After weeks of sitting in a tight range, Bitcoin finally made a move yesterday and conquered the ,300 resistance. The majority of large-cap altcoins also followed the upward tick, and, as usual, there are some notable fluctuations among low-cap alts.Bitcoin Is AliveThe last time the primary cryptocurrency stood above ,300 for more than just a candlewick was on July 9th. Since then, Bitcoin was stuck in its quite familiar range between that level and ,000.Yesterday, however, BTC showed signs of awakening. In just an hour, it went from ,200 to above ,350. Despite some retracements, the asset reached a daily high of ,440 on Bitstamp. At the time of this writing, Bitcoin has dropped slightly to ,360.BTCUSD 1h. Source: TradingViewAs CryptoPotato reported a day before, a large move

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, Ampleforth (AMPL), BCHBTC, bchusd, Bitcoin (BTC) Price, BSVBTC, BSVUSD, btcusd, btcusdt, EOSBTC, eosusd, ERDBTC, ERDUSD, ETHBTC, Ethereum (ETH) Price, ethusd, LTCBTC, ltcusd, Market Updates, Tezos (XTZ) Price, VETBTC, VETUSD, XTZBTC, XTZUSD

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Dimitar Dzhondzhorov writes Millions of ADA Sold by Cardano Whales During Market Crash – Will the Decline Continue?

After weeks of sitting in a tight range, Bitcoin finally made a move yesterday and conquered the $9,300 resistance. The majority of large-cap altcoins also followed the upward tick, and, as usual, there are some notable fluctuations among low-cap alts.

Bitcoin Is Alive

The last time the primary cryptocurrency stood above $9,300 for more than just a candlewick was on July 9th. Since then, Bitcoin was stuck in its quite familiar range between that level and $9,000.

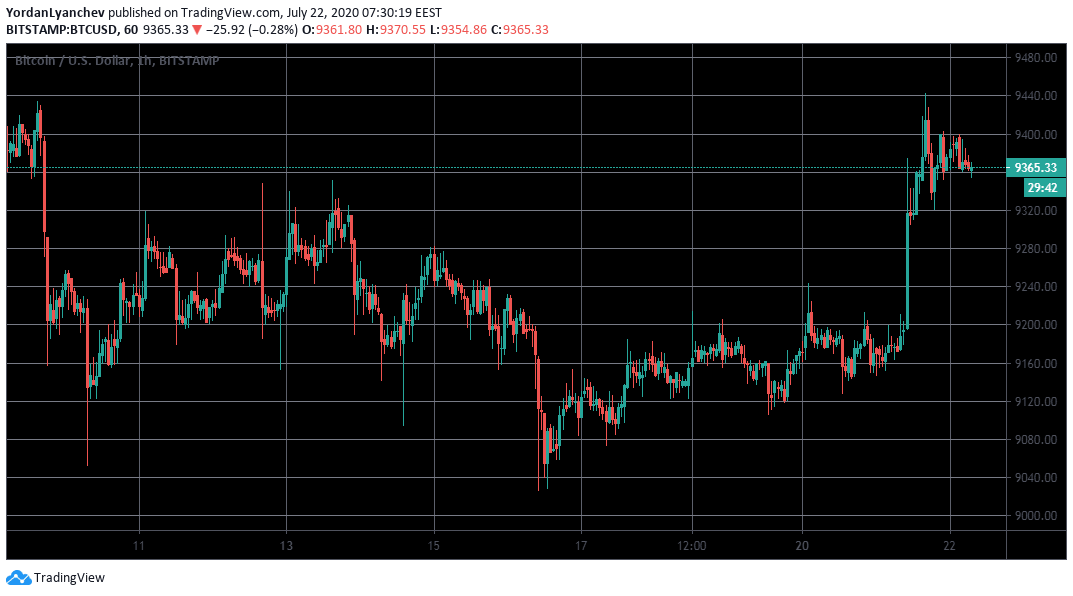

Yesterday, however, BTC showed signs of awakening. In just an hour, it went from $9,200 to above $9,350. Despite some retracements, the asset reached a daily high of $9,440 on Bitstamp. At the time of this writing, Bitcoin has dropped slightly to $9,360.

As CryptoPotato reported a day before, a large move was expected as Bitcoin had reached a maximum consolidation level. The decreasing volatility also hinted at a significant price development, but history pointed out that BTC is to drop in value.

It’s also worth noting that most of the community was expecting a sudden dive, but as it typically happens – Bitcoin likes to disprove expectations.

Interestingly, BTC’s 2% gains since yesterday seem uncorrelated with the stock market indexes. Nasdaq, after reaching a new all-time high on Monday, retraced by nearly 1% during Tuesday’s trading session. The S&P 500 and the Dow Jones are slightly in the green by 0.17% and 0.6%, respectively.

However, gold continues its decisive price increase. The precious metal peaked at above $1,865/oz yesterday. Although it has retraced a bit since then, its gains since Monday are still over 3%. Gold is close to its 2011 all-time high of $1,920, and numerous experts predict that it will break it before the year ends.

Altcoins Approved BTC’s Move

During Bitcoin’s nearly two weeks of summer sleep, the altcoin market registered serious price fluctuations. Now that BTC woke up, most alternative coins continue displaying high volatility levels.

From the large-cap alts, Ethereum, Bitcoin SV, and Litecoin are up by approximately 3%. Bitcoin Cash, Cardano, and EOS rise by about 2%, while Tezos and VeChain are the most impressive gainers from the top 20 coins. XTZ increases by 6.4% to nearly $3, while VET is up by 5% to $0.017.

Band Protocol has surged the most since yesterday by 21%, Augur follows with 20%, and Nervos Network – 18.5%. Other double-digit increases include Blockstack (15.2%), Swipe (15%), Elrond (14.8%), Terra (14.5%), and ABBC Coin (13.3%).

It’s important to note that Band, Elrond, and Kava, all of which are up around 20% or more, were all launched through an IEO on Binance Launchpad.

On the opposite shore lies Ampleforth. Following a few days in the green, AMPL is down by 13% as of writing these lines to $2.35. Reserve Rights and Aurora also drop in value by 9% and 6.5%.