Bitcoin continues to struggle ever since it peaked above ,100 during the weekend. The situation with alternative coins is even worse, and the total market capitalization has dipped to about 0 billion. Bitcoin’s Struggles Since Its 1,000-Day Peak CryptoPotato reported over the weekend that the primary cryptocurrency spiked to a new 2020 high of about ,100. The difference between this record and the previous ones registered in October was that it surpassed the 2019’s high as well. Consequently, Bitcoin reached its highest price tag since January 2018. However, the bears interfered and didn’t allow any further increases. Just the opposite, BTC started to decline in value gradually. Yesterday alone, Bitcoin dropped from about ,800 to its daily low of ,250 in a

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, Bitcoin Dominance, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, COMPBTC, COMPUSD, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, Total Market Cap, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Dimitar Dzhondzhorov writes Millions of ADA Sold by Cardano Whales During Market Crash – Will the Decline Continue?

Bitcoin continues to struggle ever since it peaked above $14,100 during the weekend. The situation with alternative coins is even worse, and the total market capitalization has dipped to about $390 billion.

Bitcoin’s Struggles Since Its 1,000-Day Peak

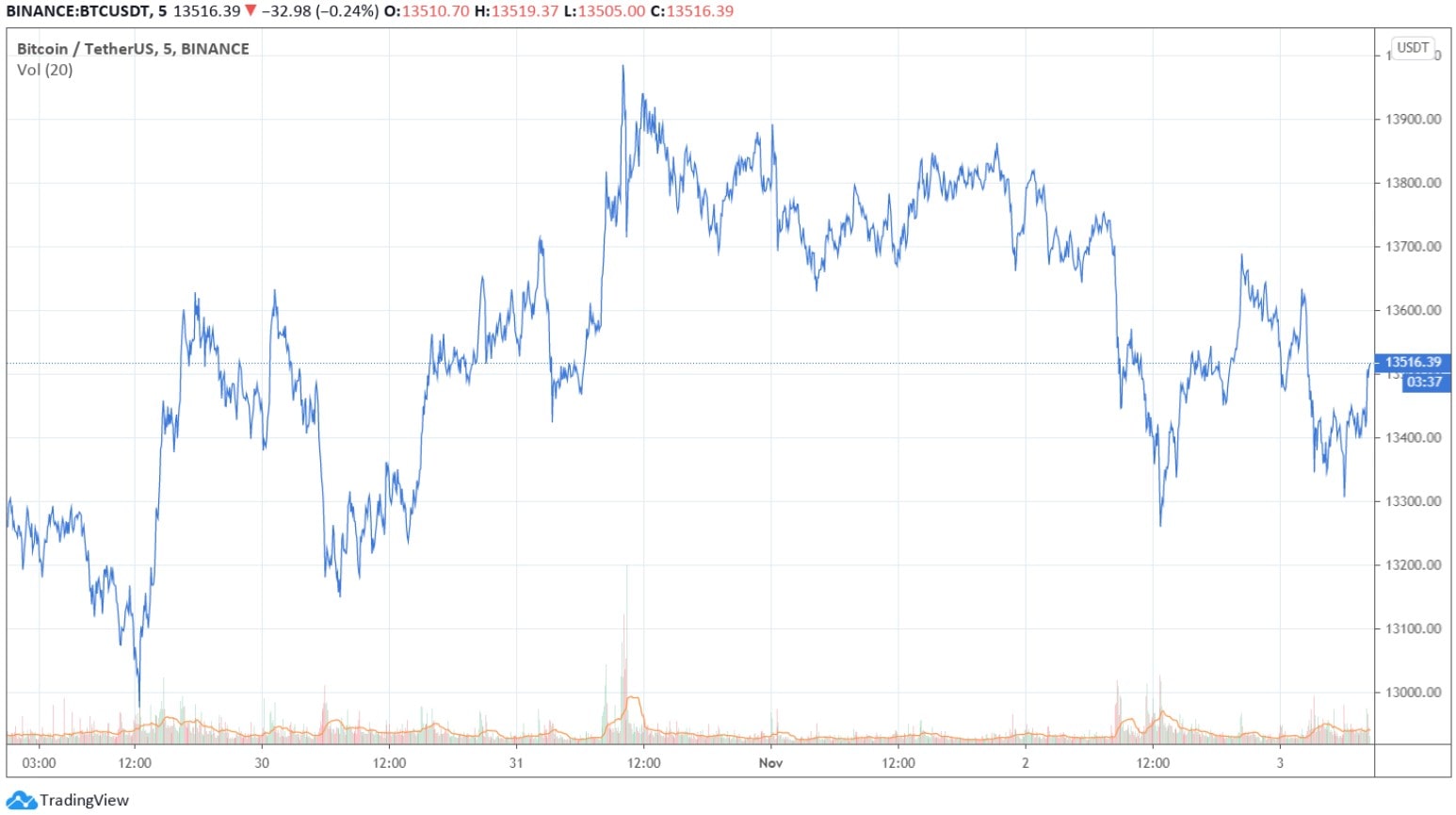

CryptoPotato reported over the weekend that the primary cryptocurrency spiked to a new 2020 high of about $14,100. The difference between this record and the previous ones registered in October was that it surpassed the 2019’s high as well. Consequently, Bitcoin reached its highest price tag since January 2018.

However, the bears interfered and didn’t allow any further increases. Just the opposite, BTC started to decline in value gradually. Yesterday alone, Bitcoin dropped from about $13,800 to its daily low of $13,250 in a few hours.

The cryptocurrency recovered most of its losses in the following hours and has shot back above $13,500 as of writing these lines.

Should further drops materialize, BTC could rely on $13,280, $13,150, and $13,000 as support. Alternatively, Bitcoin could return to its recent bull run if it overcomes the resistance lines at $13,500, $13,760, and $13,800.

Altcoins Bleed Out, Market Cap Suffers

The alternative coins were somewhat left out during Bitcoin’s most recent price jumps. This resulted in a 6% increase in the BTC dominance over the market in just a few weeks. Just over the past 24 hours, the dominance spiked to 64%.

While Bitcoin has retraced by 1.3% now, most of the altcoins have it much worse. Ethereum has lost nearly 4% on a 24-hour scale and trades at $378. Just a few days ago, ETH spiked above $400.

Ripple (-3%) is down to $0.23. The top ten sees even more losses from Bitcoin Cash (-8%), Binance Coin (-7.6%), Chainlink (-10%), Polkadot (-5.4%), Cardano (-8%), and Litecoin (-5.5%).

Most DeFi-tokens have plummeted in value, as covered earlier today. The Reserve Rights token (-15%) leads this adverse ranking. SushiSwap (-14%), Compound (-13%), Aave (-13%), Loopring (-11.8%), Synthetix Network Token (-11.6%), Energy Web Token (-11.5%) are just a few of the other double-digit price losers.

Following the controversy with Huobi, the exchange’s native cryptocurrency has also dived by 14.5%.

In total, the cumulative market capitalization of all cryptocurrencies has lost $10 billion in a day and $18 billion in a week.