The latest data suggests that Bitcoin’s recent bullish stint has excited large scale investors. Whales have been accumulating copious amounts of BTC in anticipation of a larger rally. Also, there’s an almost 38 percent increment in Bitcoin addresses holding more than million worth of BTC.Bitcoin Hodler Net Position Change Remains PositiveData from on-chain analysis and crypto market insights provider, Glassnode suggests that Bitcoin’s recent rally hasn’t induced much of a selling reaction from long-term investors.Bigshot market participants are holding tight and eagerly waiting to reap greater profits from further BTC rallies. What Glassnode says is evident from the ‘Bitcoin Hodler Net Position Change’ metric, which has remained positive since March-end. Furthermore, investors have been

Topics:

Himadri Saha considers the following as important: AA News, BTC, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The latest data suggests that Bitcoin’s recent bullish stint has excited large scale investors. Whales have been accumulating copious amounts of BTC in anticipation of a larger rally. Also, there’s an almost 38 percent increment in Bitcoin addresses holding more than $1 million worth of BTC.

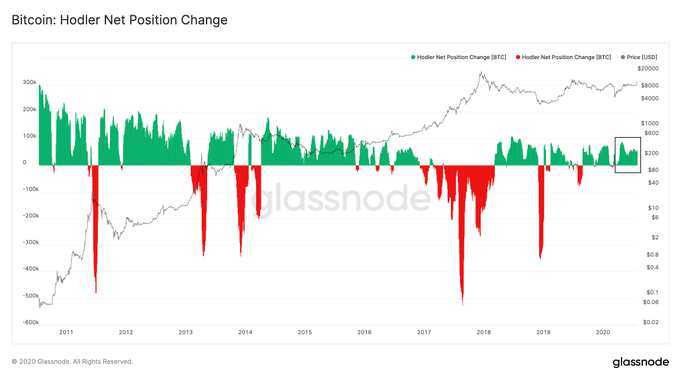

Bitcoin Hodler Net Position Change Remains Positive

Data from on-chain analysis and crypto market insights provider, Glassnode suggests that Bitcoin’s recent rally hasn’t induced much of a selling reaction from long-term investors.

Bigshot market participants are holding tight and eagerly waiting to reap greater profits from further BTC rallies. What Glassnode says is evident from the ‘Bitcoin Hodler Net Position Change’ metric, which has remained positive since March-end. Furthermore, investors have been accumulating more than 50,000 BTC every month.

Adamant Capital was the first to introduce this metric, which provides an idea of the investment sentiment and ‘changes in saving behavior’ within the Bitcoin ecosystem. To quote the exact definition:

Hodler Net Position Change shows the monthly position change of long term investors (HODLers). It indicates when HODLers cash out (negative) and when net new positions are accumulated by HODLers.

Apart from this, another metric is hinting at the rising dominance of ‘strong hands’ in the Bitcoin market.

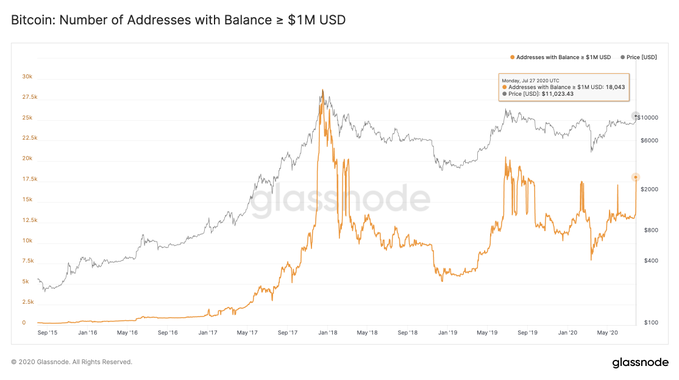

38 Percent Rise in BTC Addresses Holding At-least $1 Million

It seems whales don’t want to leave any stone unturned in buying more BTC. This, according to Glassnode, can be seen from the increment in Bitcoin addresses holding $1 million worth of the top cryptocurrency. Earlier the number was 13,000. Owing to the recent price rally, ‘millionaire BTC addresses’ have risen by almost 38 percent to 18,000.

Such an uptick in massive Bitcoin buying behavior points to increasing institutional investor interest. We talked about the slow movement of capital in the BTC market, in one of our earlier articles.

However, it seems folks staking massive fiat amounts in the cryptocurrency space, are not satisfied with the inflationary status of the global economy.

Goldman Sachs’s dollar debasement warning has also served as a wake-up call for large scale investors looking at the rally as an opportunity to stack more sats and protect the value of their savings. Bitcoin investment management firm Ryze confirmed this as well.

‘Institutions Are Jumping At The Opportunity’ to Stack Sats

Ryze, in their latest newsletter, talked about the possible reasons fuelling the ongoing Bitcoin rally. One thing that became instantly obvious is the steadily growing institutional crowd in the crypto space.

Quoting data on increasing futures volumes for BTC on various platforms, Ryze made it clear that ‘institutions are jumping at the opportunity’ to expose themselves to the flagship cryptocurrency:

Open interest (the total value of outstanding trades) is at nearly $5 Billion across all Bitcoin futures markets, which is an indicator of increased investment activity. Daily futures volume is nearly $50 Billion, the second-highest of the year. The CME’s Bitcoin futures nearly had the most volume they’ve seen in a single day, and Bakkt’s futures far surpassed previous record volume. Grayscale is also seeing record inflows, adding nearly $1 Billion in AUM in the last week, with over 80% of it being Bitcoin.

This behavior, as observed by Ryze, is very different from 2017 when retail investors caused a FOMO driven rally. BTC is an excellent fit for the current macroeconomic scenario, and institutions realize this significantly.

That’s why they are getting involved for a much longer-term. And not just to make a few bucks in the shortest possible time.