The latest positive price developments in the cryptocurrency scene have helped Bitcoin to reclaim its position as the best performing asset in 2020. BTC is currently beating the S&P 500 index, US 10 year treasury bonds, and even gold.BTC’s Recent Price Jump2020 has been nothing but volatile for the cryptocurrency market. Looking at Bitcoin, for instance, it started the year at approximately ,100, surged to above ,000 in mid-February, before plunging hard to ,700 amid the spread of the novel COVID-19.BTCUSD 4h. Source: TradingViewSince those eventful 48 hours in mid-March, however, the leading cryptocurrency has been regaining value. Just a few hours ago, it tested ,500, before retracing to the current level of about ,900. In less than two months, Bitcoin has skyrocketed with

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt, Coronavirus (COVID-19), s&p 500

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The latest positive price developments in the cryptocurrency scene have helped Bitcoin to reclaim its position as the best performing asset in 2020. BTC is currently beating the S&P 500 index, US 10 year treasury bonds, and even gold.

BTC’s Recent Price Jump

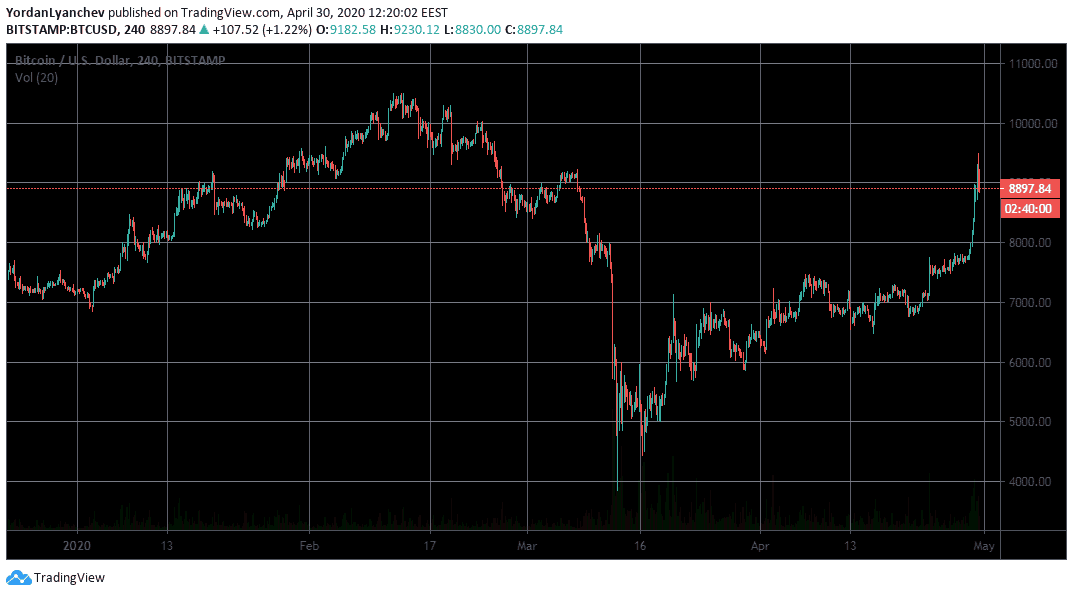

2020 has been nothing but volatile for the cryptocurrency market. Looking at Bitcoin, for instance, it started the year at approximately $7,100, surged to above $10,000 in mid-February, before plunging hard to $3,700 amid the spread of the novel COVID-19.

Since those eventful 48 hours in mid-March, however, the leading cryptocurrency has been regaining value. Just a few hours ago, it tested $9,500, before retracing to the current level of about $8,900. In less than two months, Bitcoin has skyrocketed with over 140%.

