Bitcoin is the new gold, said Thomas Fitzpatrick – a Managing Director in the giant multinational bank Citibank. He also predicted that BTC could skyrocket to 8,000 per coin in the upcoming 13 months by exploring several historical price cycles and the ongoing economic uncertainties. Bitcoin Is The Gold Of The 21st Century Fitzpatrick has spent 22 years as the Global Head of Citibank’s G10 Forex business arm called Citi FX Technicals. Apart from analyzing the foreign exchange market, though, he recently explored the performance of gold and Bitcoin as outlined by a popular cryptocurrency commentator. The Managing Director at Citibank emphatically noted in the report that “Bitcoin is the new gold.” He highlighted BTC’s limited supply and digital form as two of its most

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, social

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin is the new gold, said Thomas Fitzpatrick – a Managing Director in the giant multinational bank Citibank. He also predicted that BTC could skyrocket to $318,000 per coin in the upcoming 13 months by exploring several historical price cycles and the ongoing economic uncertainties.

Bitcoin Is The Gold Of The 21st Century

Fitzpatrick has spent 22 years as the Global Head of Citibank’s G10 Forex business arm called Citi FX Technicals. Apart from analyzing the foreign exchange market, though, he recently explored the performance of gold and Bitcoin as outlined by a popular cryptocurrency commentator.

The Managing Director at Citibank emphatically noted in the report that “Bitcoin is the new gold.” He highlighted BTC’s limited supply and digital form as two of its most distinctive features.

Bitcoin also “moves across borders easily and ownership is opaque.” That last point is “very relevant” as “the huge Fiscal deterioration of today has a cost in the future, either directly or indirectly.”

Additionally, Fitzpatrick weighed in on the argument of how would central bank digital currencies (CBDCs) impact the primary cryptocurrency and world economies:

“This is a double-edged sword. On one side, it [CBDC] creates a much more effective mechanism for distributing stimulus (particularly fiscal), but on the other side, it also makes capital confiscation easier (e.g., negative interest rates.) Both these scenarios would look to me to be positive Bitcoin and in the 21st Century give us the digital equivalent (Bitcoin versus FIAT digital) of what we saw in the 20th Century when the financial regime changed (Gold versus FIAT paper).”

Bitcoin To $318K In The Next 13 Months?

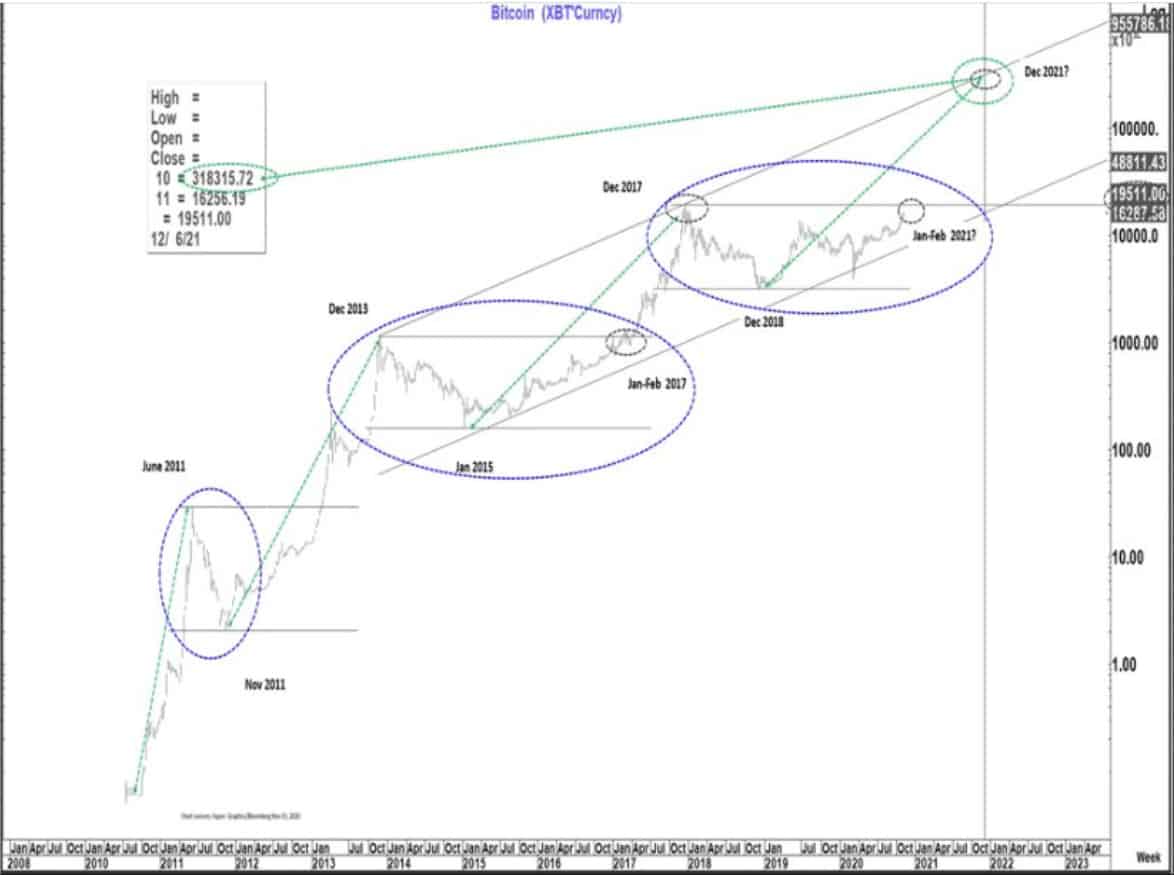

Apart from comparing BTC to gold, Fitzpatrick also examined Bitcoin’s historical price performances and provided a somewhat optimistic prediction, as the chart below demonstrates.

Fitzpatrick touched upon Bitcoin’s massive volatility and remarkable price developments during the last decade. He highlighted the two most significant market booms.

Those are BTC’s two-year-long rally from 2011 to 2013, where its price multiplied by “an incredible 555 times” and the latest major bull run that culminated in 2017’s all-time high of $20,000.

However, he also pointed out that a vicious bear market followed in both cases, which dropped BTC’s price by about 85%.

Fitzpatrick believes that Bitcoin is actually in a bull market now that started in December 2018 and could lead to groundbreaking price territories. As he noted that every new cycle is longer than the previous one, the current one could end in December 2021. This time horizon allows for BTC to explode in value and “move as high as $318,000.”

With Bitcoin’s price currently sitting at $16,000, such a 1,900% price surge sounds a bit far-fetched at the moment, to say the least.

However, it’s worth noting that Fitzpatrick’s model is not the only one that sees BTC reaching similar territory. The creator of the famous stock-to-flow model foresees $288,000 per coin by December 2021.

Featured Image Courtesy of Yahoo