Amid the latest price developments in the cryptocurrency market, Bitcoin’s dominance has increased to over 66%. Most alternative coins are in the red when compared to BTC’s 13% surge in the past 24 hours.BTC Dominance RisesBTC’s dominance index tracks the relative share of Bitcoin in the entire cryptocurrency market. During the numerous cycles over the years, it had swung from above 95% in the early years to below 33% in January 2018.The extreme levels of volatility in the past few weeks also impacted BTC’s dominance over the market. For instance, during the most notable price plunge of the year on March 12-13th, the dominance went from a high of 66.28% to a low of 62.5% in less than 24 hours.At the time of this writing, BTC’s dominance stands at 66%. Only yesterday, it was at 63.5%,

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin Dominance

This could be interesting, too:

Wayne Jones writes Charles Schwab to Launch Spot Crypto ETFs if Regulations Change

Wayne Jones writes Here’s When FTX Expects to Start Repaying Customers .5B

Dimitar Dzhondzhorov writes Is Cryptoqueen Ruja Ignatova Alive and Hiding in South Africa? (Report)

Wayne Jones writes Casa CEO Exposes Shocking Phishing Scam Targeting Wealthy Crypto Users

Amid the latest price developments in the cryptocurrency market, Bitcoin’s dominance has increased to over 66%. Most alternative coins are in the red when compared to BTC’s 13% surge in the past 24 hours.

BTC Dominance Rises

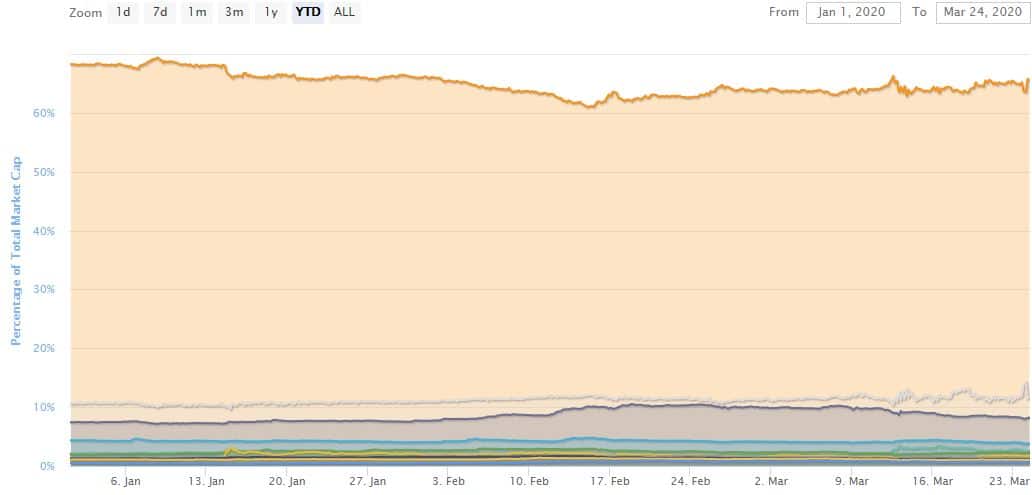

BTC’s dominance index tracks the relative share of Bitcoin in the entire cryptocurrency market. During the numerous cycles over the years, it had swung from above 95% in the early years to below 33% in January 2018.

The extreme levels of volatility in the past few weeks also impacted BTC’s dominance over the market. For instance, during the most notable price plunge of the year on March 12-13th, the dominance went from a high of 66.28% to a low of 62.5% in less than 24 hours.

At the time of this writing, BTC’s dominance stands at 66%. Only yesterday, it was at 63.5%, proving once again the violent fluctuations in this measurement as well.

As Cryptopotato reported, the largest cryptocurrency surged by 12% since yesterday. Naturally, this played an essential role in its position against the altcoins.

Trading now at approximately $6,700, BTC will face the next significant resistance at $6,800 – $6,900 level if it continues to soar. Alternatively, $6,600 now turned support if Bitcoin drops, followed by $6,400 and $6,000.

Altcoins Bleed Out Against BTC

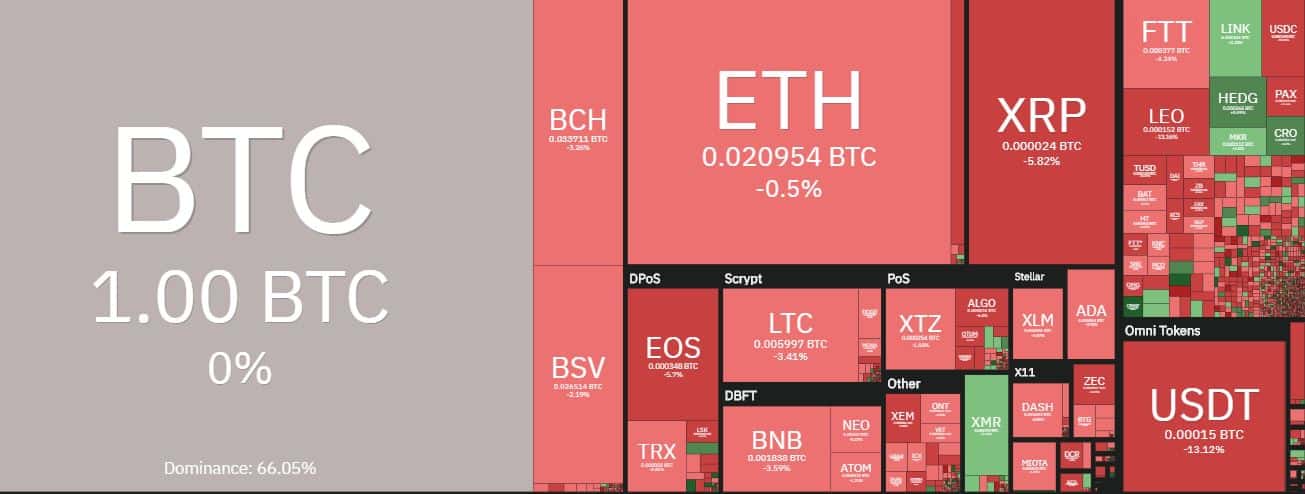

As mentioned above, the dominance factor reacts when the alternative coins make moves, as well. When they lose value against the largest cryptocurrency, Bitcoin’s dominance rises and vice-versa.

Today, most altcoins are in the red when compared to the primary digital asset. Ripple is down by almost 6% to 2413 SAT. Bitcoin Cash and Bitcoin SV drop by 3% and 2%, respectively.

EOS, Binance Coin, and Litecoin are similarly declining by 4% against Bitcoin. Among the top 10 cryptocurrencies by market cap, Ethereum performs the best in this manner, but it’s still down by 0.5% to 0.021 SAT.

It’s worth noting that even though they are losing value against BTC, most alternative coins are increasing against USD. Ethereum now trades at around $140, Litecoin at $40, and BNB at $12.

Tezos and Chainlink are among the most significant gainers throughout the day, with 15% and 17%, respectively.