After a sharp price jump towards ,650 intraday, Bitcoin has retraced and trades around ,200. The alternative coins continue to bleed out, and the total market capitalization has dropped below 0 billion. Bitcoin To ,650 And Back On ECB Stimulus News Following the latest 2020 high, Bitcoin got rejected and lost nearly ,000 of value in hours a few days ago. Since then, the asset has been struggling with the ,000 level. After another dip below it, BTC went on a roll yesterday. This resulted in a daily high of almost ,700 (on Bitstamp). Interestingly, the impressive price increase came shortly after the European Central Bank said that it could seek a new stimulus package in December. “The Governing Council will recalibrate its instruments, as appropriate, to

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, AMPLBTC, AMPLUSD, AMPLUSDT, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, COMPBTC, COMPUSD, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, social, Total Market Cap, Wall Street, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Dimitar Dzhondzhorov writes Millions of ADA Sold by Cardano Whales During Market Crash – Will the Decline Continue?

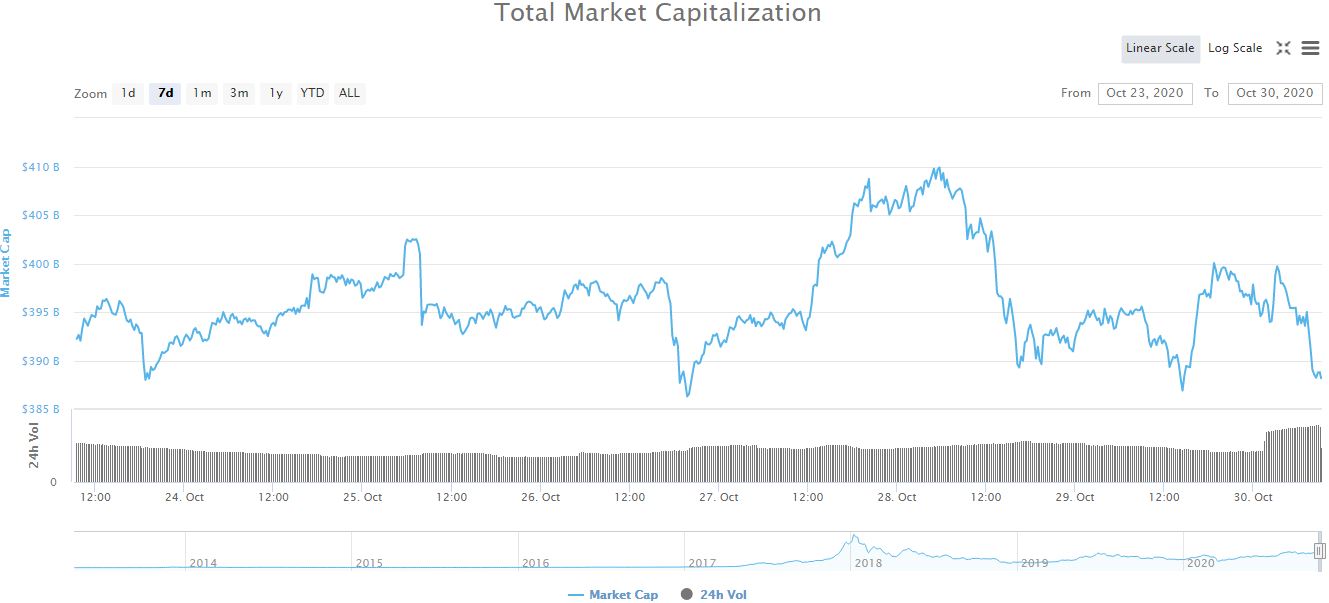

After a sharp price jump towards $13,650 intraday, Bitcoin has retraced and trades around $13,200. The alternative coins continue to bleed out, and the total market capitalization has dropped below $390 billion.

