Bitcoin has responded to the rising altcoins and just pumped to a new yearly high of over ,400. By doing this, the primary cryptocurrency has increased its dominance over the market after reaching a new yearly low earlier today.Bitcoin To ,400 and Beyond?As CryptoPotato reported earlier, Bitcoin stood still at ,800, while many low-cap alts were surging. Thus, BTC’s dominance dropped to its lowest point in over a year at 58.4%. Just a few hours ago, however, the first-ever cryptocurrency decided to act.BTC first broke above the psychological level of ,000 and then the previous 2020 high of ,100. Unlike the last time when the price move was quickly rejected, this time, Bitcoin kept its momentum and painted a new yearly high of ,460 (on Bitstamp). As of writing these lines,

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Dominance, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, EOSBTC, eosusd, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, Market Updates, XTZBTC, XTZUSD

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

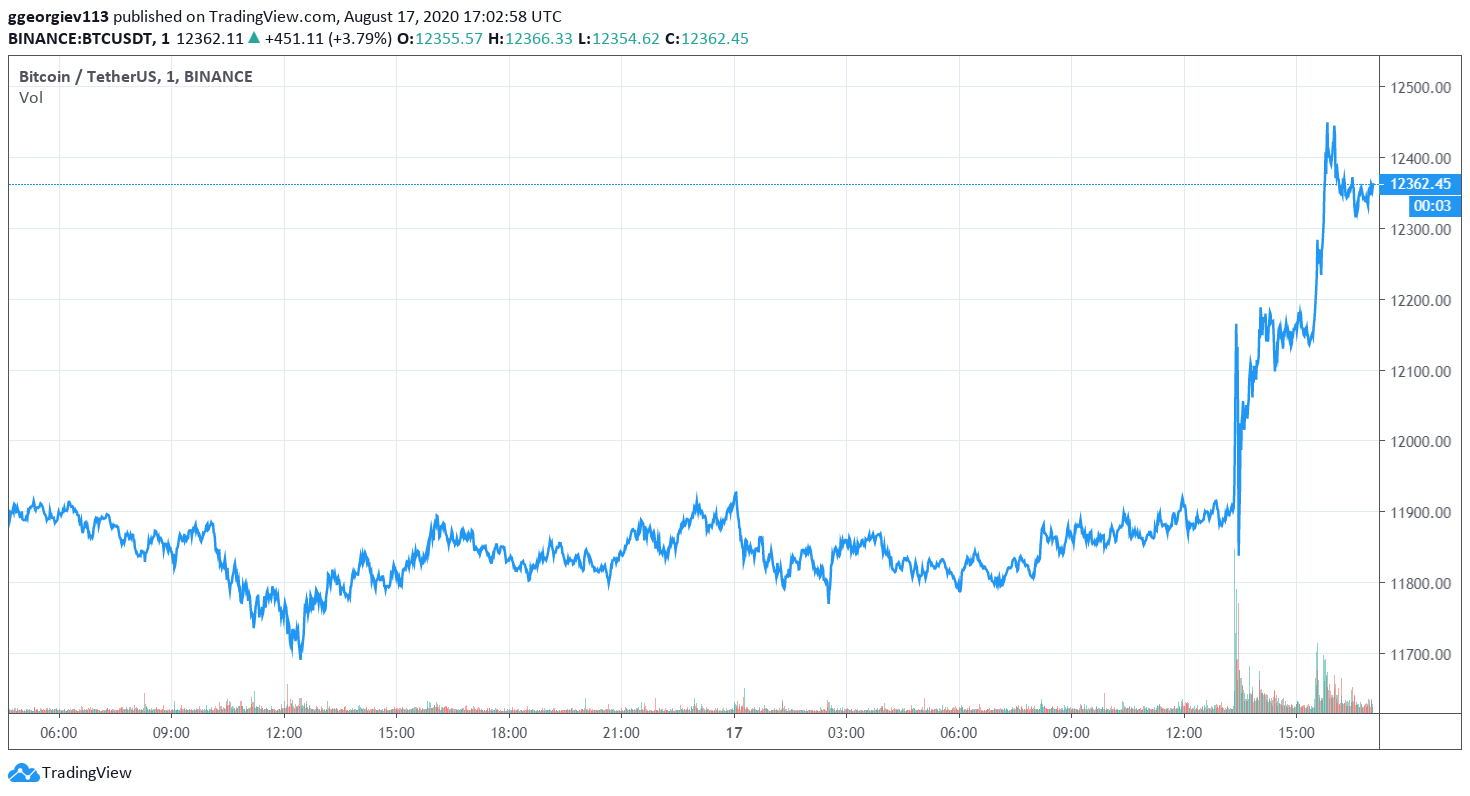

Bitcoin has responded to the rising altcoins and just pumped to a new yearly high of over $12,400. By doing this, the primary cryptocurrency has increased its dominance over the market after reaching a new yearly low earlier today.

