As the economic turmoil in Argentina continues to harm citizens and devaluate the peso, it appears that residents are turning to Bitcoin, instead. Recent data revealed that Argentinians are consistently increasing their purchases of the primary cryptocurrency.Argentinians Buy BitcoinArgentinians are spending more and more pesos on buying Bitcoin, indicated new information provided by the cryptocurrency analysis resource, Arcane Research. More specifically, the weekly volume on LocalBitcoins has surged by over 1,000% in the local currency, since the start of 2018.Bitcoin Purchases Argentina In Peso. Source: Arcane ResearchNow, it’s worth noting that during the same period, the value of the peso has declined substantially. Compared to the US dollar, for instance, it has dropped by

Topics:

Jordan Lyanchev considers the following as important: AA News, argentina, btcusd, Coronavirus (COVID-19), localbitcoins

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

As the economic turmoil in Argentina continues to harm citizens and devaluate the peso, it appears that residents are turning to Bitcoin, instead. Recent data revealed that Argentinians are consistently increasing their purchases of the primary cryptocurrency.

Argentinians Buy Bitcoin

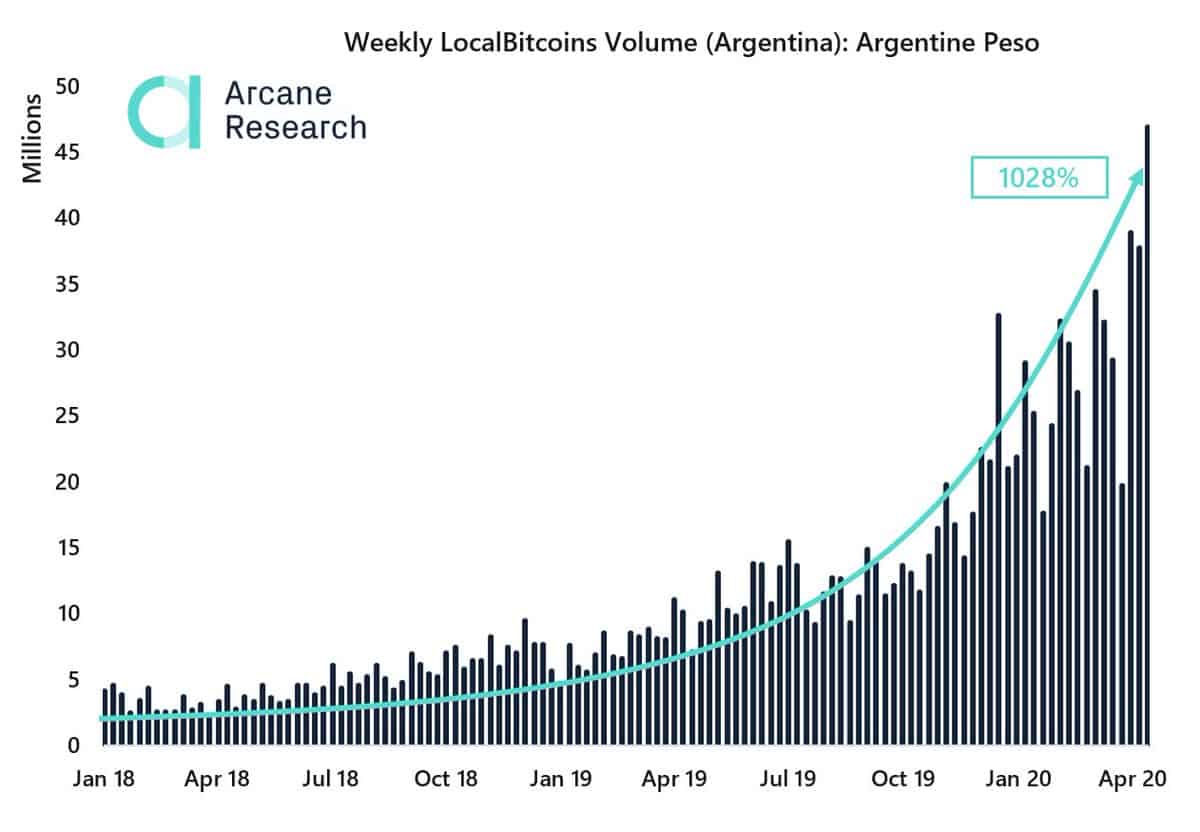

Argentinians are spending more and more pesos on buying Bitcoin, indicated new information provided by the cryptocurrency analysis resource, Arcane Research. More specifically, the weekly volume on LocalBitcoins has surged by over 1,000% in the local currency, since the start of 2018.

