Bitcoin seems stable after recovering from its drop to ,100 and trades above ,500. However, massive gains are evident among lower-cap alts and DeFi tokens, including YFI that doubled BTC’s all-time high. As such, Bitcoin’s dominance over the market has decreased by over 1%.YFI To k, Low-Caps SurgingIt’s no secret that the DeFi sector has been cryptocurrency’s hottest topic recently.YFI’s fork, which recently rebranded its name from YFII Finance to DFI.Money is the clear leader in terms of value gained. It has exploded with a surge of 300% to about ,500 per coin. Other YF derivative coins such as YF Value and YF Link are also up above 200% on the day.Yearn.Finance, however, reached highs not seen even from Bitcoin. While the community wonders if BTC will break its ATH of ,000,

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, AMPLBTC, AMPLUSD, AMPLUSDT, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, defi, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, THETABTC, THETAUSD, TRXBTC, TRXUSD, Yearn Finance, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Emily John writes Ripple Unveils Institutional Roadmap Driving XRP Ledger Growth

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

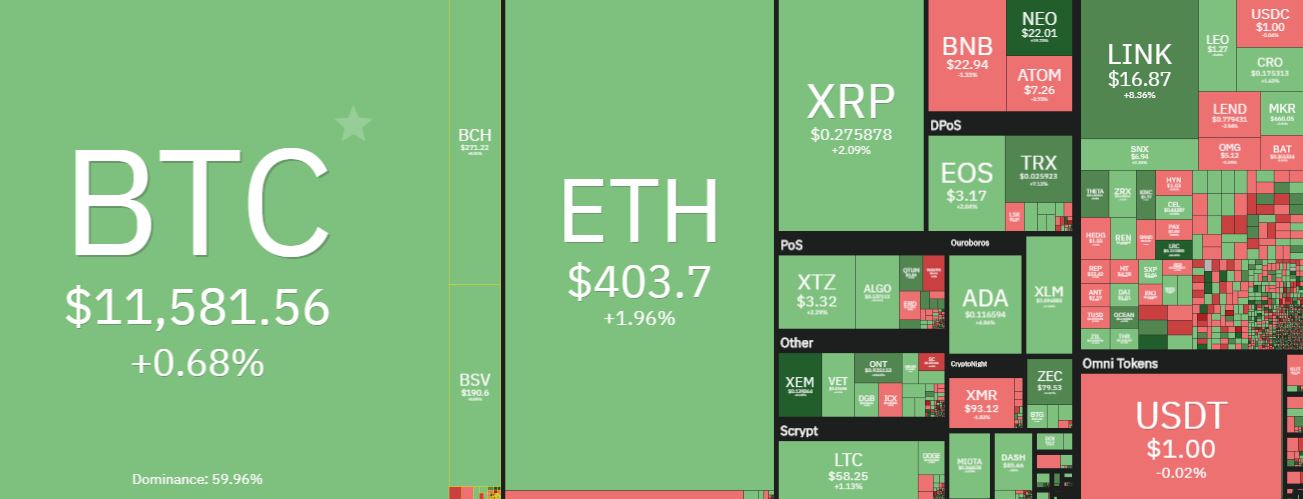

Bitcoin seems stable after recovering from its drop to $11,100 and trades above $11,500. However, massive gains are evident among lower-cap alts and DeFi tokens, including YFI that doubled BTC’s all-time high. As such, Bitcoin’s dominance over the market has decreased by over 1%.

YFI To $40k, Low-Caps Surging

It’s no secret that the DeFi sector has been cryptocurrency’s hottest topic recently.

YFI’s fork, which recently rebranded its name from YFII Finance to DFI.Money is the clear leader in terms of value gained. It has exploded with a surge of 300% to about $5,500 per coin. Other YF derivative coins such as YF Value and YF Link are also up above 200% on the day.