Bitcoin To $13,650 And Back On ECB Stimulus News

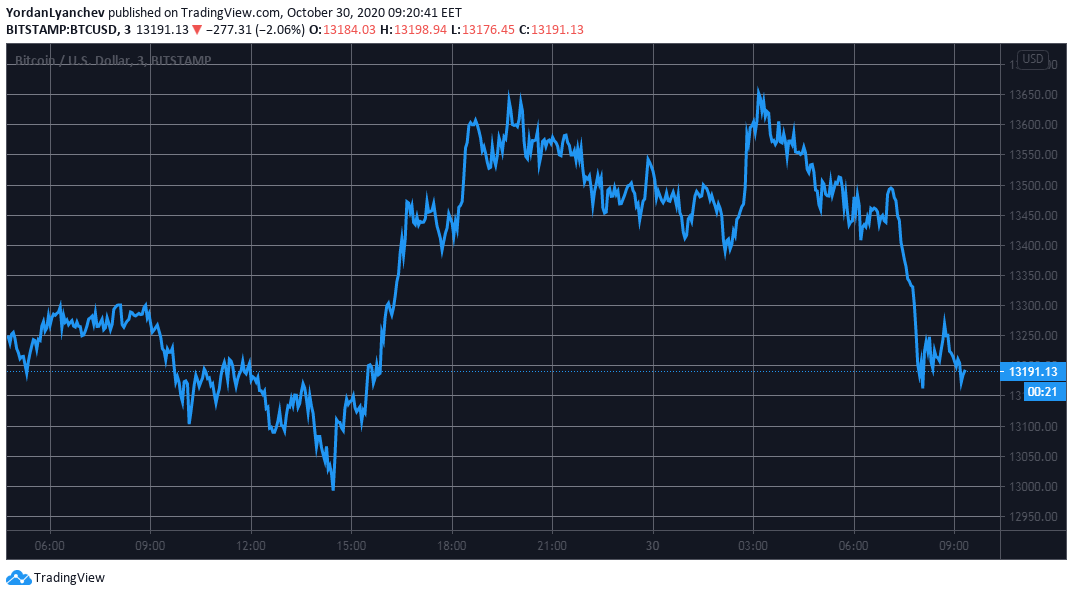

Following the latest 2020 high, Bitcoin got rejected and lost nearly $1,000 of value in hours a few days ago. Since then, the asset has been struggling with the $13,000 level.

After another dip below it, BTC went on a roll yesterday. This resulted in a daily high of almost $13,700 (on Bitstamp). Interestingly, the impressive price increase came shortly after the European Central Bank said that it could seek a new stimulus package in December.

“The Governing Council will recalibrate its instruments, as appropriate, to respond to the unfolding situation and to ensure that financing conditions remain favorable to support the economic recovery and counteract the negative impact on the pandemic on the projected inflation path.”

More impactful news came from the US. The jobless claims fell to a 7-month low – a level not registered since before the COVID-19 outbreak.

Wall Street also felt the positive effects. The three most prominent US stock indexes closed Thursday’s trading session in the green. However, the futures contracts have dropped after hours.

Bitcoin has mimicked the stocks’ performance, but being a 24/7- traded asset, it started dropping shortly after Wall Street closed doors. BTC has lost about $450 and currently sits around $13,200.

Blood On The Altcoins Street

The situation within the alternative coin market is unfavorable, to say the least. As the graph below demonstrates, all alternative coins are in the red on a 24-hour scale.

Ethereum struggles with $380 after a 2.4% drop. Ripple’s near 4% decline has taken XRP beneath $0.24. Bitcoin Cash (-2.2%), Binance Coin (-7%), Chainlink (-6%), Polkadot (-9%), Cardano (-9%) have all lost significant chunks of value from the top ten coins.

Further losses come from the lower and mid-cap altcoins. Reserve Rights has dropped by 20%, Yearn.Finance by 17.5%, and Synthetix Network Token by (-17%).

Other double-digit price declines are evident from Ampleforth (-16.7%), ABBC Coin (-16.7%), Ocean Protocol (-16.5%), Compound (-14.5%), Band Protocol (-14%), Algorand (-13%), Ren (-13%), and more.

The total market capitalization has seen $10 billion evaporate in a day and $20 billion in two days.