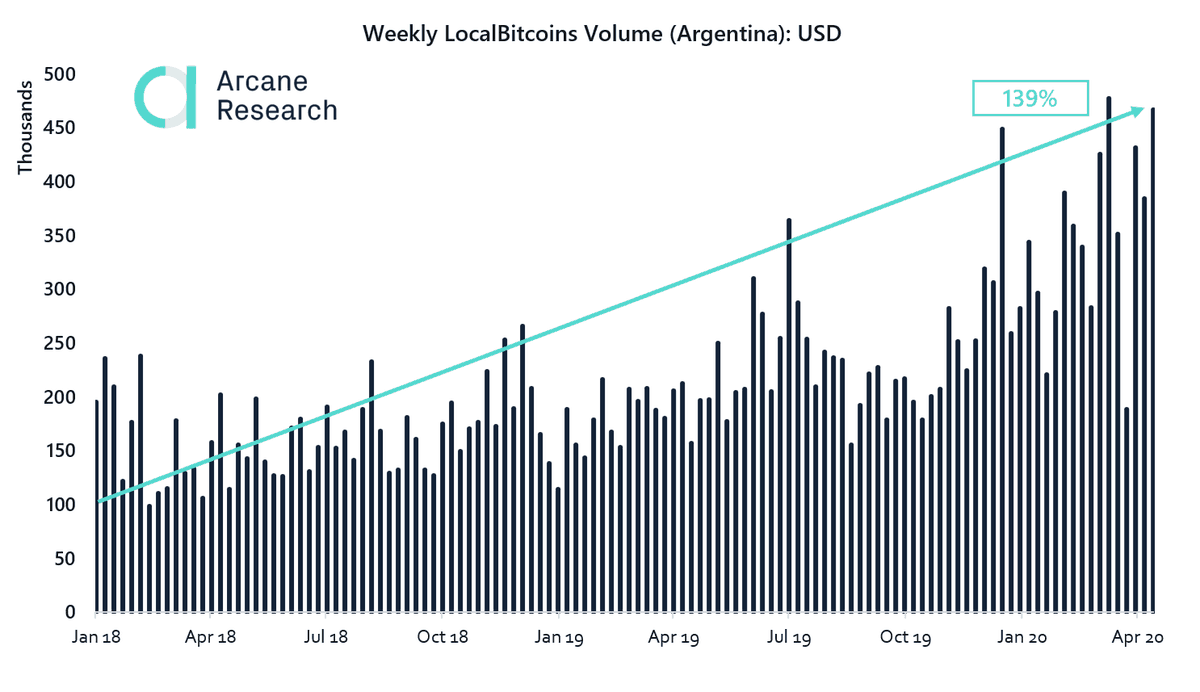

Now, it’s worth noting that during the same period, the value of the peso has declined substantially. Compared to the US dollar, for instance, it has dropped by approximately 70%.

Naturally, that means that Argentinians had to spend more of their national currency to purchase the benchmark digital asset. However, the research informed that the weekly volume in bitcoins has also risen considerably by 407%. And, at the same time, the USD volume is up as well – by 139%.

To cope with the growing interest, two of the most popular cryptocurrency exchanges expanded their services in the region. Back in February, Huobi added a fiat gateway for Bitcoin and Tether (USDT) for its Argentinian branch.

The leading exchange by volume and users, Binance, launched a fiat gateway platform of its own, dubbed Latamex, and it began serving customers in Argentina and Brazil.

The Country’s Economic Turmoil

It’s safe to say that Argentina’s economy has seen better days, and the lockdowns prompted by the COVID-19 pandemic have only deepened the suffering.

Earlier this week, the nation’s economy minister Martin Guzman said that they “will not be able to make [any] debt payments in the coming days.” Consequently, the country failed to make a $503 million payment due on Wednesday. The missed payment began a 30-day grace period during which Argentina must pay up to avoid defaulting on $65 billion of foreign debt owned by private creditors.

Guzman added that creditors, which include Fidelity, Ashmore, T Rowe Price, Wellington Management, and BlackRock, are requesting a better offer from the country. However, he noted that it’s not possible at the moment, saying, “we can’t; it is not sustainable.”

He also disclosed that the country is already in a state of virtual default. Interestingly, President Alberto Fernandez made the same statement months ago, comparing the current situation with the 2001 crisis – the worst one in the nation’s recent history.