After marking two consecutive yearly highs in the span of a few days, Bitcoin has calmed but still hovers over ,000. Most alternative coins have remained relatively stable, and the market cap is yet to break above 0 billion decisively. Bitcoin Stays Above k Although Bitcoin started the weekend with apparent stagnation, the asset entered Sunday on a roll. BTC was trading at ,100 but sharply exploded to a fresh 2020 high of above ,350. Shortly after, though, the cryptocurrency tanked in value, resulting in its intraday low of ,900. Nevertheless, the bulls intercepted the price drop and drove BTC higher. It’s worth noting that this was the highest weekly close of Bitcoin since January, 2018. BTC/USD Historics Chart. Source: TwitterIn the past 24 hours,

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, AMPLBTC, AMPLUSD, AMPLUSDT, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BSVBTC, BSVUSD, BTCEUR, BTCGBP, btcusd, btcusdt, Chainlink (LINK) Price, CROBTC, CROUSD, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, Market Updates, Total Market Cap, XMRBTC, XMRUSD, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Dimitar Dzhondzhorov writes Millions of ADA Sold by Cardano Whales During Market Crash – Will the Decline Continue?

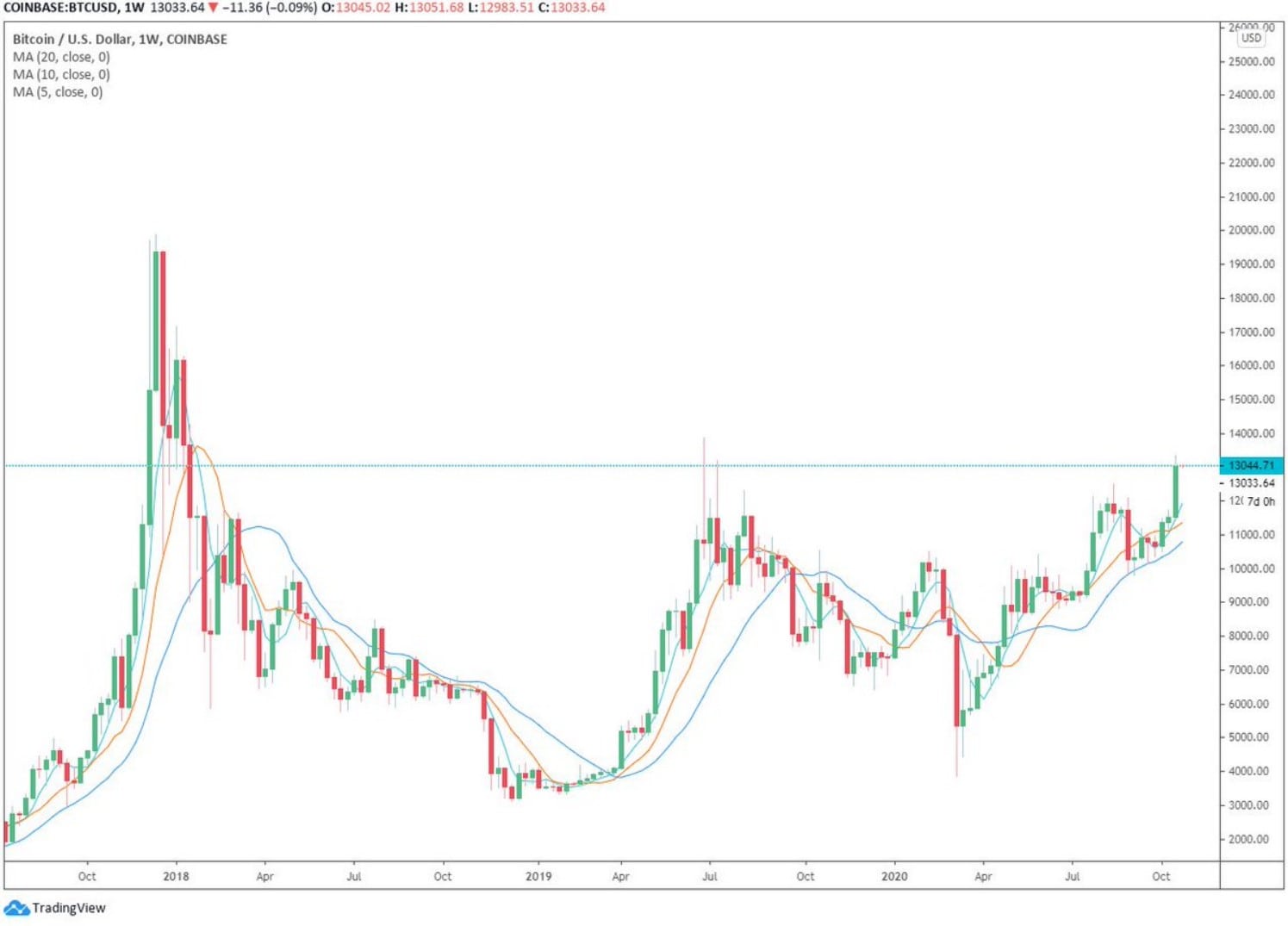

After marking two consecutive yearly highs in the span of a few days, Bitcoin has calmed but still hovers over $13,000. Most alternative coins have remained relatively stable, and the market cap is yet to break above $400 billion decisively.

