There’s something curious unfolding in global markets this month. While COVID-19 rages across the planet and the economy has ground to a halt, equities have actually been rallying. Global stock prices have been on their way up for two weeks now. It appears like Wall Street’s doing great. The Dow Jones Industrial Average has increased by 21.8% since Mar 23.So have investors lost their minds? On the face of it– this seems absolutely crazy. How could stocks be rallying when 10 million people in the U.S. have lost their jobs in just two weeks? On Mar 23, the day the rally started, Morgan Stanley forecast a 30% decline in U.S. GDP for the second quarter of this year. We’re looking at economic damage of Great Depression proportions here.An Unseemly RallyTo really give an idea of just how strange

Topics:

Wesley Messamore considers the following as important: AA News, btcusd, Coronavirus (COVID-19), Editorials, nasdaq, s&p 500, Stock Markets

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

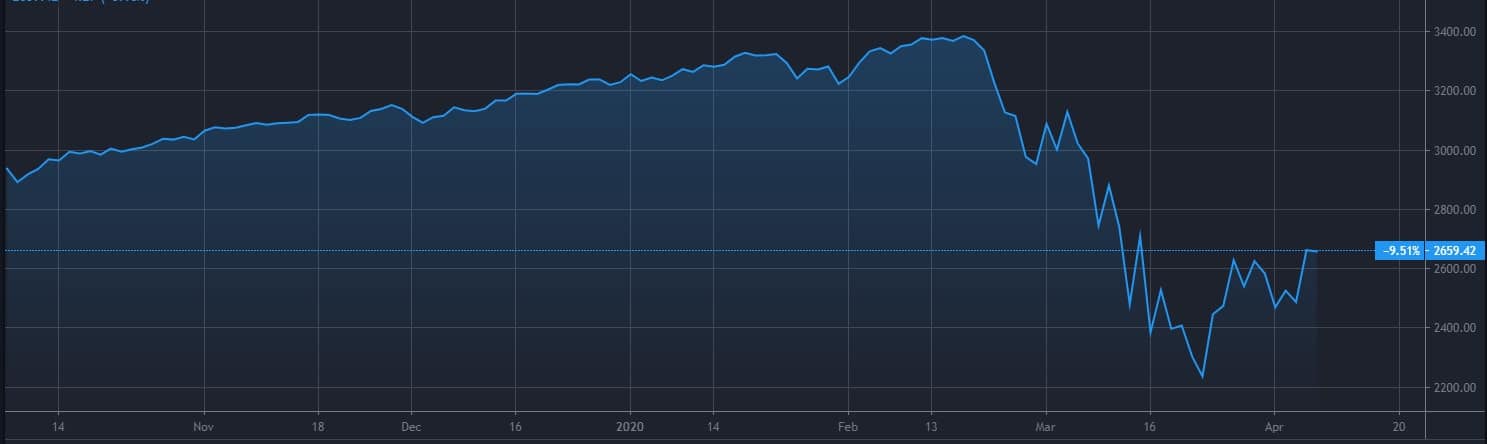

There’s something curious unfolding in global markets this month. While COVID-19 rages across the planet and the economy has ground to a halt, equities have actually been rallying. Global stock prices have been on their way up for two weeks now. It appears like Wall Street’s doing great. The Dow Jones Industrial Average has increased by 21.8% since Mar 23.

So have investors lost their minds? On the face of it– this seems absolutely crazy. How could stocks be rallying when 10 million people in the U.S. have lost their jobs in just two weeks? On Mar 23, the day the rally started, Morgan Stanley forecast a 30% decline in U.S. GDP for the second quarter of this year. We’re looking at economic damage of Great Depression proportions here.

An Unseemly Rally

To really give an idea of just how strange this stock market rally is, consider this: the top 100 stocks by market capitalization in the London Stock Exchange rallied 2.19% Monday– while the British Prime Minister Boris Johnson laid in a hospital intensive care unit (ICU) with COVID-19. This doesn’t seem like mere optimism. It doesn’t even seem like the characteristically reckless euphoria of an equities bull run in its final throes. This just seems plain unhinged.

But the stock market rally does actually make sense, counterintuitive though it may be. There are a couple of reasons for it. The main one is that big bounces like this always happen during bear markets. Or as a columnist for the “Real Money” vertical on The Street wrote as the stock market rally began, “What you’re witnessing is classic bear market action.” It’s textbook.

Besides, the markets’ main role is to forecast the future. The current situation, of thousands of casualties every day, along with a lockdown until the end of April (according to President Donald Trump), is already priced in. As a reminder, this impressive price rally came after the quickest 30% drop in Wall Street’s history.

As long as there is no new information, the COVID-19 financial crisis will evaporate, and the economy will recover. However, there is more unknown than known these days. Scenarios like the bankruptcy of leading corporates, like the famous Lehman Brothers’ collapse back in 2008, might change the balance.

Another cause might come from an extension to the lockdown, which will have a direct effect on the consumption and the earning reports of Q2 and maybe Q3 of 2020.

Bear Markets 101

During bear markets, prices swing wildly up and back down again. The joke on Wall Street is, “Even a dead cat will bounce if you drop it from high enough.” As markets crash, there’s a demand for equities at a value that drives these bounces. But it’s not enough to keep the capitulation from continuing until the market correction is over. In the case of this bear market, it looks far from over.

From peak to bottom, the last bear market for U.S. stocks lasted 17 months. That was from Oct 2007 until Mar 2009. The wave of mortgage defaults in the subprime lending market, along with a couple of major corporate implosions in the finance industry were bad. But they weren’t nearly as devastating as the COVID-19 pandemic, and the radical measures taken by many world governments to contain it. And today’s debt bubble is far worse than the one that burst in 2008.

Stimulus Will Boost Bitcoin

The other factor fueling this rally is the massive stimulus efforts undertaken by central banks and world governments. The U.S. has committed $6 trillion in monetary and fiscal stimulus for emergency relief. That has no doubt buoyed markets over the past several days. But even extraordinary stimulus measures to fight the 2008 financial crisis didn’t stop that one from dragging out for 17 months. Will the current bounce last after the sugar rush wears off? Only time will tell.

But if it does, it might have a positive effect and drive up the price of cryptocurrencies like Bitcoin.

* Disclaimer: This article is the opinion of the author, and does not represent professional financial or investing advice.