With bitcoin’s latest rally beyond the ,000 mark, it seems like the next bull market is here. It can be seen from BTC markets that have been on fire for the last 7 days, including derivatives. The latest data shows that bitcoin futures markets on Binance have clocked the highest 24h BTC futures volumes amongst all platforms. This comes amid the exchange registering 0 million in open interest. Binance Experiences Explosive Bitcoin Futures Market Action Bitcoin rallied beyond ,000, galvanizing every BTC related market along the way, including the futures market on Binance. As per the latest data from crypto market analytics firm Skew, the exchange logged the highest 24h bitcoin futures volume amongst all BTC derivative trading platforms. Binance Clocks Highest 24h

Topics:

Himadri Saha considers the following as important: AA News, Binance, bitcoin futures, BTCEUR, BTCGBP, btcusd, btcusdt, CME

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

With bitcoin’s latest rally beyond the $13,000 mark, it seems like the next bull market is here. It can be seen from BTC markets that have been on fire for the last 7 days, including derivatives. The latest data shows that bitcoin futures markets on Binance have clocked the highest 24h BTC futures volumes amongst all platforms. This comes amid the exchange registering $760 million in open interest.

Binance Experiences Explosive Bitcoin Futures Market Action

Bitcoin rallied beyond $13,000, galvanizing every BTC related market along the way, including the futures market on Binance.

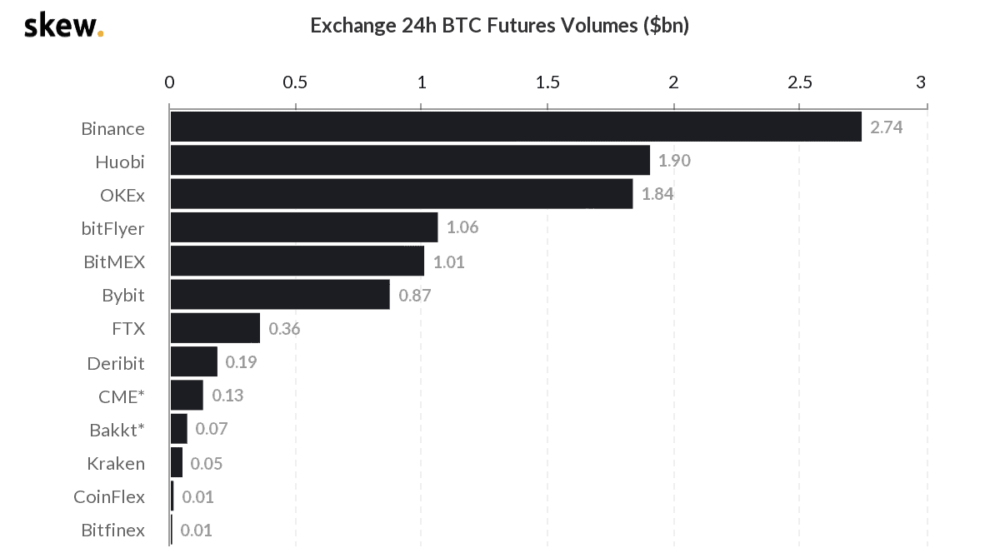

As per the latest data from crypto market analytics firm Skew, the exchange logged the highest 24h bitcoin futures volume amongst all BTC derivative trading platforms.

This is coming after the Malta-based cryptocurrency exchange registered heavy futures trading traffic as open interest (OI) jumped 30 percent to $150 million in just 2 days from October 19 to October 21. Binance’s current OI figure stands at $760 million.

Skew’s data also shows that Binance hosted the highest aggregated daily bitcoin futures volumes on October 21. The cumulative figure was $32 billion that day, out of which Binance’s share was $8.3 billion. But at $3.3 billion, Binance still has the highest aggregated futures volumes.

BTC Futures Market Metrics On Other Platforms Are Booming As Well

With bitcoin’s recent week-long upside correction, traders using other platforms are mainly interested in BTC futures. Skew’s observations from October 20 show that there has been a 54 percent appreciation in 24h Futures and Swap Volumes on Huobi.

#bitcoin in focus, volume market share is increasing pic.twitter.com/ai8T97qfXp

— skew (@skewdotcom) October 20, 2020

Compared to bitcoin, only ether (ETH) has experienced a 30 percent surge in volumes. And that’s not all. Bitcoin futures open interest on institutional platform CME rose to $784 million today. This has added nearly 1500 contracts to the already bubbling CME BTC futures roster, scheduled for expiry by the end of this month.

But how are these futures traders on CME actually betting on bitcoin?

Institutions Are Going Long While Hedge Funds Are Busy Shorting

Skew did a deep inspection of the above spike of bitcoin futures open interest on the CME, and the firm concluded that bets are mainly coming from institutions and hedge funds. The former is more optimistic about bitcoin price rallying further in the near term, as opposed to hedge funds who have record short bets on BTC. The same is visible from the Commitment of Trader (COT) numbers displayed in the chart below:

New CME Commitment Of Trader report just came in for BTC Futures:

?HFs all-time short

? Institutions all-time long

❓ Who’s wrong? pic.twitter.com/EAHrZnDKdF

— skew (@skewdotcom) October 17, 2020

Amidst all the above-market activity, the aggregated open interest for bitcoin futures for all platforms sharply rose to $5 billion and has since remained the same.