Bitcoin’s total supply gets distributed among more addresses as its network matures over time. At the same time, some notable altcoins have up to 95% of their total supply held by several large addresses.This information came from a report gathered by the popular monitoring resource – coinmetrics. By examining numerous variables of data, the paper outlines the wealth distribution of some popular cryptocurrencies.BitcoinNaturally, the report begins with the largest cryptocurrency by market capitalization. It concludes that back in 2011, only a few individuals held most bitcoins. More specifically, 33% of Bitcoin’s supply was held in addresses that contained 1/1000th of all BTC.As Bitcoin’s popularity kept increasing with time and more people got involved, it’s gradually been distributed to

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Bitcoin’s total supply gets distributed among more addresses as its network matures over time. At the same time, some notable altcoins have up to 95% of their total supply held by several large addresses.

This information came from a report gathered by the popular monitoring resource – coinmetrics. By examining numerous variables of data, the paper outlines the wealth distribution of some popular cryptocurrencies.

Bitcoin

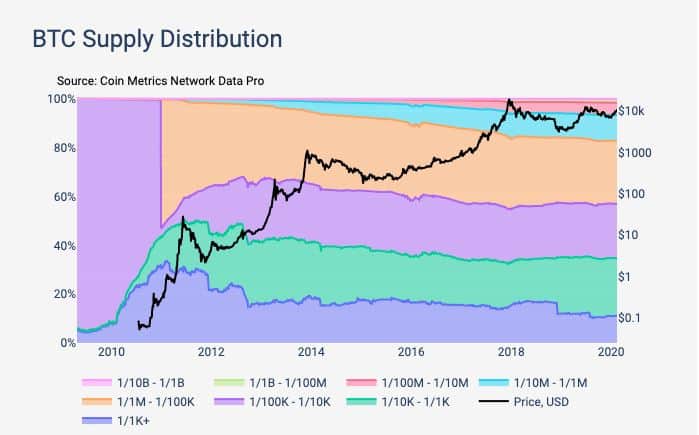

Naturally, the report begins with the largest cryptocurrency by market capitalization. It concludes that back in 2011, only a few individuals held most bitcoins. More specifically, 33% of Bitcoin’s supply was held in addresses that contained 1/1000th of all BTC.

As Bitcoin’s popularity kept increasing with time and more people got involved, it’s gradually been distributed to millions of different addresses. As Cryptopotato reported in January, there are almost 30 million BTC addresses. Therefore, fast-forwarding nine years to this February, only about 11% of Bitcoin’s total supply is concentrated in whale addresses.

Alternative Coins

Ethereum, mainly because of its initial token sale, had 60% of its total supply in addresses with at least 1/1000th back in 2016. According to the report, though, the ICO bubble of 2017 and 2018 deflated those numbers. As of February 2020, large addresses hold about 40% of the total Ether supply.

Litecoin’s wealth distribution is similar. Large addresses containing at least 1/1000th of the total supply control 46% of all LTC.

Out of all examined cryptocurrencies, Ripple and Stellar have the most significant amounts of their supply concentrated. As official foundations store some portions of their native currencies, 85% of XRP and 95% of XLM are held on large addresses.

Stablecoins

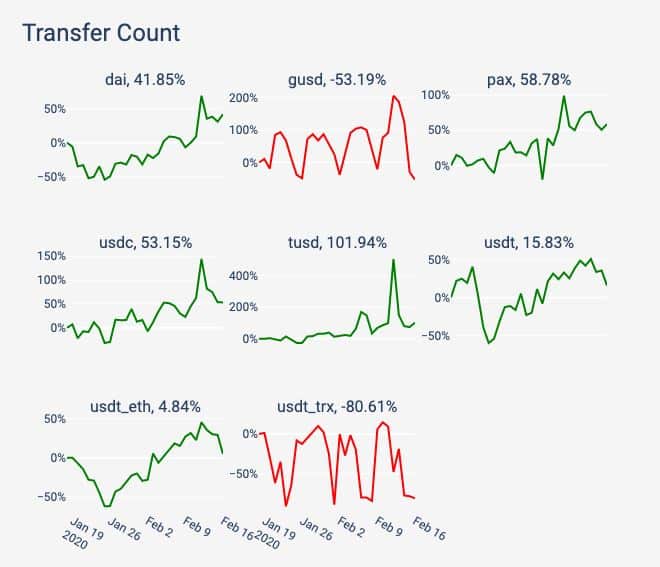

Tether (USDT) uses multiple blockchain networks for its tokens. The paper has examined USDT’s distribution on three of them – Ethereum, Omni, and Tron. It concludes that all three began 100% concentrated. However, USDT-ETH and USDT-Omni are becoming increasingly distributed in time. USDT-TRX, though, hasn’t moved much yet, and almost all of it is still concentrated.

According to the report, the different distribution comes from the adoption levels. While USDT-ETH and USDT-Omni are used as a medium of exchange, Tron’s version is mostly being neglected.

Also, other stablecoins have surpassed Tether in terms of transfer counts in the past 30 days. The report implies that USDT’s dominance over the stablecoin market may be decreasing.