After increased volatility that took Bitcoin to ,000 and ,200, the cryptocurrency has calmed and trades around ,500. The altcoins have surged in the past 24 hours as Ethereum is above 0, while Ripple is north of %excerpt%.26. Most impressively, Yearn Finance’s YFI token increased by around 100%. Bitcoin Calms After Record Days The primary cryptocurrency has been marching confidently in the past several days. This led to consecutive yearly records and its highest price tag in almost three years at about ,000. After gaining notable chunks of value in a relatively short period, Bitcoin has calmed a bit. The asset got rejected at the new yearly high yesterday and tanked to its intraday low of ,250 (on Bitstamp). However, the bulls intercepted the sharp price decline

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, Chainlink (LINK) Price, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, social, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Dimitar Dzhondzhorov writes Millions of ADA Sold by Cardano Whales During Market Crash – Will the Decline Continue?

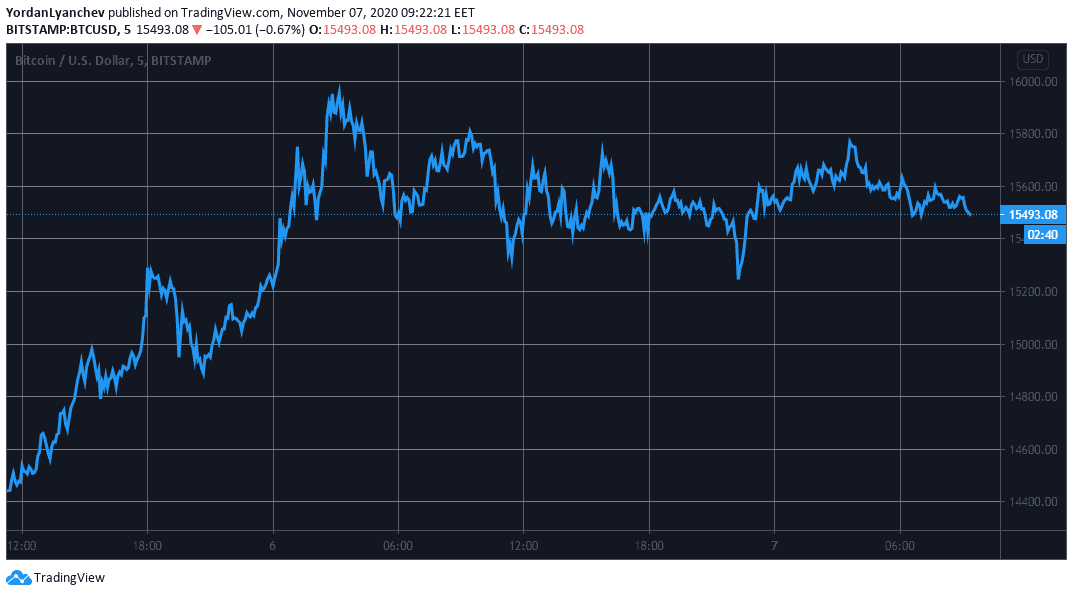

After increased volatility that took Bitcoin to $16,000 and $15,200, the cryptocurrency has calmed and trades around $15,500. The altcoins have surged in the past 24 hours as Ethereum is above $450, while Ripple is north of $0.26. Most impressively, Yearn Finance’s YFI token increased by around 100%.

Bitcoin Calms After Record Days

The primary cryptocurrency has been marching confidently in the past several days. This led to consecutive yearly records and its highest price tag in almost three years at about $16,000.

After gaining notable chunks of value in a relatively short period, Bitcoin has calmed a bit. The asset got rejected at the new yearly high yesterday and tanked to its intraday low of $15,250 (on Bitstamp).

However, the bulls intercepted the sharp price decline and drove the first-ever cryptocurrency higher to its current level around $15,500.

From a technical perspective, the resistance lines in Bitcoin’s way north are situated at $16,000, $16,400, and $16,720. Alternatively, BTC could rely on the support levels at $15,200, $15,000, and $14,650 in case of a price breakdown.

Altcoins To The Moon

Most alternative coins missed out on Bitcoin’s recent gains. However, as CryptoPotato reported yesterday, an altcoin surge could be just around the corner and it has materialized in the past 24 hours.

Ethereum has spiked by 6% and has neared $460. Just a few days ago, on November 3rd, the second-largest cryptocurrency was struggling at $370.

Ripple’s 4% surge has taken XRP above $0.26 for the first time since late October. Bitcoin Cash (6%), Binance Coin (2%), Polkadot (5%), Cardano (8%), and Litecoin (2.5%) are also in the green from the top 10. Yet, Chainlink has outperformed them all after a 14% surge. Consequently, LINK trades at $13.

Even more impressive gains are evident from lower and mid-cap altcoins. Yearn.Finance leads with a 62% surge on a 24-hour scale. The token surged by almost 100% to reach $18,000 but has since retraced to its current price.

Solana (43%), Band Protocol (34%), DxChain Token (30%), SushiSwap (25%), Energy Web Token (23%), Aave (21%), Reserve Rights (21%), and Ren (20%) are just a few of the representatives of the double-digit price increase club.

As a result of these massive gains, the altcoins have reduced Bitcoin’s dominance over the market from 66% yesterday to 64%.