Cap

Tether, which is pegged to the US Dollar, has been on a massive printing spree lately to cope with the growing demand from cryptocurrency traders and investors. The company had minted over 1.5 billion USDT in April alone, as CryptoPotato reported.

Then, the Tether Treasury had printed nearly 500 million of fresh USDT only in the first week of May. During the rest of May, until now, the most popular stablecoin hasn’t slowed down. Data from Whale Alert regularly outlines massive batches being minted at the Tether’s treasury.

And, as many digital asset proponents predicted, these levels of “printing” new USDT into the market have assisted Tether to surpass Ripple in its way to being the third-largest cryptocurrency by market cap. At the time of this writing, USDT’s market cap is exceeding $8.8 billion, while XRP is left behind – with $8.79 billion market cap.

Transfers At All-time High

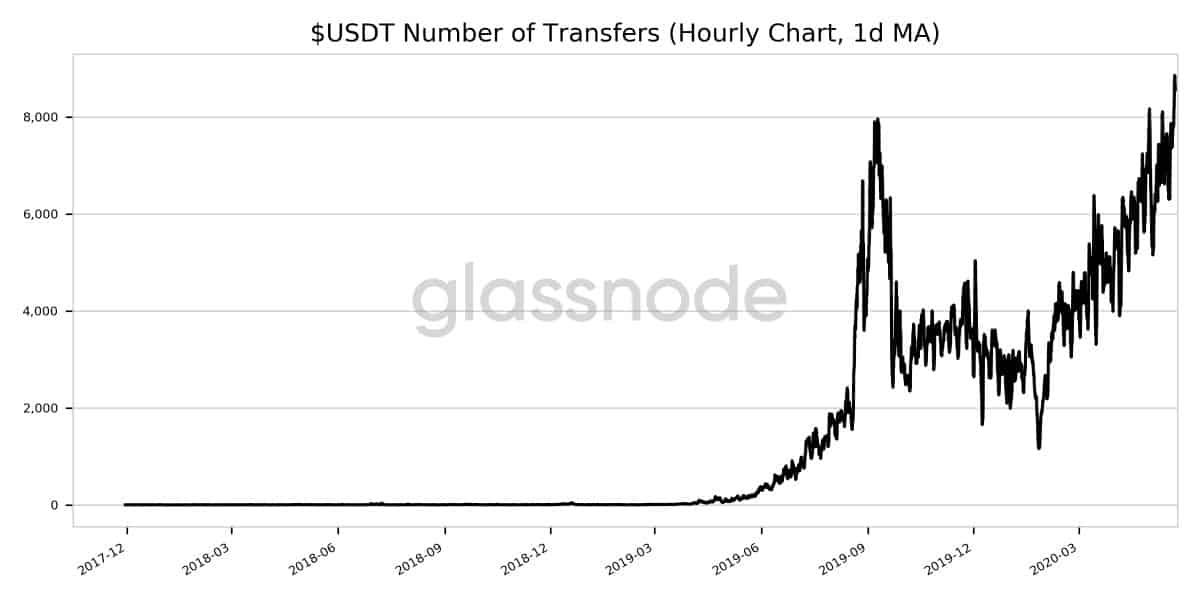

Aside from climbing in terms of market capitalization, Tether has been recording impressive amounts of transfers as well.

Per data provided from GlassNode, the 1-day moving average (MA) of transfers involving the popular stablecoin reached a new all-time high on May 21 with 8,334.167. The new record didn’t hold much, because on the following day the number increased to 8,590.083.

The May 2020 record-breaking daily transaction number outperform the recent high levels of September 2019. Interestingly, the number of USDT transfers was fluctuating in late 2019 and early 2020 before it dropped to its yearly lows in February. Since then, though, the increase is evident.

Tether And The Price of Bitcoin

One of the most discussed topics within the crypto community is whether Tether is directly impacting the price of Bitcoin and the whole cryptocurrency market. The concern remains unresolved primarily because it has different viewpoints.

For instance, a two-part study from US-based academics suggested that Tether may have been behind the 2017 parabolic price increase as the surge to $20,000 was caused “probably by market manipulation.” Tether quickly opposed the blame, claiming that USDT has never been employed for any price manipulation.

Another research on the matter supported Tether’s position, saying that USDT issuance does not affect prices directly.

Contrary, recent analysis implied an inverse correlation between BTC’s price and the total supply of the stablecoin sitting on exchanges. More specifically, the decreasing amount of USDT on cryptocurrency platforms could be propelling Bitcoin price surges.