BTC Vs. Gold Vs. S&P500 Vs. US10Y

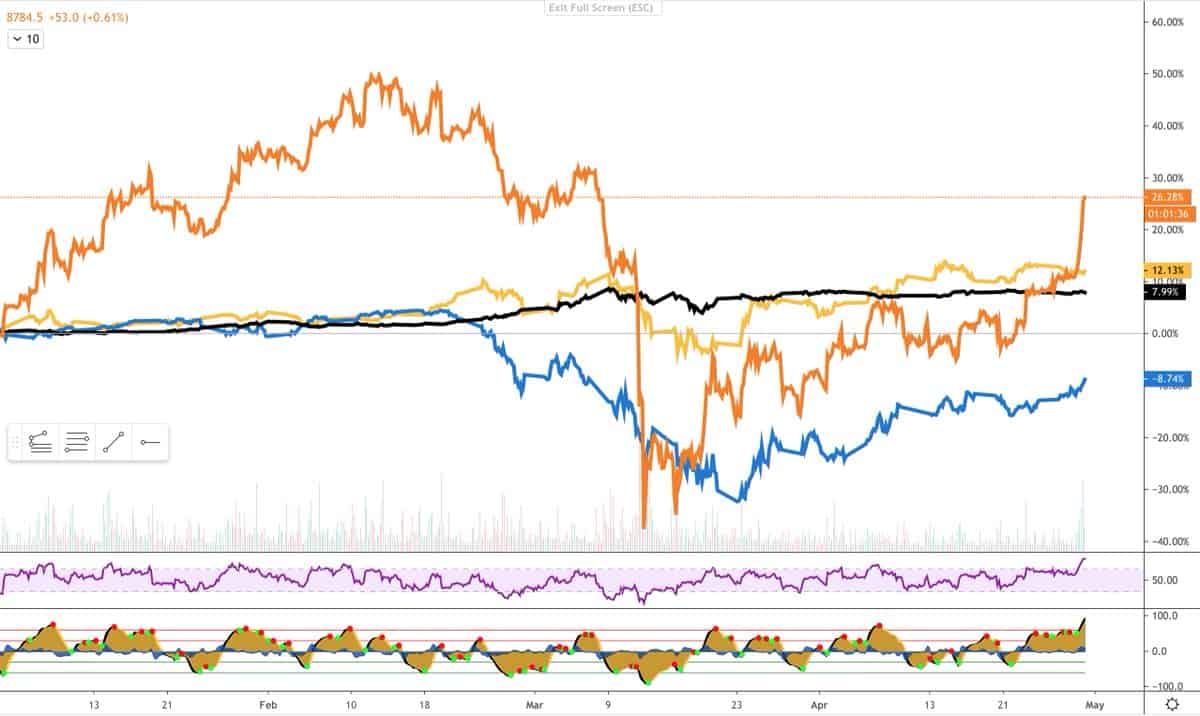

The popular cryptocurrency commentator, Alex Saunders, posted a compelling chart comparing some of the most popular investment options and their performance so far this year. Aside from the primary digital asset, the others included the S&P 500 stock market index measuring 500 large companies listed on US exchanges, US 10 Year Treasury, and the precious metal gold.

One can take several notable outtakes from the chart. The S&P 500, for instance, was slowly increasing from January to the end of February when it reached an all-time high level of $3,386. When the coronavirus infiltrated the western world, though, it plunged massively with about 34% in less than a month.

In fact, Wall Street had to halt trading on several occasions after triggering the “limit down.” The index is rising since those darkest hours, but it’s still negative this year with -8.74%.

US 10 year treasury bonds are arguably the safest and least volatile asset in this category. It usually performs best in times of economic hurdles. US10Y has been somewhat steadily climbing since the start of the year amid the COVID-19 crisis and is currently 8% up.

The precious metal, regarded by most as the ultimate safe-haven investment tool, is also in the green this year. Typically, gold also reacts positively in times of economic uncertainty. Although it went down when investors were panic selling their assets in March, it turned the trend and is now 12% higher than it was at the start of the year.

Last but definitely not least comes Bitcoin. By examining the chart, it’s easy to notice that being a free market asset has its ups and downs. For example, when the Black Thursday hit in March, BTC lost the most substantial value. However, it’s also the asset that has gained the most before and after those events.

Ultimately, this means that Bitcoin is the best performing asset of this year (and this century for that matter) with over 23% gains so far.