Cryptocurrency derivatives trading volume reached a new monthly all-time high in May 2020, surpassing the previous record recorded in March, recent research indicates. Volumes on regulated exchanges such as CME soared as well for both futures and options trading. Crypto Derivatives Monthly Volume ATH According to the report by CryptoCompare, the monthly trading volume of cryptocurrency derivatives surged by 30% in May. It hit a fresh all-time high of 2 billion, beating the previous record from March by just billion. Crytpo derivates are basically contracts getting their value from the base asset, which is mostly Bitcoin. Derivates include futures and options, which are mostly traded on crypto margin trading exchanges. Derivatives Monthly Volume: Source: CryptoCompareThe report

Topics:

Jordan Lyanchev considers the following as important: AA News, Binance, Binance Futures, bitcoin futures, Bitmex, btcusd, btcusdt, CME, huobi, okex

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Cryptocurrency derivatives trading volume reached a new monthly all-time high in May 2020, surpassing the previous record recorded in March, recent research indicates. Volumes on regulated exchanges such as CME soared as well for both futures and options trading.

Crypto Derivatives Monthly Volume ATH

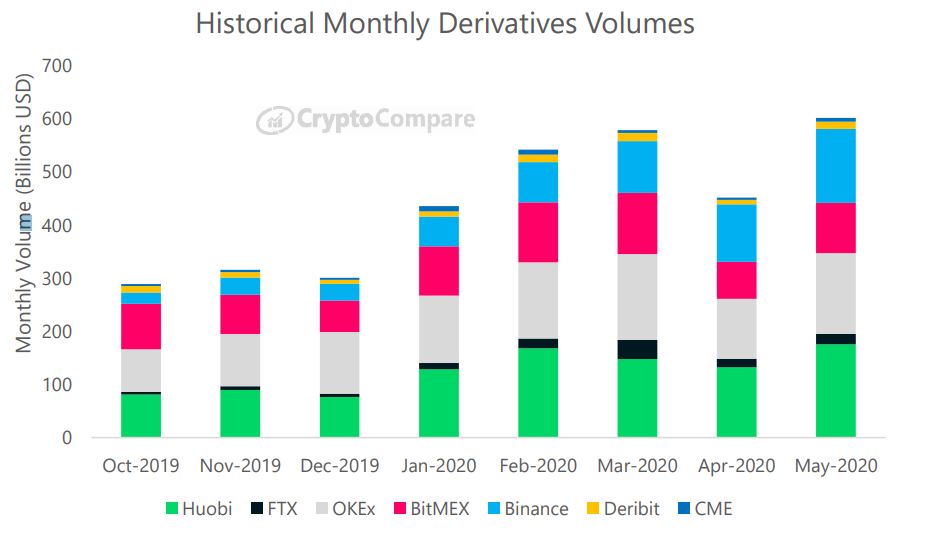

According to the report by CryptoCompare, the monthly trading volume of cryptocurrency derivatives surged by 30% in May. It hit a fresh all-time high of $602 billion, beating the previous record from March by just $2 billion.

Crytpo derivates are basically contracts getting their value from the base asset, which is mostly Bitcoin. Derivates include futures and options, which are mostly traded on crypto margin trading exchanges.

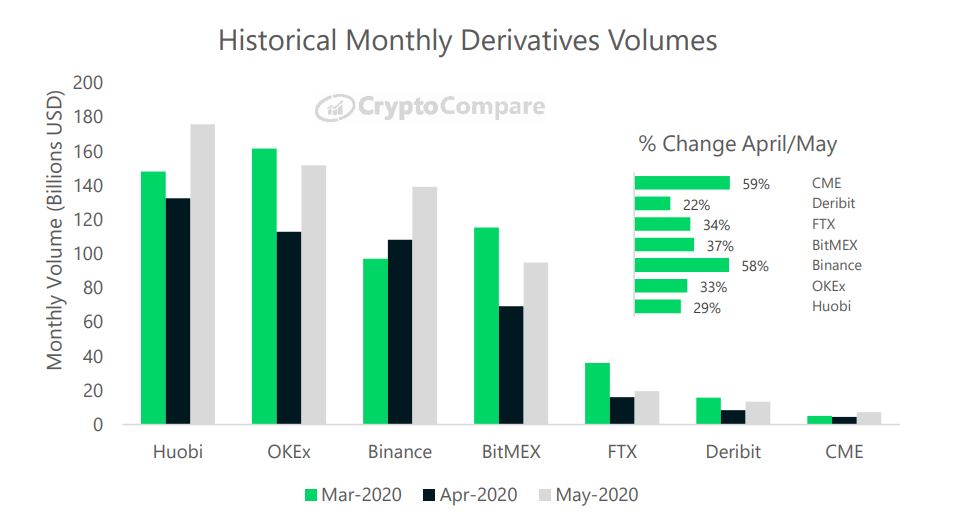

The report outlined the growth in the trading volumes on most exchanges. While all examined platforms saw double-digit increases in derivatives volumes in May, the Chicago Mercantile Exchange (CME) registered the most significant surge of 59% since April.

