Bitcoin and most altcoins have retraced slightly in the past 24 hours, after a few days of gains. Interestingly, similar price fallbacks are visible in the traditional stock markets, as the Dow Jones is down by 1.4%.Bitcoin’s False BreakoutAfter the unsuccessful attempt to conquer ,500, Bitcoin hovered above the significant 50-MA level at ,300. However, the primary cryptocurrency has since slipped below it as it went from ,440 to its current position at ,150 in a few hourly candles. On some exchanges, such as Bitstamp, BTC plunged as low as ,050.BTCUSD 5m. Source: TradingViewDuring the increase to nearly ,500, speculations rose that BTC whales manipulated the price to create volume to place large sell orders and reduce slippage. The end goal is for retail traders to start

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt, Chainlink (LINK) Price, Coronavirus (COVID-19), ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, Wall Street, xrpbtc, xrpusd, XTZBTC, XTZUSD

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Bitcoin and most altcoins have retraced slightly in the past 24 hours, after a few days of gains. Interestingly, similar price fallbacks are visible in the traditional stock markets, as the Dow Jones is down by 1.4%.

Bitcoin’s False Breakout

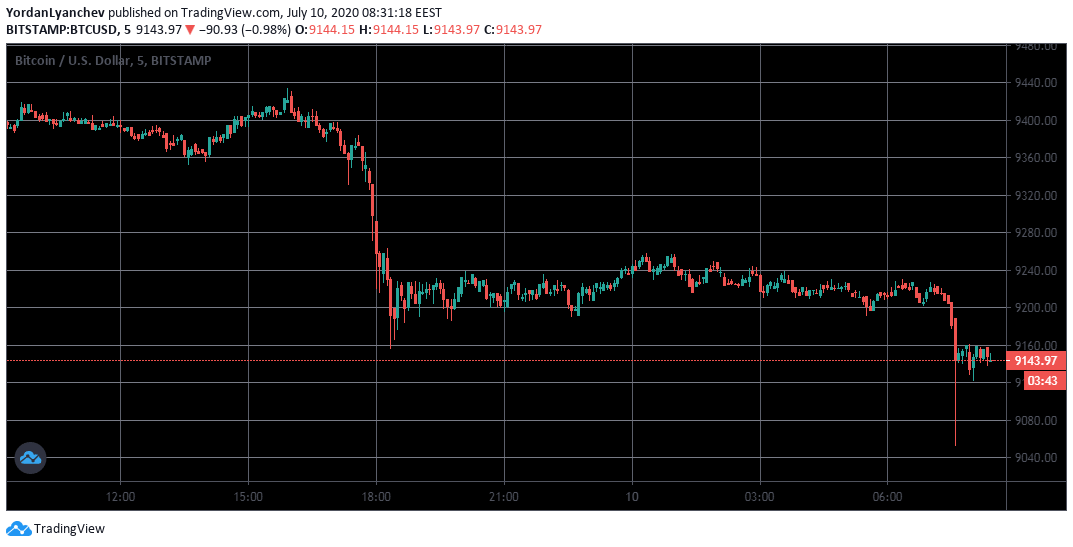

After the unsuccessful attempt to conquer $9,500, Bitcoin hovered above the significant 50-MA level at $9,300. However, the primary cryptocurrency has since slipped below it as it went from $9,440 to its current position at $9,150 in a few hourly candles. On some exchanges, such as Bitstamp, BTC plunged as low as $9,050.

During the increase to nearly $9,500, speculations rose that BTC whales manipulated the price to create volume to place large sell orders and reduce slippage. The end goal is for retail traders to start placing buy orders after the asset reaches an area of high liquidity – in this case, above the $9,300 50-MA. Ultimately, such traders typically have their positions liquidated, and so far, it appears that the execution was successful.

At the time of this writing, Bitcoin is close to the major support line situated at $9,000. It’s also a psychological level that managed to hold the asset’s price above it on several occasions lately.

If BTC turns bullish again, it would have to conquer all over again the $9,300 resistance, followed by $9,500, and $9,800, in case of an especially decisive run.

Following The Stock Markets

Whether it’s price manipulation or another example of an increased correlation with the stock markets, it’s unclear. Nevertheless, when Bitcoin dropped by 3%, somewhat similar happened to the Dow Jones index. DJI went down from its daily high of 26,100 to 25,545 at one point before recovering slightly to 25,700.

The S&P 500 index also went on a negative spiral yesterday from 3,180 to its daily low of 3,116 but managed to close at 3,152. Nasdaq, on the other hand, closed with slight gains of 0.5% despite also diving intraday.

These primarily adverse developments came after news from Florida, indicating an uptick of coronavirus deaths. It also impacted the EU-based stocks, as the composite Stoxx 600 declined by nearly 1%, while London’s FTSE 100 dropped by 1.7%.

Altcoins Retrace

The altcoin market had several consecutive positive days, marking some impressive double-digit increases. DeFi tokens, riding the latest trend in the cryptocurrency space, were particularly notable.

However, they couldn’t keep the momentum going, and most altcoins are in the red today. Ethereum and Ripple slip by approximately 3% to $238 and $0.197, respectively.

Litecoin’s nosedive is similar, and LTC is below $44 now. Tezos’s price decrease is quite significant by nearly 5% to $2,44. After marking a new all-time high of $6,51 two days ago, Chainlink is now at $5,92. In other words, LINK has dropped by 9.3% since then.

Despite the tanking altcoins, Bitcoin couldn’t capitalize on the movement, and its dominance over the market remains below 63%.