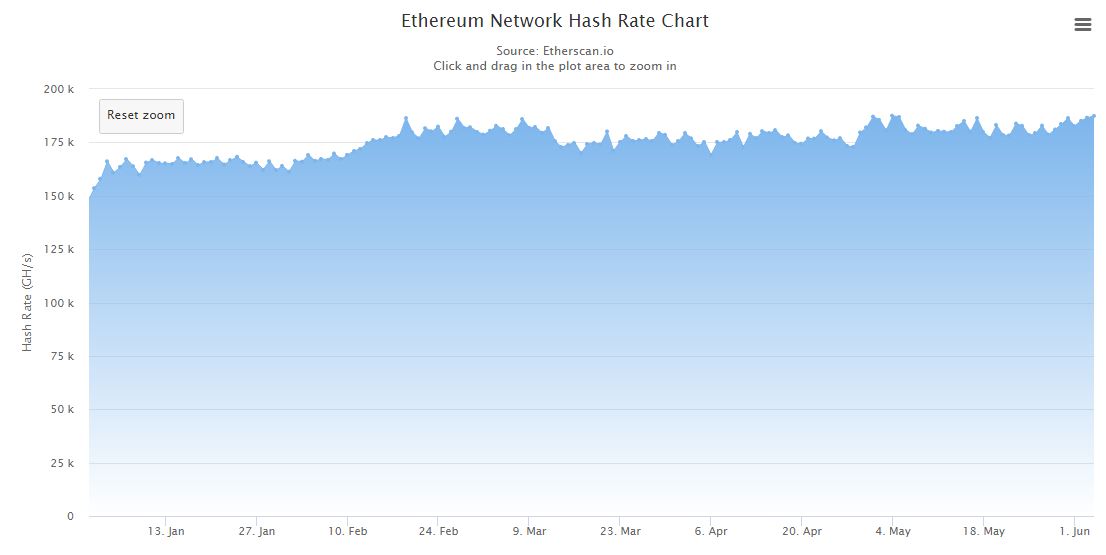

Ethereum’s hash rate has increased by nearly 30% since the start of 2020 to the current levels of 187,369 GH/s suggesting that miners are becoming more involved before the impending launch of Ethereum 2.0.ETH Hash Rate Rises In 2020According to data from Etherscan, ETH’s hash rate started the year at approximately 147,405 GH/s. Almost immediately it increased by 10%, and since then it has continued with the same positive trend. At the time of this writing, the hash rate is at 187,369 GH/s, marking an increase of about 27%.Ethereum Hash Rate 2020. Source: EtherscanNaturally, the rising hash rate means a more secure network and a lower chance of a 51% attack. A website calculating the potential costs of running such attacks on the various blockchain networks estimates that the necessary

Topics:

Jordan Lyanchev considers the following as important: AA News, btcusd, btcusdt, ETHBTC, Ethereum (ETH) Price, ethereum 2.0, ethusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Ethereum’s hash rate has increased by nearly 30% since the start of 2020 to the current levels of 187,369 GH/s suggesting that miners are becoming more involved before the impending launch of Ethereum 2.0.

ETH Hash Rate Rises In 2020

According to data from Etherscan, ETH’s hash rate started the year at approximately 147,405 GH/s. Almost immediately it increased by 10%, and since then it has continued with the same positive trend. At the time of this writing, the hash rate is at 187,369 GH/s, marking an increase of about 27%.

Naturally, the rising hash rate means a more secure network and a lower chance of a 51% attack. A website calculating the potential costs of running such attacks on the various blockchain networks estimates that the necessary amount to jeopardize Ethereum is about $140,000 per hour.

This places ETH at the second position on this scale, trailing only to Bitcoin. Although BTC’s hash rate dropped after the halving in May, the costs for a 1-hour attack is more than $430,000.

