The total value transferred on the Ethereum network reached full parity with Bitcoin last week. It’s mainly due to the increasing role of stablecoins in the market as they are responsible for 80% of all transactions on the Ethereum blockchain. Ethereum Network Transfer Value Parity With Bitcoin A publication revealed by Ryan Watkins, a researcher in the cryptocurrency intelligence firm Messari, showcased the comparison in transferred value on Ethereum and Bitcoin. Transferred Value On Bitcoin/Ethereum. Source: messari.ioThe graph illustrates two primary outcomes. For starters, Bitcoin carried out more transfer value in mid-2019 by reaching nearly .5 billion daily. At the same time, Ethereum’s network was responsible for approximately B. With time, however, Bitcoin’s position

Topics:

Jordan Lyanchev considers the following as important: AA News, btcusd, ETHBTC, ethusd, Stablecoins

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The total value transferred on the Ethereum network reached full parity with Bitcoin last week. It’s mainly due to the increasing role of stablecoins in the market as they are responsible for 80% of all transactions on the Ethereum blockchain.

Ethereum Network Transfer Value Parity With Bitcoin

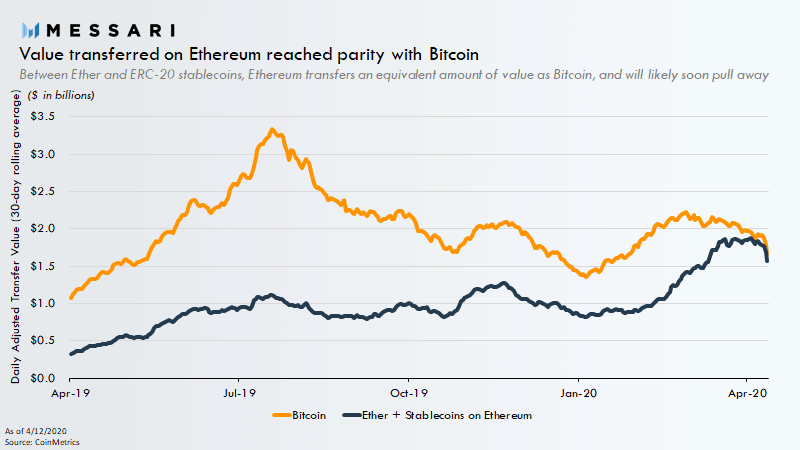

A publication revealed by Ryan Watkins, a researcher in the cryptocurrency intelligence firm Messari, showcased the comparison in transferred value on Ethereum and Bitcoin.

The graph illustrates two primary outcomes. For starters, Bitcoin carried out more transfer value in mid-2019 by reaching nearly $3.5 billion daily. At the same time, Ethereum’s network was responsible for approximately $1B.

With time, however, Bitcoin’s position decreased, while Ethereum grew considerably. And, during the past few weeks, they arrived into parity.

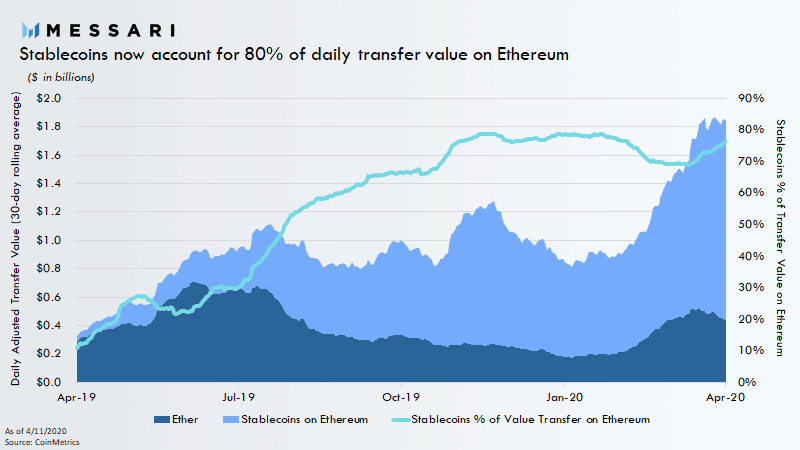

According to the data, ERC-20 stablecoins carried most of the responsibility for the growth. In fact, their daily adjusted transferred value on the Ethereum network has risen to almost 80%.

“Stablecoins are used for significantly larger transfers on average than Bitcoin. They simply have a better product-market fit for transferring value between exchanges, one of today’s dominant use cases.” – per Watkins.

Another conclusion emanating from the report indicated that Ethereum “is by far the leading platform for stablecoin issuance, and will likely extend its lead due to its maturity and lively project ecosystem.”

Best Quarter For Stablecoins

The first three months of 2020 were nothing short than rigorously volatile for the cryptocurrency market. Bitcoin, for instance, entered the new century at approximately $7,150 before it jumped to above $10,000 in mid-February.

When the COVID-19 pandemic infiltrated the western world, however, came the darkest hours. On March 12th-13th, most assets plunged vigorously with as much as 50% at one point. The primary cryptocurrency even dipped below $4,000 briefly.

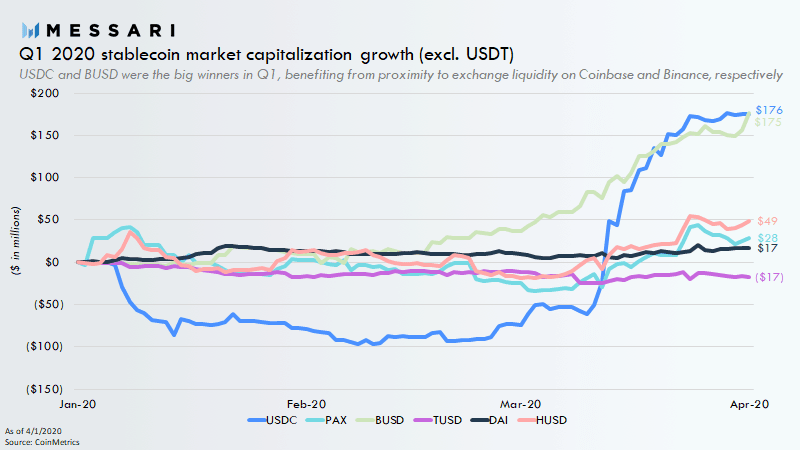

But, when something goes down, another tends to go up. In this scenario, the adverse market developments benefited stablecoins the most. They added nearly as much market cap in Q1 2020 as they did in the whole of 2019.

Their stability in times of intense price fluctuations is what typically attracts traders. The most widely adopted stablecoin – Tether (USDT) – continues minting new coins to cope with the demand. At the time of this writing, over 6.3B USDT are in circulation. This places Tether at 4th place in terms of total market capitalization, only trailing to Bitcoin, Ethereum, and Ripple.

Other examples of availing stablecoins in Q1 2020 include Circle’s USDC and Binance’s BUSD.

Somewhat naturally as their popularity grows, world watchdogs feel the necessity to establish clear regulations. Such a recent example came from G20’s Financial Stability Board (FSB) when it issued ten recommendations for common legislation on stablecoins.