Bitcoin Stays Above $13k

Although Bitcoin started the weekend with apparent stagnation, the asset entered Sunday on a roll. BTC was trading at $13,100 but sharply exploded to a fresh 2020 high of above $13,350.

Shortly after, though, the cryptocurrency tanked in value, resulting in its intraday low of $12,900. Nevertheless, the bulls intercepted the price drop and drove BTC higher.

It’s worth noting that this was the highest weekly close of Bitcoin since January, 2018.

In the past 24 hours, Bitcoin has been relatively stable. It reached a daily high of about $13,150 and has slightly retraced since then to $13,050. To continue its recent bull run, Bitcoin has to overcome the first resistance at $13,200. Further ahead, BTC could encounter obstacles at $13,400 before having a chance to challenge the 2019 high at nearly $13,900.

Alternatively, $13,000 serves as the first support in case of a price break down. The following ones are at $12,700 and $12,500.

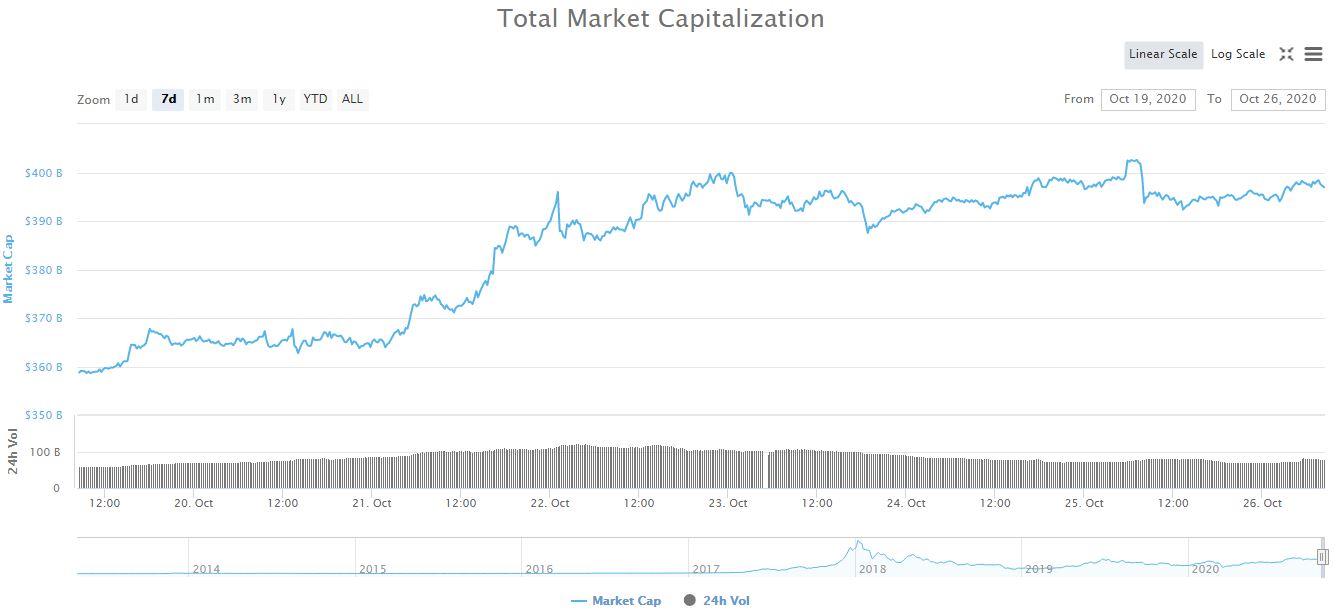

Market Cap Challenges $400B

The recent price increases have pushed the cumulative market capitalization of all cryptocurrencies to about $400 billion. The metric even surged above that level briefly yesterday but so far struggles to overcome it decisively.

Most alternative altcoins haven’t assisted in surpassing the $400 billion level in the past 24 hours. As the graph below demonstrates, most of them have displayed low fluctuations and even some retracements.

Ethereum spiked to about $420 a few days ago but has been gradually decreasing since then. ETH now trades just above $403. Despite a minor increase, Ripple is still around $0.253.

Bitcoin Cash (-0.9%), Chainlink (-2.7%), and Cardano (-1.7%) have lost value from the top 10.

BitcoinSV (5%) and Monero (4.7%) are the most impressive gainers from the larger-cap altcoins.

Further gains are evident from Velas (20%), Filecoin (16%), and Quant (10%). In contrast, Ocean Protocol (-12.5%), ABBC Coin (-9%), Energy Web Token (-7.3%), Crypto.com Coin (-7%), and Ampleforth (-6.5%) have lost the most on a 24-hour scale.