Apart from a brief spike to above ,500, Bitcoin has remained relatively calm around ,400 in the past 24 hours. Most alternative coins have marked minor losses, with Ethereum dipping below 0 and Ripple beneath %excerpt%.25. Bitcoin Stays Around ,400 As reported yesterday, Bitcoin traded around ,400, despite US President Donald Trump’s call for additional economic stimulus. In the past 24 hours, BTC initiated a leg up towards its daily high of ,550 (on Binance). However, the increase was rather shortlived, and Bitcoin headed south quickly. In the following hours, the primary cryptocurrency charted its intraday low at beneath ,300. Bitcoin has managed to reclaim some ground since then and has spiked back up to a familiar level – hovering around ,400. The

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, Ripple (XRP) Price, Wall Street, xrpbtc, xrpusd

This could be interesting, too:

Wayne Jones writes Argentina’s Mining Sector Pioneers Lithium Tokenization by Tapping Cardano

Wayne Jones writes Chinese Auto Dealer Dives Into Bitcoin Mining With 6M Investment

Wayne Jones writes Nigeria Arrests 792 in Landmark Crypto-Romance Scam Raid

CryptoVizArt writes Ethereum Price Analysis: Following a 15% Weekly Crash, What’s Next for ETH?

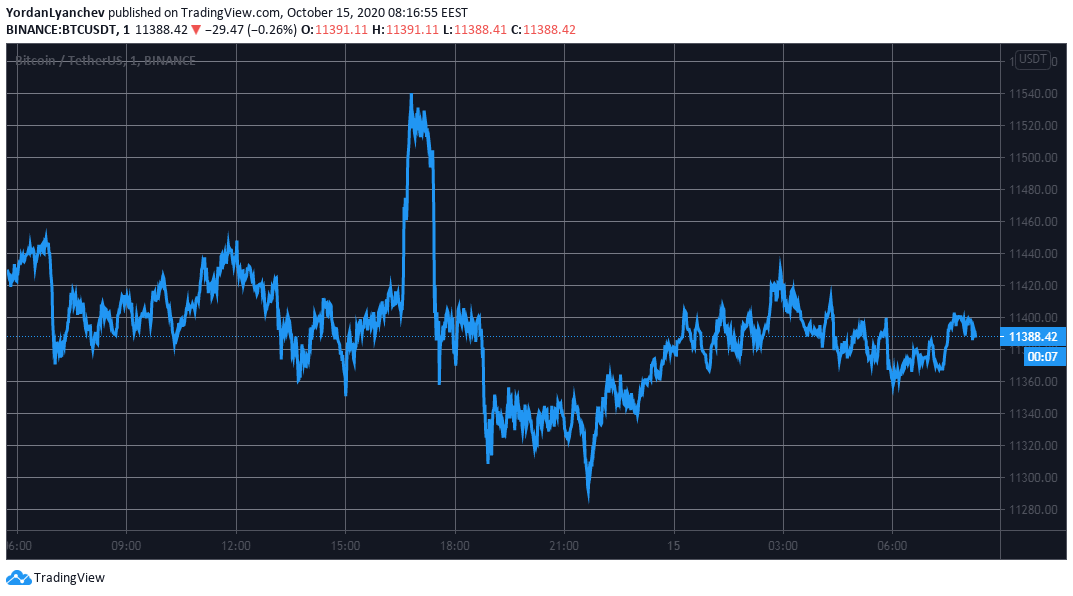

Apart from a brief spike to above $11,500, Bitcoin has remained relatively calm around $11,400 in the past 24 hours. Most alternative coins have marked minor losses, with Ethereum dipping below $380 and Ripple beneath $0.25.

Bitcoin Stays Around $11,400

As reported yesterday, Bitcoin traded around $11,400, despite US President Donald Trump’s call for additional economic stimulus. In the past 24 hours, BTC initiated a leg up towards its daily high of $11,550 (on Binance).

However, the increase was rather shortlived, and Bitcoin headed south quickly. In the following hours, the primary cryptocurrency charted its intraday low at beneath $11,300.

Bitcoin has managed to reclaim some ground since then and has spiked back up to a familiar level – hovering around $11,400.

The technical indicators behind Bitcoin suggest that the asset could rely on the support lines at $11,200, $11,050, and $10,930 in case of a price breakdown. Alternatively, the first resistance levels within its side if BTC heads upwards are $11,464 and $11,600.

The three most prominent US stock indexes ended yesterday’s trading session with declines between 0.6% – 0.8%. Given Bitcoin’s increased correlation with Wall Street as of late, these developments could suggest a short-term price drop for BTC as well.

Altcoins In The Red

As seen on the graph below, red dominates most of the market. Ethereum has failed to sustain its current bullish run, which drove it above $385 a few days ago. ETH trades below $380, after another 1% drop.

Ripple has also lost some value (2.7%), and XRP finds itself beneath $0.25. Polkadot (-2.8%), Chainlink (-3.7%), Cardano (-2.5%), and Litecoin (-1%) have also dipped since yesterday.

Bitcoin Cash and Binance Coin are the only exceptions from the top 10 with minor gains.

Near Protocol is the most significant loser since yesterday. NEAR has plummeted by 30% following yesterday’s hype created after listings on two leading exchanges – Binance and Huobi.

Uniswap (-14%), Storj (-13%), Aave (-11%), 0x (-11%), Ocean Protocol (-10%), and Synthetix Network Token (-10%) are next.

In contrast, ABBC Coin has gained the most on a 24-hour scale – 36%. Reserve Rights follows with a 16% spike.