The perpetrators behind the alleged cryptocurrency Ponzi scheme PlusToken have transferred over 26 million EOS tokens from one of the wallets linked to the project to an unknown address.Historically, similar events have driven down the price of the moved asset, which brings the question if there will be any short-term consequences for EOS.PlusToken Withdraw 26M EOSThe Chinese project began a few years ago as a cryptocurrency wallet offering suspiciously high return rates to its users. To invest in the platform, customers had to purchase PLUS crypto tokens with other assets such as Bitcoin and Ethereum.The momentous rise of the project during which its popularity in China skyrocketed and the price of the token peaked at 0, was followed by similarly intense actions from authorities

Topics:

Jordan Lyanchev considers the following as important: AA News, btcusd, btcusdt, crypto scams, EOS Price, EOSBTC, eosusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The perpetrators behind the alleged cryptocurrency Ponzi scheme PlusToken have transferred over 26 million EOS tokens from one of the wallets linked to the project to an unknown address.

Historically, similar events have driven down the price of the moved asset, which brings the question if there will be any short-term consequences for EOS.

PlusToken Withdraw 26M EOS

The Chinese project began a few years ago as a cryptocurrency wallet offering suspiciously high return rates to its users. To invest in the platform, customers had to purchase PLUS crypto tokens with other assets such as Bitcoin and Ethereum.

The momentous rise of the project during which its popularity in China skyrocketed and the price of the token peaked at $350, was followed by similarly intense actions from authorities cracking down on it. Beijing claimed that PlusToken is an illegal Ponzi scheme, and Chinese law enforcement agents arrested six people connected to it.

Despite the majority of PlusToken officials still behind bars, asset liquidations still occur. The latest one allegedly came earlier today, as caught by the cryptocurrency tracking resource – WhaleAlert.

An EOS wallet previously linked to the Chinese project has sent 26,316,340 EOS to an unknown address. Put in USD perspective, the sizeable quantity of the digital asset is worth over $67 million.

EOS Price Dump In The Making?

History shows that when PlusToken has moved a significant amount of assets, the price of the corresponding token has experienced an adverse price development shortly.

As CryptoPotato reported earlier this year, the fraudulent project laundered 13,000 bitcoins (with an estimated value of $118m) through a variety of mixing services.

The primary cryptocurrency was trading at about $9,200, but in the following hours, it dropped by $500. The effects also impacted the rest of the cryptocurrency market.

A report examined the price performance of different assets following substantial cash outs of stolen digital assets by PlusToken. It concluded that “we can say that those cashouts cause increased volatility in Bitcoin’s price and that they correlate significantly with Bitcoin price drops.”

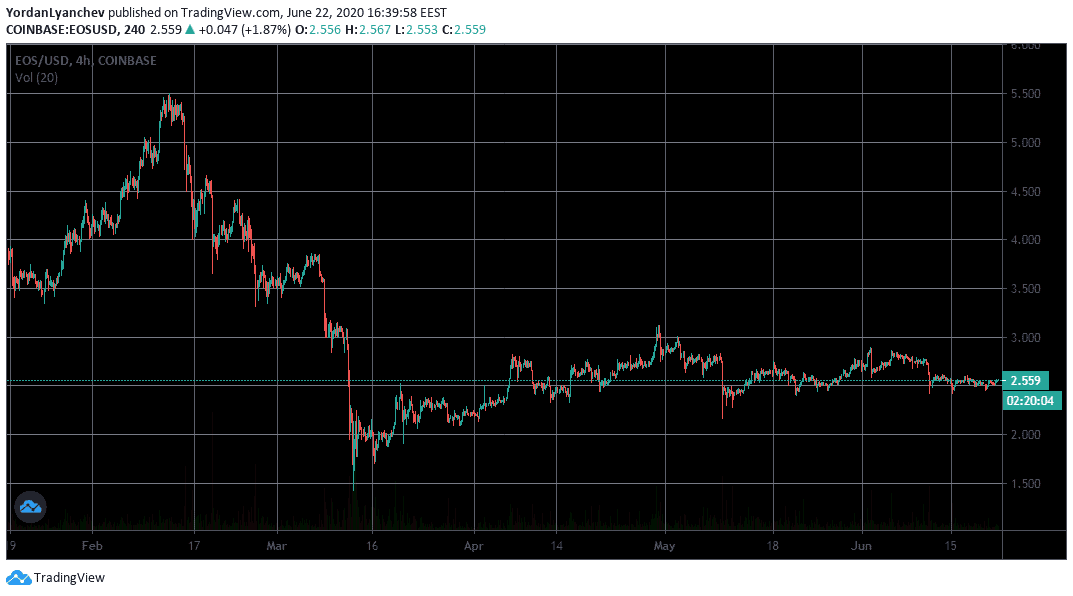

As such, it’s interesting to follow how EOS will perform in the upcoming hours. EOS is currently situated at the 9th spot in terms of total market capitalization with a token price of $2,55.

EOS had previously reached a yearly high of $5,5 in mid-February before bottoming at $1,40 during the most intense days of the COVID-19 pandemic.