This is not the Bitcoin halving the crypto industry was talking about in 2020. The Bitcoin price crashed on the worst day for equities markets in 33 years. The Dow Jones plummeted 9.99% during trading, the S&P 500 lost 9.51%, and the NASDAQ took a 9.43% dive.Even spot gold declined by some 4% Thursday, as the logic of Bitcoin’s detractors like Peter Schiff, gold is now positively correlated with stocks. However, Bitcoin was the biggest loser, with a massive run on the world’s first cryptocurrency driving prices down by over 40% in under 24 hours.Wild Bitcoin Price ActionSpikes punctuated the losses as opportunists took big bites out of Bitcoin on sale. This kind of volatile price action is common in capitulating markets.Following a price crash of over 00 in an hour, Bitcoin price was

Topics:

Wesley Messamore considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, coronavirus

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

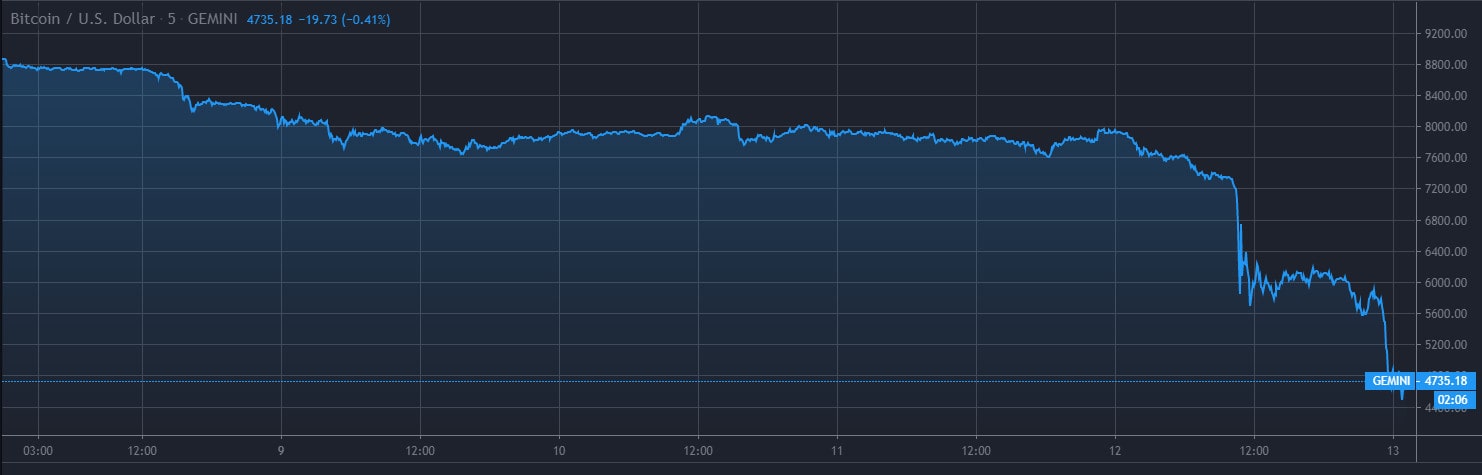

This is not the Bitcoin halving the crypto industry was talking about in 2020. The Bitcoin price crashed on the worst day for equities markets in 33 years. The Dow Jones plummeted 9.99% during trading, the S&P 500 lost 9.51%, and the NASDAQ took a 9.43% dive.

Even spot gold declined by some 4% Thursday, as the logic of Bitcoin’s detractors like Peter Schiff, gold is now positively correlated with stocks. However, Bitcoin was the biggest loser, with a massive run on the world’s first cryptocurrency driving prices down by over 40% in under 24 hours.

Wild Bitcoin Price Action

Spikes punctuated the losses as opportunists took big bites out of Bitcoin on sale. This kind of volatile price action is common in capitulating markets.

Following a price crash of over $1500 in an hour, Bitcoin price was steady around the $6000 in the next hours, however, as the Asian side of the world woke up there came the second course: A sudden crash from the $6K zone to a current low of $4266 on BitMEX (as of writing these lines).

There were also wild discrepancies between Bitcoin prices on different cryptocurrency exchanges. For example, a $400 spread at one point between BitMEX and CoinBase.

Bitcoin’s Worst Day Ever

Bitcoin’s price has cratered even further than this before, from its December 2017 all-time high of nearly $20,000 to even lower prices than today during the ‘Crypto Winter’ of 2018. But never has the Bitcoin price fallen so much in a single day.

There’s no doubt an absolute hysteria over coronavirus that has wholly gripped the financial markets. Toilet paper became a trending term on Twitter on March 12, 2020, a day that will forever live in infamy because panic buyers bought all the toilet paper in big-box retailers across the United States.

Unfortunately, the same mentality has infected financial markets. It’s a testament to the reality that market pricing is only rational and value-based given enough time. And that given any short period, irrational emotions can be a significant factor in the pricing of financial goods.

All is left is to wait patiently to see what the new day will bring. Oh, yes. The new day is Friday the 13th…