The leading digital asset management company Grayscale Investments has received approval from FINRA for public quotations for two more of its cryptocurrency products. Consequently, shares of both Grayscale Bitcoin Cash Trust (BCHG) and Grayscale Litecoin Trust (LTCN) have become the first publicly-quoted securities in the US deriving value from Bitcoin Cash (BCH) And Litecoin (LTC).FINRA Approves Grayscale’s BCH And LTC TrustsAccording to the official announcement from the digital currency fund manager, the Financial Industry Regulatory Authority (FINRA) has approved shares of the company’s Bitcoin Cash Trust and Litecoin Trust for public trading. As a result, the two stocks will begin trading on OTC (over-the-counter) Markets under the symbols BCHG and LTCN.Company data revealed that

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin Cash, btcusd, btcusdt, ETHBTC, ethusd, Grayscale, LTCBTC, ltcusd, United States, XLMBTC, XLMUSD, xrpbtc, xrpusd, ZECBTC, ZECUSD

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The leading digital asset management company Grayscale Investments has received approval from FINRA for public quotations for two more of its cryptocurrency products. Consequently, shares of both Grayscale Bitcoin Cash Trust (BCHG) and Grayscale Litecoin Trust (LTCN) have become the first publicly-quoted securities in the US deriving value from Bitcoin Cash (BCH) And Litecoin (LTC).

FINRA Approves Grayscale’s BCH And LTC Trusts

According to the official announcement from the digital currency fund manager, the Financial Industry Regulatory Authority (FINRA) has approved shares of the company’s Bitcoin Cash Trust and Litecoin Trust for public trading. As a result, the two stocks will begin trading on OTC (over-the-counter) Markets under the symbols BCHG and LTCN.

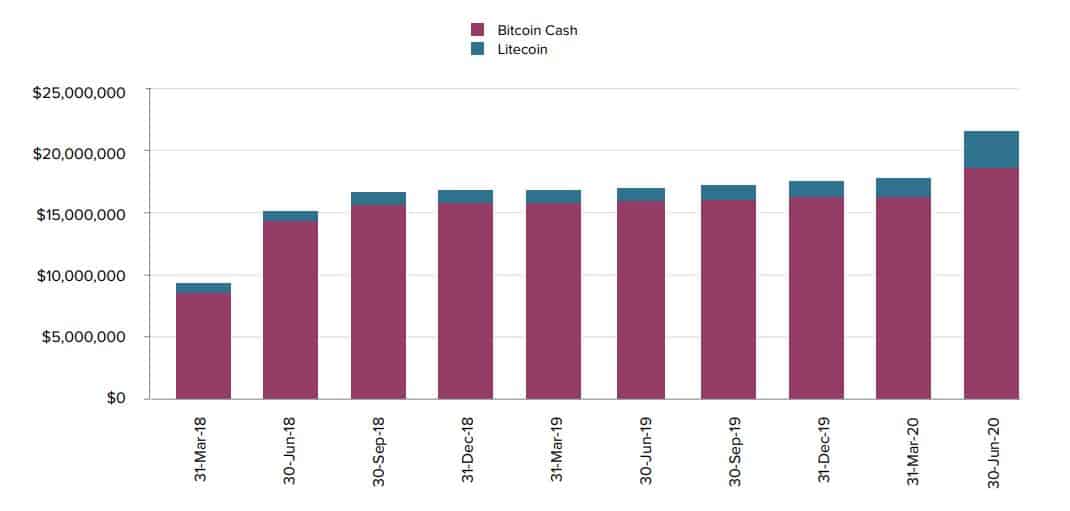

Company data revealed that after the end of Q2 2020 (June 30th, 2020), Grayscale Investments had in its custody 2,725,300 shares of the Bitcoin Cash Trust and 509,400 of the Litecoin Trust. Each share for the BCH Trust represented ownership of 0.009433 BCH, while each share of the LTC Trust – 0.09433 LTC.

“The Trusts are open-ended trusts sponsored by Grayscale and are intended to enable exposure to the price movement of the Trusts’ underlying assets through a traditional investment vehicle, avoiding the challenges of buying, storing, and safekeeping digital Bitcoin Cash and Litecoin directly.” – reads the statement.

Apart from BCH and LTC, Grayscale offers its institutional and individual accredited investors exposure to other cryptocurrency assets. Those include Bitcoin (BTC), Ethereum (ETH), Ethereum Classic (ETC), Horizen (ZEN), Stellar Lumens (XLM), Ripple (XRP), and Zcash (ZEC).

Best Quarter To Date

The cryptocurrency fund manager recently shared its Q2 2020 results, which turned out to be the most substantial quarterly inflows of over $900 million. The impressive amount represented an 80% increase from Q1 2020.

Although the firm said that Bitcoin and Ethereum remained the most popular cryptocurrencies for its institutional customers, other digital assets also attracted significant attention. Interestingly, the demand towards the Grayscale Bitcoin Cash Trust and the Grayscale Litecoin Trust had noted a serious increase during the second quarter of 2020.

Despite a continuous period of relatively low fresh inflow towards the two trusts, the total value invested in both now exceeds $20 million. However, it’s worth noting that the BCH Trust represents the majority with over $15 million.