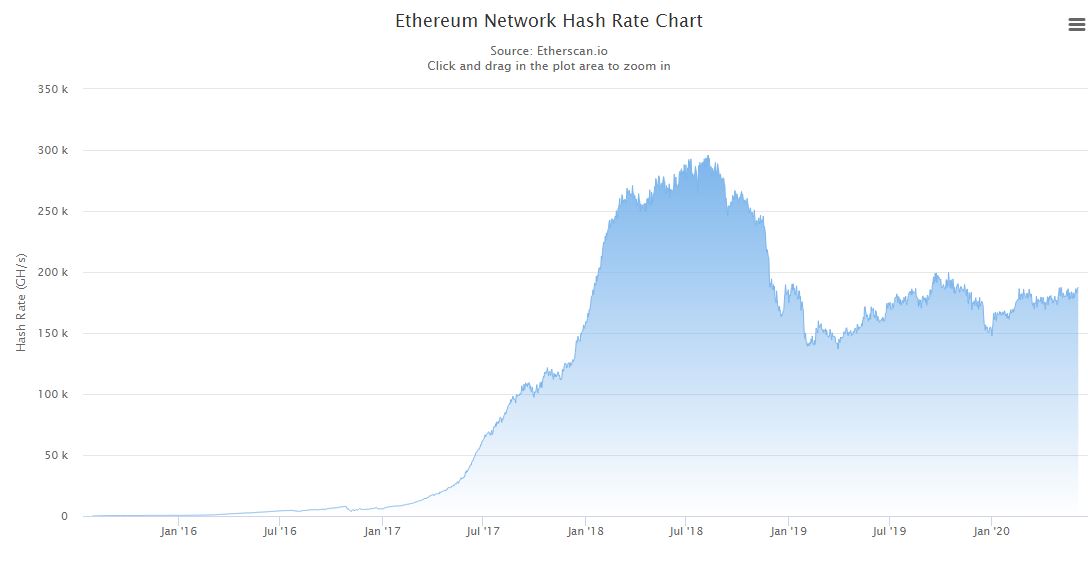

Despite the recent increases, Ethereum’s hash rate is still significantly lower than its all-time high levels of 2018. From March to October in that year, the hash rate was almost constantly over 250,000 GH/s, and it peaked on August 9th, just shy 300K GH/s.

Waiting For Ethereum 2.0

2020 could be an essential year for ETH as the community is anticipating the launch of the long-awaited Ethereum 2.0. This upgrade will see the network transition from the current proof-of-work consensus algorithm to proof-of-stake. By implementing it, the company aims to address some present security and scalability issues.

While Vitalik Buterin, co-founder of the project, recently revealed the launch of various Layer 2 solutions on Ethereum, the precise date of the ETH 2.0 release is still unknown.

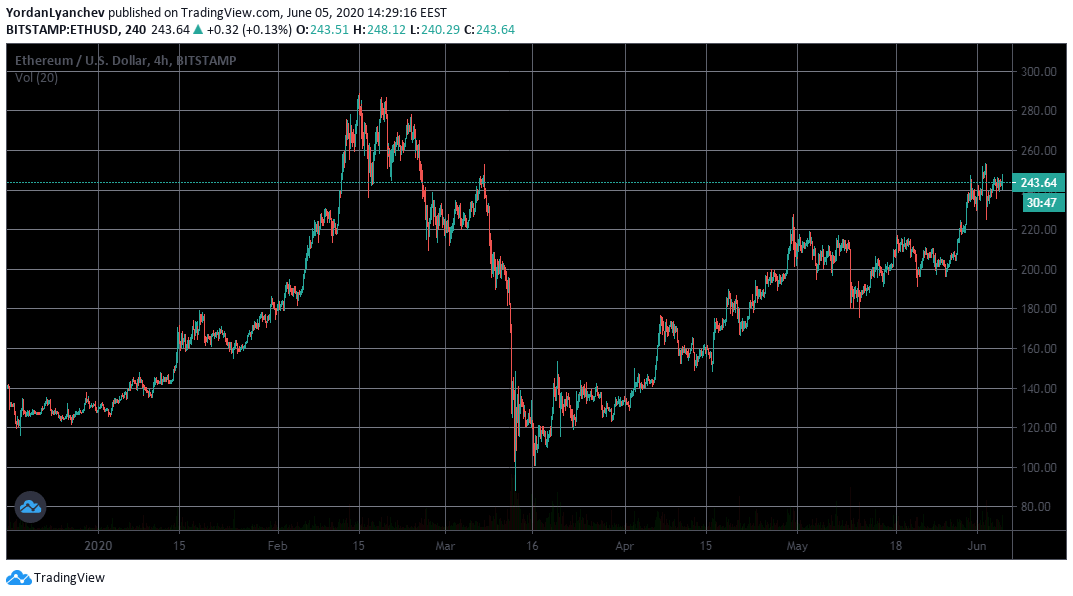

This year has been considerably positive price-wise as well for the second-seeded cryptocurrency by market cap. ETH entered the new century at about $130 and is currently trading at $243. This represents a surge of 87%, even though the asset plunged to below $90 during the Black Thursday in mid-March.

Despite the yearly increase, a recent report outlined that the asset’s price is still “significantly undervalued.” It based its conclusion on several key metrics, including developments, gas usage, and HODLing mentality from investors and miners.