In its latest report regarding Bitcoin, the leading digital asset management firm Grayscale has outlined the growing HODLing mentality from BTC investors, rather than so-called speculators.The company also asserted that store-of-value investment tools such as BTC are becoming more attractive to institutional investors, which could prompt a massive price surge soon.Bitcoin’s Growing MetricsGrayscale, which recently launched a successful commercial campaign highlighting Bitcoin’s merits across the US, admitted in its August 2020 report that assessing BTC’s fair value may not be a simple task, especially for investors outside of the cryptocurrency field.The company noted that “since Bitcoin is not a cash-generating asset, investors can’t apply a standard discounted cash flow analysis to model

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, Grayscale

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

In its latest report regarding Bitcoin, the leading digital asset management firm Grayscale has outlined the growing HODLing mentality from BTC investors, rather than so-called speculators.

The company also asserted that store-of-value investment tools such as BTC are becoming more attractive to institutional investors, which could prompt a massive price surge soon.

Bitcoin’s Growing Metrics

Grayscale, which recently launched a successful commercial campaign highlighting Bitcoin’s merits across the US, admitted in its August 2020 report that assessing BTC’s fair value may not be a simple task, especially for investors outside of the cryptocurrency field.

The company noted that “since Bitcoin is not a cash-generating asset, investors can’t apply a standard discounted cash flow analysis to model its present value. In many ways, valuing Bitcoin is similar to how some value gold. Instead of depending on cash flows, we can use relative valuation and supply/demand analysis to value Bitcoin as an investment.”

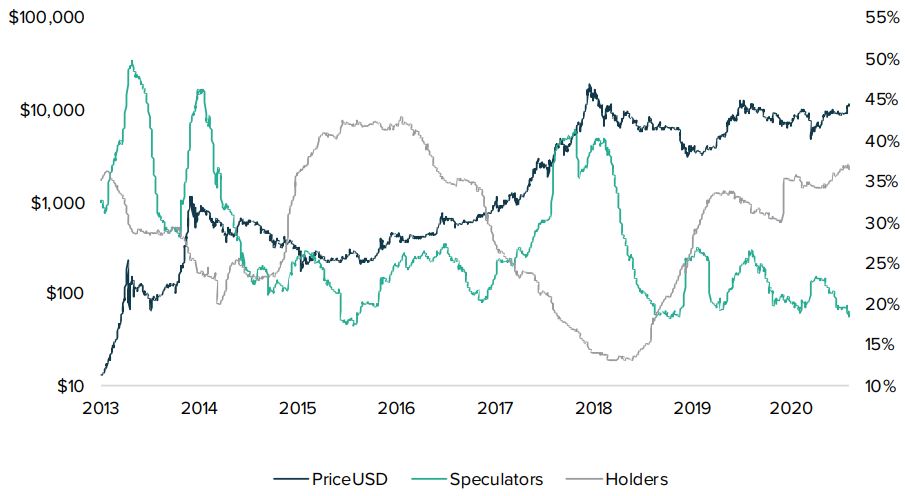

Consequently, Grayscale brought up several merits of BTC, such as its digital scarcity and its past decade price performance. Another metric mentioned by the company compared the approach from so-called speculators (coins belonging to investors that have moved in the past 90 days) and HODLers (coins stagnant for one to three years.)

According to Grayscale, the chart beneath “looks potentially promising for Bitcoin, as there are a growing number of HODLers relative to a small number of speculators in the market. Notice the similar structure to that of early 2016.”

Additionally, the Bitcoin days destroyed (BDD) metric, which blocks the fake noise of high transaction volumes, also suggests that investors prefer storing their coins instead of spending them.

Bitcoin To Increase In Value Soon?

By examining further BTC measurements, such as the realized capitalization (taking into account the last price of all traded coins), and the famous stock-to-flow model, Grayscale concluded that despite rising in value since the May 2020 halving, Bitcoin may still be undervalued.

The primary cryptocurrency has finally begun attracting the attention of prominent traditional investors such as Paul Tudor Jones III and MicroStrategy. Grayscale attributed this to the growing demand for assets serving as a store of value, such as gold and Bitcoin. The precious metal recently reached a new all-time high of above $2,000 per ounce, which corresponded with BTC’s yearly high of above $12,450.

Therefore, the report noted that “the current market structure is reminiscent of early 2016, the period that preceded Bitcoin’s historic bull run. Bitcoin continues to command global investor attention, there is scant supply to meet growing demand, and the infrastructure is now in place to satisfy that demand.”