Bitcoin is on course to reach and possibly break its all-time high level of ,000 by the end of the year, says Bloomberg’s latest report.It adds that BTC has matured as an asset in the past several months, which is supported by the increasing number of similarities with gold and its performance during the price drops prompted by the COVID-19 pandemic.BTC: ,000 And Beyond This Year?“Something needs to go really wrong for Bitcoin to Not appreciate,” emphatically starts the report.By comparing the 2020 price developments of BTC with those from 2016, since a halving event took place in both years, Bloomberg says, “Bitcoin will approach the record high of about ,000 this year, in our view, if it follows 2016’s trend.”It also brings up the 2017 bull run, which ultimately led to Bitcoin’s

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt, CME, Coronavirus (COVID-19)

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Bitcoin is on course to reach and possibly break its all-time high level of $20,000 by the end of the year, says Bloomberg’s latest report.

It adds that BTC has matured as an asset in the past several months, which is supported by the increasing number of similarities with gold and its performance during the price drops prompted by the COVID-19 pandemic.

BTC: $20,000 And Beyond This Year?

“Something needs to go really wrong for Bitcoin to Not appreciate,” emphatically starts the report.

By comparing the 2020 price developments of BTC with those from 2016, since a halving event took place in both years, Bloomberg says, “Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend.”

It also brings up the 2017 bull run, which ultimately led to Bitcoin’s ATH of nearly $20,000. According to the Bloomberg Galaxy Crypto Index (BGCI), which measures the performance of digital assets by combining various indicators, BTC’s ratio is higher now (25) than it was three years ago (23). Therefore, the price of the asset could excel beyond the coveted $20k mark.

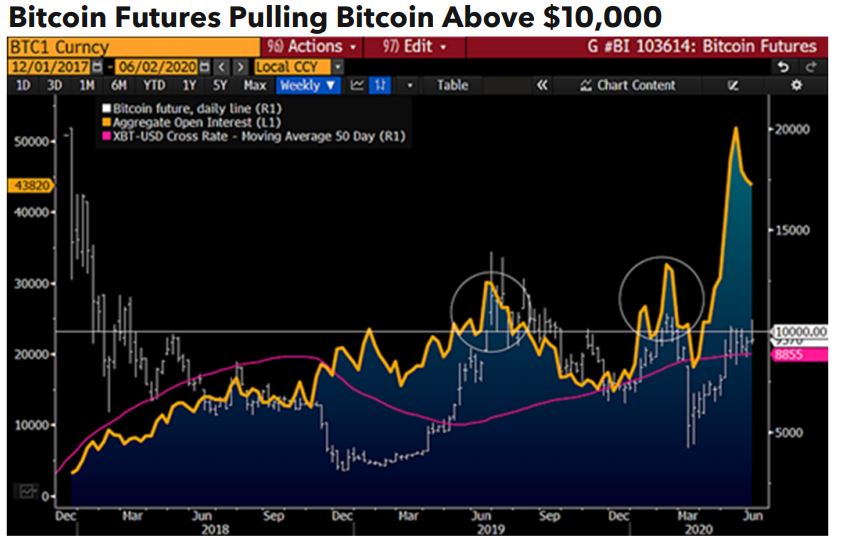

Bloomberg lists two more features, which could attribute to an upcoming price surge based on the increasing attention toward the asset. Firstly, the report outlines the rising interest in futures trading on cryptocurrency exchanges and regulated platforms such as CME. This shows a “rapid pace of maturation and a tilt toward higher prices.”

