Bitcoin and most large-cap altcoins have recovered from yesterday’s price dives. However, most altcoins are still far from their last week’s all-time highs.Bitcoin Back To ,600The largest cryptocurrency by market cap dipped to the ,400 support following another unsuccessful attempt to reclaim ,000. The nosedive seemed somewhat steep, and speculations rose that BTC may be aiming to close a CME gap at ,600.BTCUSD. Source: TradingViewAs CryptoPotato reported, Bitcoin futures aggregated open interest approached an ATH figure at billion. Still, the overall trend has been declining, with most traders closing their positions rather than opening new ones.From a technical standpoint, Bitcoin now struggles with significant support turned resistance area at ,600. In case Bitcoin

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, Market Updates, polkadot, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Bitcoin and most large-cap altcoins have recovered from yesterday’s price dives. However, most altcoins are still far from their last week’s all-time highs.

Bitcoin Back To $11,600

The largest cryptocurrency by market cap dipped to the $11,400 support following another unsuccessful attempt to reclaim $12,000. The nosedive seemed somewhat steep, and speculations rose that BTC may be aiming to close a CME gap at $9,600.

As CryptoPotato reported, Bitcoin futures aggregated open interest approached an ATH figure at $5 billion. Still, the overall trend has been declining, with most traders closing their positions rather than opening new ones.

From a technical standpoint, Bitcoin now struggles with significant support turned resistance area at $11,600. In case Bitcoin decisively overcomes it, the next resistance level is likely $11,800 before another stand-off with the psychological line of $12,000 and $12,100. As a reminder, Bitcoin saw a false breakout last Monday, spiking to $12,500, but quickly losing it.

If Bitcoins dives again, the first support line awaits at $11,400 – the level from which BTC bounced off yesterday. Should the asset breaks below it, $11,200 and $11,000 to follow.

Large-Cap Alts Recover, DOT Fires Engines

After some controversy around its listing time, the DOT token surged to over $4, which is approximately 40% on the daily. DOT belongs to PolkaDot, a project that carried a broad interest in the crypto community. The project completed its second token sale a month ago, after a first sale during 2017.

Besides DOT, most altcoins have recovered from yesterday’s dips as well, but still far from their 2020 high levels. Ethereum dived to $378 but surged to nearly $400 in just a few hours. Though, ETH got rejected there and has retraced to $387 as of writing these lines.

Ripple is back to above $0.28, while Chainlink gains over 7% of its value. LINK has surpassed Bitcoin Cash, which is slightly in the red and is once again the 5th largest digital asset by market cap.

Cosmos is the most impressive gainer of the day, with a price surge of 28%. The team behind the project shared several milestones yesterday – including “three million blocks, 125 validators, and $1.5 billion of value secured.”

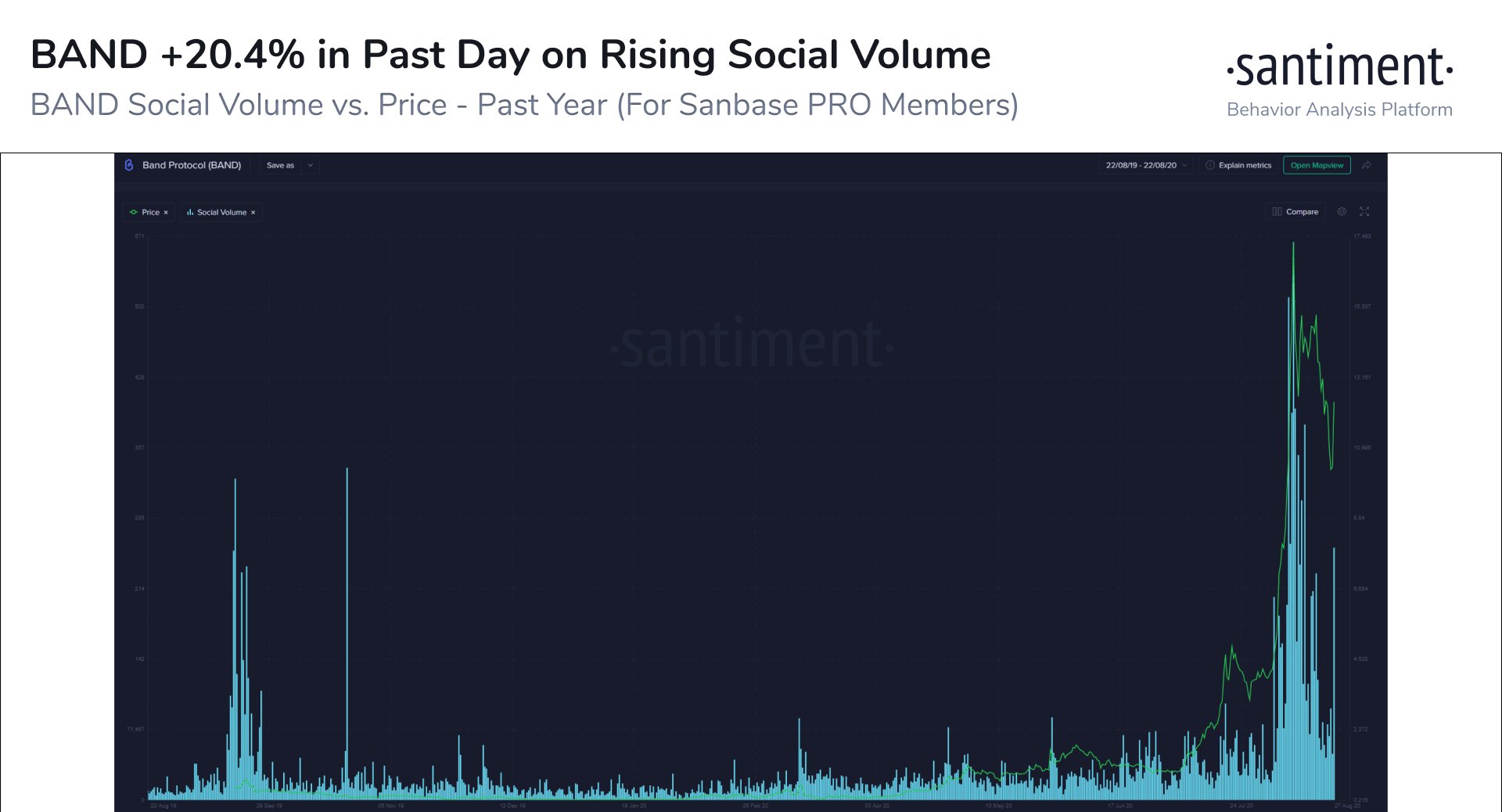

Balancer (20%), Bytom (19%), NEM (17%), Kusama (16%), and Band Protocol (15%) are also increasing their respective value by double-digits. Interestingly, data from the analytics company Santiment connects the most recent BAND price pump with the social media volume regarding the asset. According to the company, the social spike “foreshadowed” the price uptick.

Golem and Augur, after seeing decent increases yesterday, are retracing today by 16% and 12%, respectively. ICON (-10%), Flexacoin (-7.5%), 0x (-7%), KuCoin Shares (-6%), and Holo (-5.5%) are also in the red.