Despite Bitcoin’s tumultuous performance following an announcement of the US Federal Reserve regarding its new approach to average inflation targeting, the cryptocurrency has managed to stabilize around ,400 where it’s currently trading at.Elsewhere, Chainlink and Polkadot are both in red but LINK has returned to the top 5 coins by market cap.Bitcoin Spikes And DropsAs CryptoPotato reported yesterday, the US Federal Reserve announced new plans to target inflation averaging 2% over time. While some may have expected this, the news had an immediate effect on prices among all financial markets.Bitcoin went rapidly from below ,300 to an intraday top just shy ,600. As sharp as the pump was, a drop followed just as vigorously, and BTC bottomed at about ,100.The cryptocurrency has

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BSVBTC, BSVUSD, BTCEUR, BTCGBP, btcusd, btcusdt, Chainlink (LINK) Price, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, polkadot, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

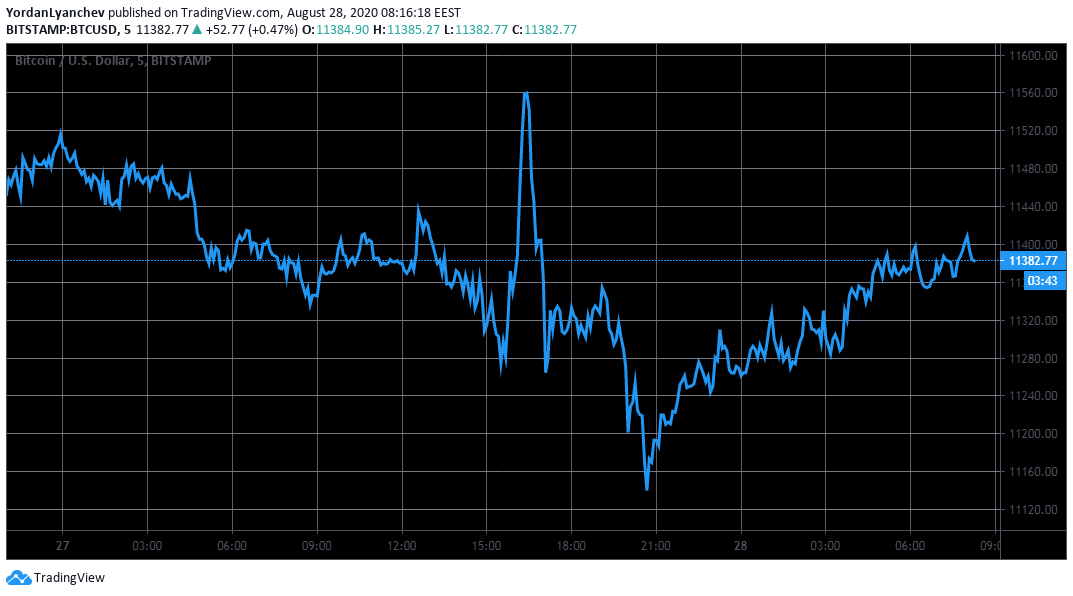

Despite Bitcoin’s tumultuous performance following an announcement of the US Federal Reserve regarding its new approach to average inflation targeting, the cryptocurrency has managed to stabilize around $11,400 where it’s currently trading at.

Elsewhere, Chainlink and Polkadot are both in red but LINK has returned to the top 5 coins by market cap.

Bitcoin Spikes And Drops

As CryptoPotato reported yesterday, the US Federal Reserve announced new plans to target inflation averaging 2% over time. While some may have expected this, the news had an immediate effect on prices among all financial markets.

Bitcoin went rapidly from below $11,300 to an intraday top just shy $11,600. As sharp as the pump was, a drop followed just as vigorously, and BTC bottomed at about $11,100.

The cryptocurrency has recovered since the daily low and is currently trading at $11,400. Should another price dip materialize for BTC, it would have to rely on $11,200, $11,100, and $11,000 as support.

In case the asset emerges upwards, it needs to overcome the significant resistance at $11,800 before having a chance to face-off with the psychological $12,000 level.

As mentioned above, other financial markets experienced similar price developments as Bitcoin and gold is no exception. The precious metal pumped from $1,930 per ounce to above $1,970 following the Fed news and then bottomed at $1,915 minutes after. Nevertheless, similarly to BTC, gold has recovered and is back at $1,940/oz.

Chainlink Returns To #5, Low-Cap Alts Fluctuate Massively

Despite being 2.5% down and below $15, Chainlink has climbed one spot in terms of market capitalization. Polkadot’s weekly impressive gains resulted in DOT’s market cap exceeding that of LINK. Today, however, DOT retraces by 5% to below $6, and LINK has become the 5th largest digital asset, according to CoinGecko.

Ethereum is one of the few larger-cap alts in the green today after a 1.4% increase to $391. Another major exception comes from Binance Coin (3% up). BNB trades now at above $23 as the leading cryptocurrency exchange’s futures platform announced a DeFi Composite Index Perpetual Contract with up to 50x leverage.

The rest of the top 10 coins are bleeding out – Ripple (-3%), Bitcoin Cash (-2%), Litecoin (-2%), BitcoinSV (-1.6%), and Crypto.com Coin (-1%).

The most notable fluctuations in either direction are evident among lower-cap alts. Numeraire leads the green part with a nearly 50% surge, followed by UMA (30%), Serum (26%), Synthetix Network (12%), and THORChain (11%).

On the other hand, Aragon loses the most substantial chunk of value after an 18% drop, followed by Flexacoin (-11%), Ren (-9%), NXM (-9%), and Nervos Network (8.5%).