According to a new study, the total trading volume of cryptocurrency derivatives has increased dramatically by over 300%.At the same time, BitMEX’s leadership position in the field has been challenged by Huobi, OKEx, and Binance.Derivatives On The RiseAnd amid the most apprehensive days of uncertainty prompted by the eventual aftermath of the COVID-19, the cryptocurrency market went through a substantial losses. Most assets plunged by as much as 50% in mid-March.During these times of hyper volatility, however, trading volume was surging, especially on cryptocurrency derivatives trading platforms.According to the report compiled by TokenInsight, in Q1 2020 alone, “the total futures trading volume in the industry reached ,1048 trillion, an increase of 314% from Q4 2019.”Derivatives Volume

Topics:

Jordan Lyanchev considers the following as important: AA News, Binance Futures, bitcoin futures, Bitmex, btcusd, btcusdt, Coronavirus (COVID-19), EOSBTC, eosusd, ETHBTC, ethusd, huobi, okex

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

According to a new study, the total trading volume of cryptocurrency derivatives has increased dramatically by over 300%.

At the same time, BitMEX’s leadership position in the field has been challenged by Huobi, OKEx, and Binance.

Derivatives On The Rise

And amid the most apprehensive days of uncertainty prompted by the eventual aftermath of the COVID-19, the cryptocurrency market went through a substantial losses. Most assets plunged by as much as 50% in mid-March.

During these times of hyper volatility, however, trading volume was surging, especially on cryptocurrency derivatives trading platforms.

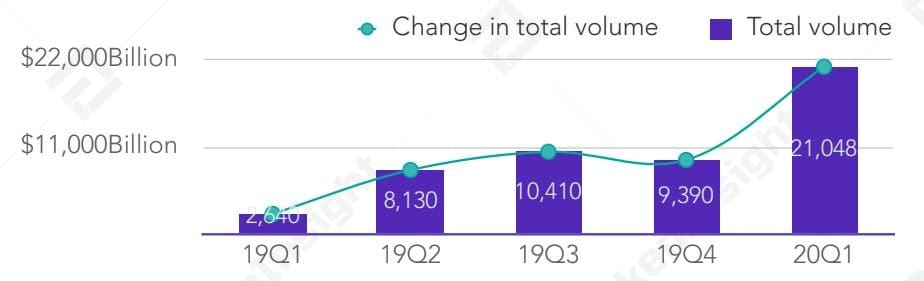

According to the report compiled by TokenInsight, in Q1 2020 alone, “the total futures trading volume in the industry reached $2,1048 trillion, an increase of 314% from Q4 2019.”

The graph above also demonstrates the yearly interest growth in futures trading. The total market turnover in Q1 2020 is approximately eight times higher than Q1 2019.

The average daily trading volume of the whole market in this quarter was roughly $23.3B, which is a 274% increase from last year.

As the price was going down at unprecedented rates, however, so did liquidations. BitMEX alone saw just shy of $500 million worth of liquidated positions in less than a few hours.

Traded Assets And Exchange Volumes

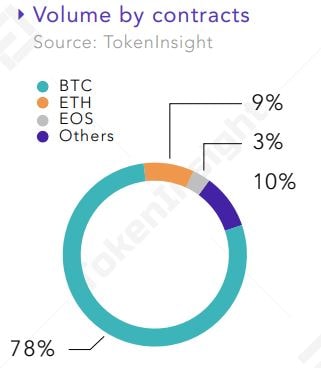

Over 90% of the futures market volume came from three major asset contracts. Bitcoin was accounted for 78% of the market share, while Ethereum has 9%. A bit surprisingly, EOS took the 3rd spot with 3%.

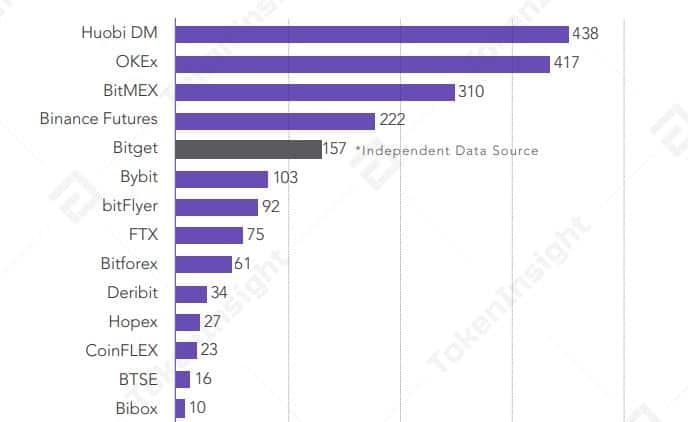

In terms of trading volume by exchanges, the paper concluded that “BitMEX’s leading position has been taken.”

The data from Q1 2020 indicated that several exchanges had total futures turnover exceeding $100B. Those included the new leaders in this category – Huobi DM ($428B) and OKEx ($417B). BitMEX ($310B) and Binance Futures ($222B) were holding the 3rd and 4th positions.

“In this exchange ranking, the top three exchanges accounted for 56% of the market volume, and the top six accounted for 81%,” the report outlined.

However, fully regulated exchanges have not developed significantly. CME and Bakkt trading volumes came to about $6.83B, and $1.51B, respectively. Of course, it’s worth noting that both of them are oriented towards institutional clients which require a lot more oversight and control.