Bitcoin To $12,400 and Beyond?

As CryptoPotato reported earlier, Bitcoin stood still at $11,800, while many low-cap alts were surging. Thus, BTC’s dominance dropped to its lowest point in over a year at 58.4%. Just a few hours ago, however, the first-ever cryptocurrency decided to act.

BTC first broke above the psychological level of $12,000 and then the previous 2020 high of $12,100. Unlike the last time when the price move was quickly rejected, this time, Bitcoin kept its momentum and painted a new yearly high of $12,460 (on Bitstamp). As of writing these lines, BTC’s has retraced slightly to about $12,350.

If BTC manages to overcome the $12,400 resistance decisively, it will have to face $12,800 as the next obstacle towards $13,000.

Bitcoin’s price pump today coincided again with a similar move from gold. The precious metal, which has displayed an increased correlation with BTC as of late, traded at about $1,950 per ounce for a few consecutive days before increasing its value with a sharp move today to $1,990.

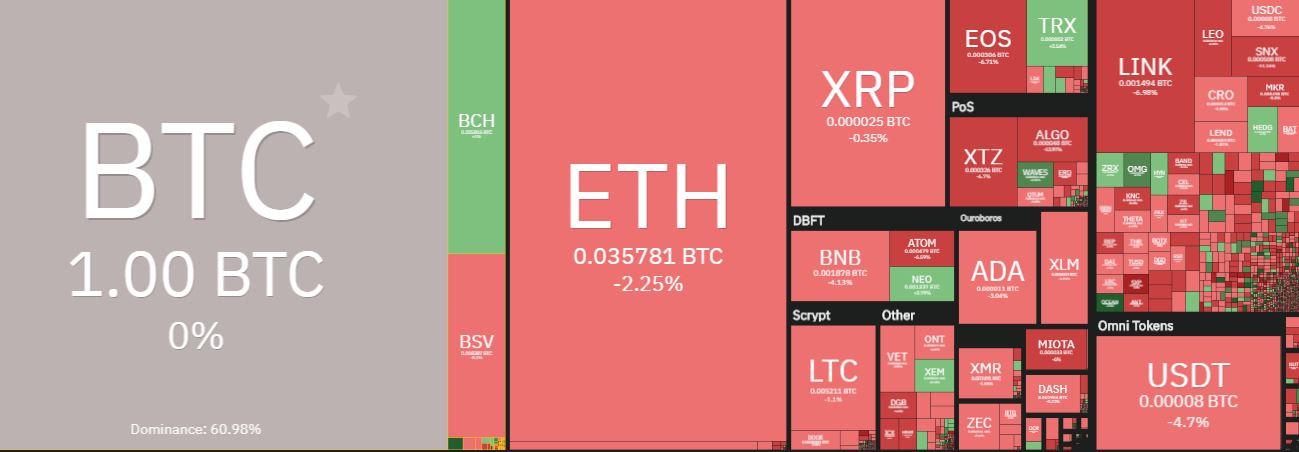

Altcoins Bleed Against BTC

With its move upwards, Bitcoin has left most of the altcoins hanging behind. While they were surging lately, most alternative coins are now in the red against the primary cryptocurrency despite marking some impressive gains against the dollar.

Ethereum is down by 2.5% against BTC, Chainlink by 4.5%, EOS and Tezos by about 6%, and Binance Coin loses 4% of its value compared to Bitcoin.

The most substantial losers against BTC are Swipe (-20%), Quant (-16%), Blockstack (-12%), Algorand (-11%), Kava (-11%), and Compound (-10%).

Nevertheless, some altcoins are in the green, including Ocean Protocol (22%), OMG Network (10%), and Flexacoin (10%). Interestingly, Yearn.Finance, an asset intended to have no financial value by its creator, reached a new all-time high earlier today against the dollar.

YFI/USDT exceeded $9,100 on Binance just a few hours ago and has retraced slightly to about $8,000.

Ultimately, though, Bitcoin’s price pump has increased its market dominance, despite those increases from some alts. The metric comparing BTC’s total market cap with all other alternative coins has now grown to 59.1%.