Nearly 90% of cryptocurrency investors worry about what will happen to their funds in case they pass away, a new study revealed. However, less than 25% of participants noted that they organized a comprehensive plan regarding their digital asset will.Cryptocurrency Funds After DeathThe digital asset field differs from traditional finance in various forms. Apart from the decentralized nature which attracts numerous proponents and investors, leaving a detailed will is not as simple.Due to features such as dedicated digital wallets and public digital addresses, and complicated words like private keys, leaving cryptocurrencies as an inheritance could be challenging for people unfamiliar with the matter.UK-based cryptocurrency company Coincover estimated that nearly 4 million bitcoins had been

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, BNBBTC, bnbusd, btcusd, btcusdt, ETHBTC, ethusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Nearly 90% of cryptocurrency investors worry about what will happen to their funds in case they pass away, a new study revealed. However, less than 25% of participants noted that they organized a comprehensive plan regarding their digital asset will.

Cryptocurrency Funds After Death

The digital asset field differs from traditional finance in various forms. Apart from the decentralized nature which attracts numerous proponents and investors, leaving a detailed will is not as simple.

Due to features such as dedicated digital wallets and public digital addresses, and complicated words like private keys, leaving cryptocurrencies as an inheritance could be challenging for people unfamiliar with the matter.

UK-based cryptocurrency company Coincover estimated that nearly 4 million bitcoins had been lost after the owners’ death. To put this into a USD perspective, it amounts to almost $37 billion.

Consequently, researchers from the Cremation Institute decided to compile a study among over 1,100 digital asset investors regarding their views and plans for their cryptocurrency funds.

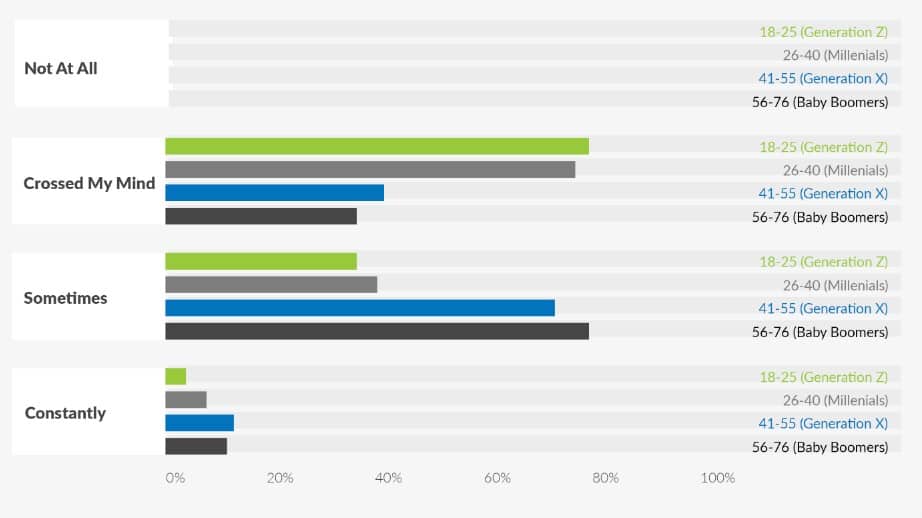

“The findings overwhelmingly show that cryptocurrency investors have a real worry about their assets simply disappearing after they pass away. Overall, 89% of participants worry on some level about whether their crypto assets will be passed on to their loved ones.”

Generation Z (aged 18-25) and Millennials (26-40), who are particularly fond of investing in digital assets, seem less bothered. Contrary, and somewhat expectedly, Baby Boomers (56-76) were most concern.

Lack Of Plan

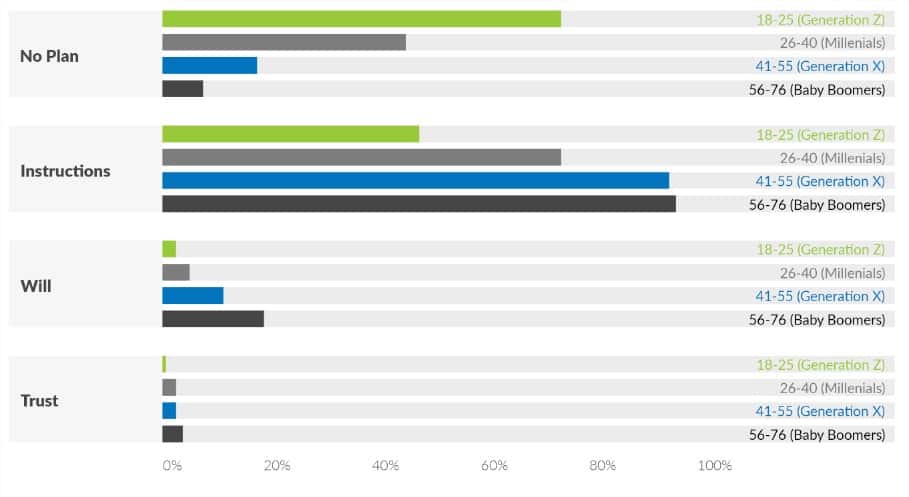

Although evidently worrying, most participants indicated a lack of precise planning regarding the future of their assets if they were to pass away. The report explained that “this is especially true for younger generations. The findings reveal that a concerning 59% of Generation Z crypto holders have no plan, while 35% of Millennials reported no plan.”

Contrary, 86% of Generation X and 94% of Baby Boomers claim they had set up a plan to ensure their family members receive the cryptocurrency wealth.

The paper also observed vital differences in the approach from cryptocurrency and traditional investors towards their assets. The Cremation Institute analyzed a 2020 Estate Planning study and found that 32% of “normal” investors already have a will this year. In contrast, only 7% of cryptocurrency holders have included their digital assets in their will.

Once again, this disparity increases for younger generations, as “18% of people within the 18-34 bracket have a will, while only approximately 3% of crypto-asset holders in this bracket document their plans in a will.”

Interestingly, the research pointed out that women are significantly more likely than men to have a “cryptocurrency contingency plan” in place.