With the third Bitcoin Halving just around the corner, the number of BTC whales is on the rise again, similar to what happened before the previous one in 2016. Individuals and entities owning at least 1,000 of the primary cryptocurrency are currently at a 2-year high.BTC Whales Accumulate Before The Halving?The Bitcoin Halving is one of the most anticipated events in the cryptocurrency community this year. It will slash the block rewards for miners to 6.25 BTC per block. It’s scheduled to take place on block number 630,000, which, as of now, should be on May 12th.According to information from the popular cryptocurrency monitoring resource, Glassnode Insights, Bitcoin whales are using the opportunity to accumulate more. The number of entities with at least 1,000 BTC is at a 2-year high –

Topics:

Jordan Lyanchev considers the following as important: AA News, bitcoin whales, Bitcoin-Halving

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

With the third Bitcoin Halving just around the corner, the number of BTC whales is on the rise again, similar to what happened before the previous one in 2016. Individuals and entities owning at least 1,000 of the primary cryptocurrency are currently at a 2-year high.

BTC Whales Accumulate Before The Halving?

The Bitcoin Halving is one of the most anticipated events in the cryptocurrency community this year. It will slash the block rewards for miners to 6.25 BTC per block. It’s scheduled to take place on block number 630,000, which, as of now, should be on May 12th.

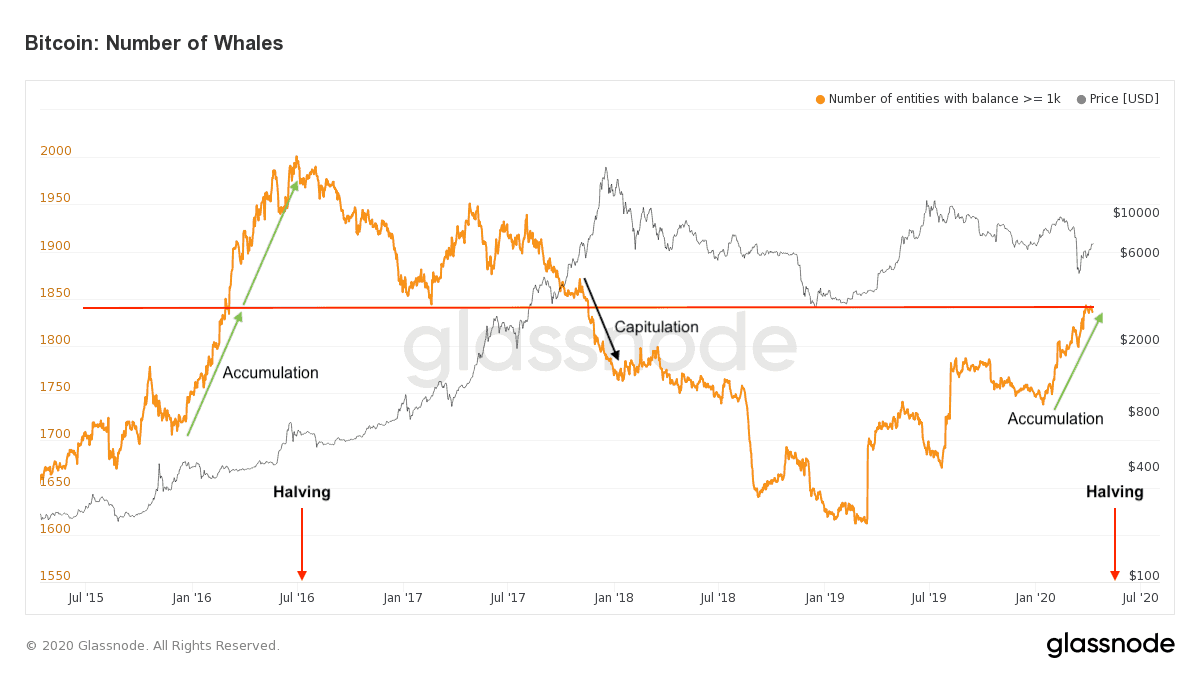

According to information from the popular cryptocurrency monitoring resource, Glassnode Insights, Bitcoin whales are using the opportunity to accumulate more. The number of entities with at least 1,000 BTC is at a 2-year high – approximately 1,840 such addresses.

Interestingly enough, something similar occurred before the 2016 Bitcoin Halving. As one can see from the graph above, that year started with approximately 1,700 BTC whales. During the months leading to the Halving, however, they rose to an all-time high point of about 2,000.

It’s also worth noting that upon the completion of the Halving, the number of BTC whales started gradually decreasing.

The report concluded that this particular period – prior to each Halving – is “a good time to be accumulating BTC.” This is valid even today, despite the “uncertain market environment” caused by the COVID-19 outbreak.

Do BTC Whales Know Something More?

The topic of “what will happen with Bitcoin’s price after the Halving” is amongst the most widely discussed in the community. The predictions vary from a possible doomsday scenario to envisioning a new all-time high.

This data, however, brings out the question if BTC whales are now relying on past performances and are expecting another price surge. After the previous Halving, the primary digital asset skyrocketed in the following year and reached $20,000 by late December 2017. Interestingly, that coincided with the most significant decrease of Bitcoin whales – referred to in the report as the “capitulation” period.

And this leads to the most ached question at this time – what will happen after the Halving? Will Bitcoin whales sell their significant portions again? If so, could that force another price dump?