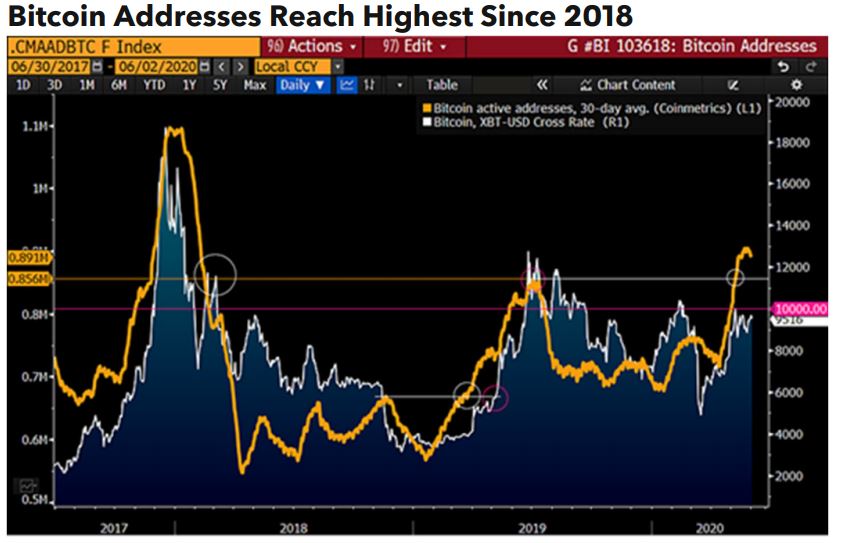

The second indicative measurement is the growing number of active Bitcoin addresses. Despite still being a long way since the ATH from late 2017 and early 2018, this metric has experienced a notable increase as of late and is currently at a two-year high.

Bitcoin, Gold, Oil, Stock Markets

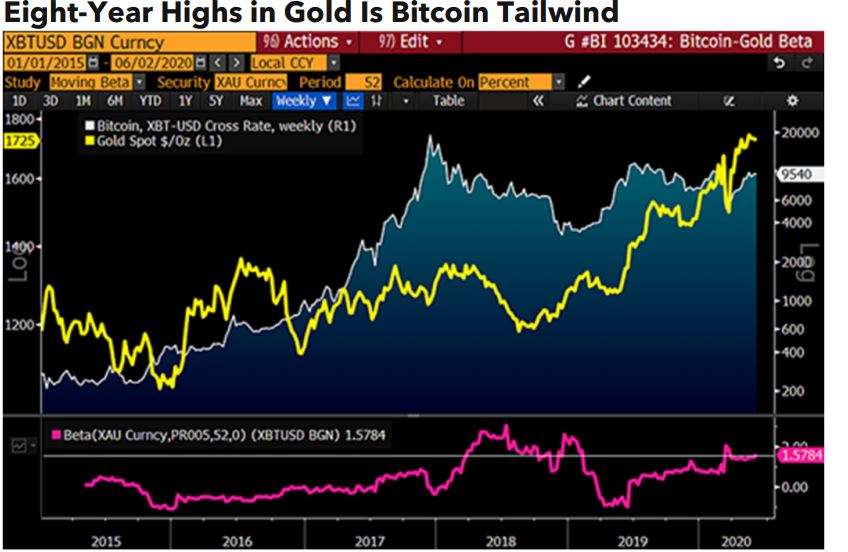

With this month’s paper, Bloomberg doubled down on the predictions for gold and Bitcoin from the previous one. The high number of similarities between the two assets suggest that the primary cryptocurrency “may consolidate its 2017 gains for an extended period. Yet, unless gold declines, Bitcoin is likely to advance toward its peak.”

Crude oil and its unprecedented drops to negative territory earlier this year could propel BTC to join “the mainstream and progress toward the digital equivalent of gold.”

“Representing a nascent technology designed to increase in fiat currency terms vs. the primary commodity that is deflationary and heading toward redundancy, the Bitcoin price is set to stay the upward course vs. crude oil.

The coronavirus is accelerating Bitcoin’s maturity vs. the stock market and crude oil, supporting price appreciation for the crypto, in our view. Amid historic declines in equities and the world’s most significant commodity, the first-born crypto’s probe lower was promptly rejected, indicating a firming price foundation.” – concludes the report