Yearn.Finance, however, reached highs not seen even from Bitcoin. While the community wonders if BTC will break its ATH of $20,000, YFI just doubled it by peaking just beneath $40,000. The asset has retraced slightly to $30,000, but this still represents a 90% increase since yesterday.

Sushi farming, the latest hype in the field, has also pumped other coins such as Ampleforth by over 70%.

Further below, NXM (26%), Balancer (23%), NEM (22%), bZx Protocol (20%), Neo (18%), Loopring (15%), Status (14%), Serum (14%), THETA (12%), THORChain (12%), and Ontology (10%) also see their value surge by double-digits.

Although larger-cap altcoins display less volatility as expected, there’re still some impressive gainers. Chainlink rises by 9% to $17, Cardano by 6% to $0.117, and TRON by 7% to $0.026.

Ethereum’s 2% increase means that ETH remains above $400, while Litecoin is close to challenging $60.

It’s worth noting that few coins are in the red, starting with Flexacoin (-22%), UMA (-10%), Decentraland (-9%), and Bancor (-5.5%).

Bitcoin’s Recovery Continues But Its Dominance Drops

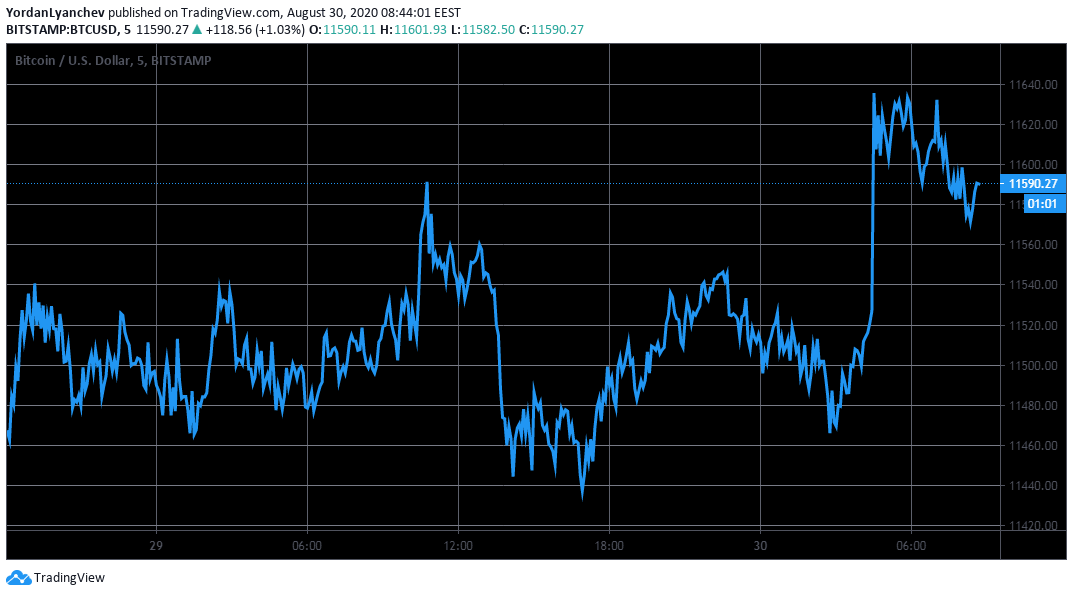

After bouncing off $11,100 a few days ago, the primary cryptocurrency has been slowly but steadily increasing its value. At the time of this writing, BTC is hovering at $11,600 after a rapid surge from $11,450 to $11,650 a few hours ago.

To continue further north, however, Bitcoin has to conquer the first resistance that lies at $11,650, before facing $11,800, and the psychological level of $12,000.

Contrary, if the asset fails on its way up and reverses, it can rely on $11,300, $11,000, and $10,750 as support.

Despite Bitcoin’s recovery, the more notable gains in the altcoin market have affected BTC’s dominance. The metric comparing Bitcoin’s total market cap with the rest of the cryptocurrency market has fallen to 58.4% after reaching 59.6% on Thursday.