Bitcoin continued heading upwards, but it couldn’t challenge the ,000 line. Bitcoin Cash’s 10% increase is among the most impressive from the larger-cap alts, while some lower-cap altcoins have been surging by double-digits.Bitcoin Aims At ,000Bitcoin was steadily progressing towards ,000 in the past 24 hours. After yesterday’s low of ,580, bulls took charge and spiked BTC’s price to a daily high of ,910 on Bitstamp. However, the primary cryptocurrency couldn’t sustain its run and dipped briefly to ,700.After another unsuccessful attempt to conquer ,900 and head towards the psychological level at ,000, BTC has retraced slightly to ,800. Just below (,750) is a major resistance line that has to be overtaken decisively if the asset indeed wants to break above

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, Ethereum (ETH) Price, Market Updates, Ripple (XRP) Price

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Bitcoin continued heading upwards, but it couldn’t challenge the $12,000 line. Bitcoin Cash’s 10% increase is among the most impressive from the larger-cap alts, while some lower-cap altcoins have been surging by double-digits.

Bitcoin Aims At $12,000

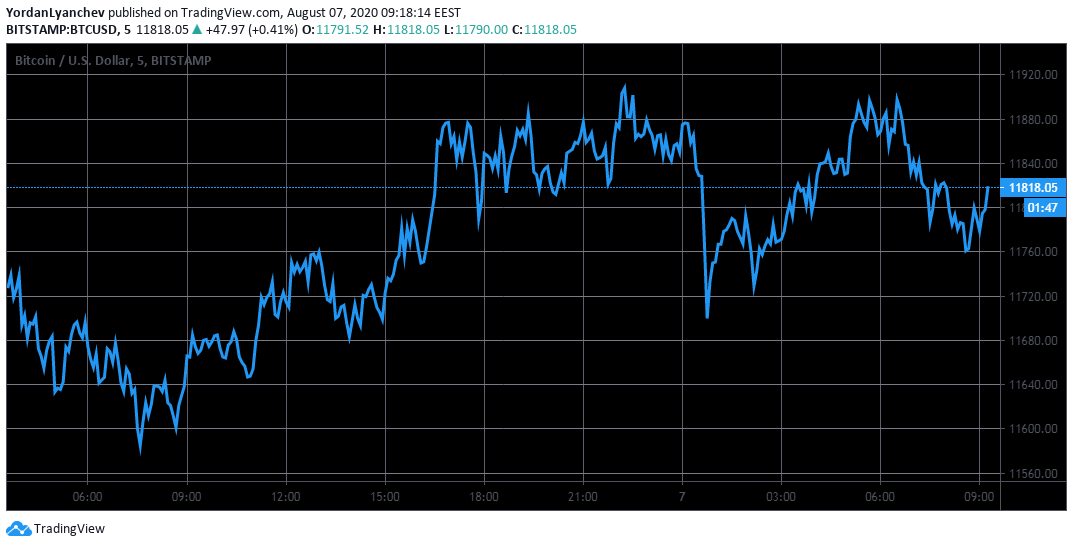

Bitcoin was steadily progressing towards $12,000 in the past 24 hours. After yesterday’s low of $11,580, bulls took charge and spiked BTC’s price to a daily high of $11,910 on Bitstamp. However, the primary cryptocurrency couldn’t sustain its run and dipped briefly to $11,700.

After another unsuccessful attempt to conquer $11,900 and head towards the psychological level at $12,000, BTC has retraced slightly to $11,800. Just below ($11,750) is a major resistance line that has to be overtaken decisively if the asset indeed wants to break above $12,000 and march towards a new yearly high.

Should it fail and bears take control, Bitcoin can rely on $11,400 as support, followed by $11,175, and $11,050.

As reported yesterday, Bitcoin and gold have significantly increased its correlation levels in the past several weeks. As such, it’s somewhat unsurprisingly that the precious metal’s performance in the last 24 hours resembles that of BTC again. Gold marked a new all-time high of $2,070/oz but has retraced since to $2,060 as of writing these lines.

Fluctuations Among Low-Cap Alts

Ethereum and Ripple remain relatively stable at $395 and $0.30, respectively. Minor gains are evident with Bitcoin SV (2.75%), Litecoin (2%), Cardano (1.5%), and Chainlink (2.5%) from the top 10 coins. However, Bitcoin Cash is outperforming all of them, with a 10% increase to $320.

The most impressive gainer in the top 100 market, though, is Balancer. BAL has skyrocketed by nearly 40% to $14. The surge could be largely attributed to news coming from the leading cryptocurrency exchange by volume. Yesterday, Binance announced listing the BAL token, and the price has reacted immediately.

The double-digit increase club is quite crowded today. Decentraland is next with a 25% price pump, followed by Aave (16%), Ocean Protocol (12.2%), Blockstack (12%), THORChain (11%), Dash (10.3%), Kava (10.2%), and Band Protocol (10.1%).

In contrast, stands again Ampleforth, with a 7% decrease. AMPL is in negative rebase territory as it trades below $1 for several consecutive days now. In other words, AMPL investors are losing tokens as the protocol is intended to deflate the supply in case there’s no sufficient demand.

The Midas Touch Gold is down by 6.6%, followed by Nexo (-3.6%), and Bancor retraces by 3.5%.