Outside of the regulated exchange, Binance, mostly complied with the Binance Futures platform volume, was the second-seeded with a 58% surge, followed by BitMEX, FTX, and OKEx. Interesting fact, Binance is beating BitMEX for the second month in a row.

Nevertheless, Huobi remained the leader in terms of the most substantial derivatives trading volume. OKEx and Binance followed tightly.

Stablecoins’ Corner

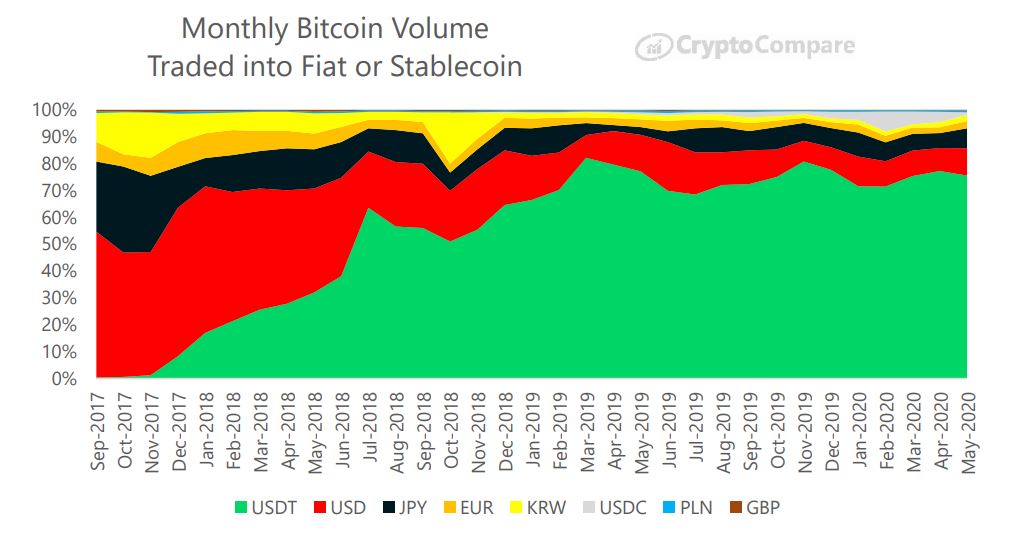

Bitcoin traded into USD, and JPY increased by 12% each, while EUR and KRW markets saw a surge by 17% and 21%, respectively.

Stablecoins such as USDC and PAX registered a drop in their total volume traded into the primary cryptocurrency. Although the BTC/USDT pair also decreased by 7% in May, it “still represents the majority of BTC traded into stablecoins at 98%.”

The paper also exemplified the continuous growth of derivatives trading by informing that it now represents 32% of the entire market, while in April, it accounted for 27%.

CME On The Rise

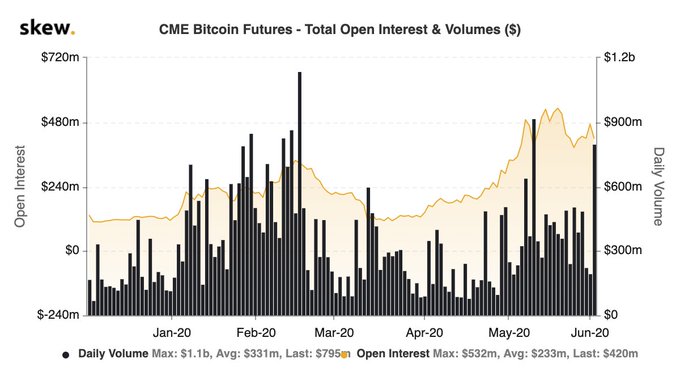

As mentioned above, CME’s growth in May was quite impressive, but this could also be attributed to the lack of serious interest in April. Following the notorious Black Thursday in mid-March, when most cryptocurrency assets lost substantial portions of their value, the volume levels plunged, both in futures and in options trading on the regulated platform.

“CME futures volumes have recovered since April, increasing 36% (number of contracts) to reach 166,000 in May. Meanwhile, CME total options volumes reached an all-time high monthly high of 5986 contracts traded (16 times April’s volume).” – reads the report.

June has also started rather positively for CME as data from Skew noted that on the 3rd of the month, Bitcoin futures trading volume on the platform was nearly $800 million.