A record-breaking number of 210 Bitcoin options contracts were traded yesterday on the Chicago Mercantile Exchange, which set up a new all-time high of nearly m. Of the total amount, 202 contracts were May calls (bullish), while 8 were May puts (bearish).CME Bitcoin Options Volume On The RiseCME launched options on Bitcoin in January this year. Despite a promising start with massive volumes, the platform has struggled to maintain consistent numbers of traded contracts.Moreover, following the days of extreme price volatility in mid-March, the trading volumes had declined. More specifically, CME’s Bitcoin options platform recorded its worst trading day on March 17th, with only three BTC contracts traded.As of today, new data outlined precisely the opposite: Only yesterday, the regulated

Topics:

Jordan Lyanchev considers the following as important: AA News, bitcoin futures, Bitcoin-Halving, btcusd, btcusdt, CME

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

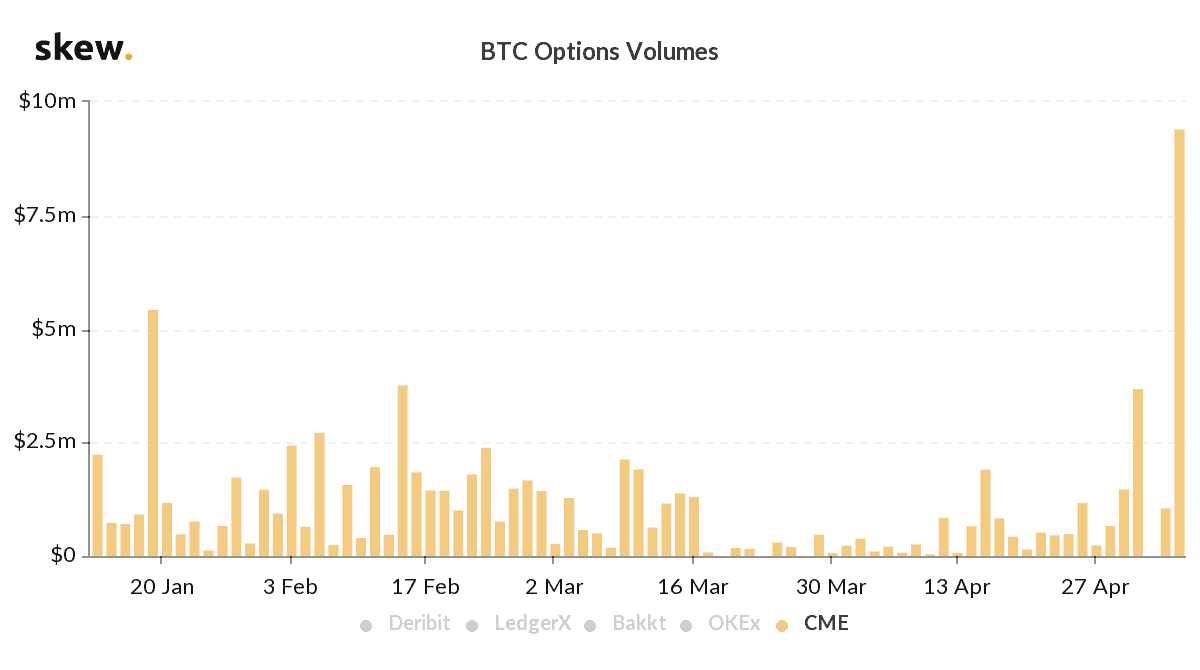

A record-breaking number of 210 Bitcoin options contracts were traded yesterday on the Chicago Mercantile Exchange, which set up a new all-time high of nearly $10m. Of the total amount, 202 contracts were May calls (bullish), while 8 were May puts (bearish).

CME Bitcoin Options Volume On The Rise

CME launched options on Bitcoin in January this year. Despite a promising start with massive volumes, the platform has struggled to maintain consistent numbers of traded contracts.

Moreover, following the days of extreme price volatility in mid-March, the trading volumes had declined. More specifically, CME’s Bitcoin options platform recorded its worst trading day on March 17th, with only three BTC contracts traded.

As of today, new data outlined precisely the opposite: Only yesterday, the regulated US derivatives exchange marked a new all-time high level of 210 contracts traded in total.

Since one contract is leveraged by 5, it means that the traded amount equals 1050 BTC. As the price of the primary cryptocurrency was hovering around the $9,000 mark yesterday, the volume in USD was almost $10 million.

Out of the total 210 traded contracts, 202 were calls for May, and the rest 8 were put options. Call options provide the buyer the option to purchase the asset at a given strike price on or before the expiration date; hence, the buyer is bullish on the asset’s value. Contrary, put options give the buyer the option to sell the underlying asset at a specific price and profit when Bitcoin’s price declines.

Upcoming Bitcoin Halving

It’s worth noting that these contracts will be settled in a month, which will take place after the upcoming Bitcoin halving. Arguably the most anticipated event in the cryptocurrency community this year is scheduled to take place next week, on May 12. Thus, it leaves the question if institutional investors are expecting a serious price increase in the value of Bitcoin.

Aside from price speculations, more recent data suggested that the overall interest in purchasing BTC has increased lately. New data by Google Trends indicated that search volume for the phrase “buy Bitcoin” surged a week before the halving.

Additionally, Bitcoin whales (addresses containing more than 1,000 BTC) are already showcasing increased accumulation levels. The number of such wallets reached a two-year high recently, similarly to what happened before the 2016 halving.